Choom Holdings (CHOO.C) entered into an agreement to acquire Phivida Holdings (VIDA.C) for in an arm’s-length all-share deal for $7.3 million yesterday.

For the longest time it looked like Choom was going to continue their expansion, focusing on their brick and mortar presence without giving any thought to enhancing or expanding into any of the available verticals. Now it seems that they have simply been biding their time and waiting for the appropriate opportunity. Phivida could be that opportunity.

“The acquisition of Phivida will further Choom’s ability to deliver on our business plans and accelerate our growth initiatives, enabling our omni-channel strategy through enhanced digital capabilities, and an expanded brick-and-mortar presence across Canada. The timing is ideal as we prepare to expand our retail footprint in Ontario, Canada’s largest market for cannabis sales, later this year, with several flagship locations already secured,” said Corey Gillon, CEO of Choom.

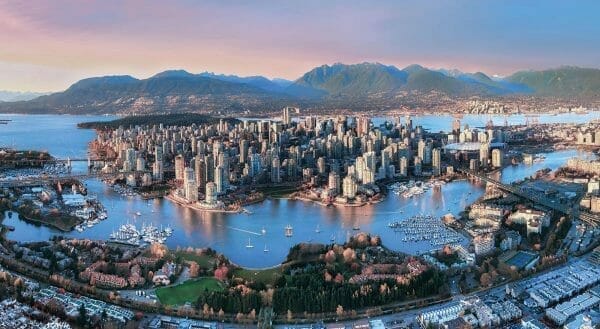

Phivida is a Vancouver-based CBD-centric holding group with assets in technology, publishing and consumer-packaged goods markets (CPG). They have operations in San Diego, Toronto and Belgrade. Their core business is CBD-infused foods and beverages, and CBD topicals and supplements, in addition to managing and operating two CBD-related online marketplaces called Bloomgroove and Wikala. The company also produces an online publication and knowledge centre for all things CBD called Greencamp.

The combined company will add another layer of vertical integration focused on cannabis retail and consumer experiences to Choom’s portfolio. They’ve been focused on spreading out their brick and mortar retail presence, opening stores in B.C., and Ontario at a decent rate, and now they’re adding VIDA’s digital assets and branded product.

Phivida brings more to the table than just connections. They have an e-commerce solution and marketing platforms that they can use to enhance customer experience.

When the transaction closes Choom will use Phivida’s assets to continue the build-out of their additional stores in Ontario and B.C, benefiting from the Phivida’s relationshp with prominent landlords to support moving Choom stores into marquee locations.

“Following an extensive evaluation of the Canadian cannabis market, we’re thrilled to partner with Choom and continue to execute on our digital growth strategy which will be complimentary to Choom’s brick and mortar retail store growth. By leveraging consumer data collected through our online websites and working with the Choom team to enhance in store analytics, we are well positioned to optimize our business for continued success,” said David Moon, CEO of Phivida.

The transaction will be effected by way of a court-approved plan of arrangement completed under the Business Corporations Act (British Columbia) and still needs to meet the approval of at least 66 2/3% of the Phivida shareholder votes at a special company meeting. In addition to requiring shareholder approval, the transaction is still subject to applicable regulatory, court and stock exchange approvals and certain other closing conditions customary in transactions of this nature.

Upon completion of the Transaction, existing Choom and Phivida shareholders will hold approximately 78% and 22% of the combined company, respectively, on a fully diluted basis.

—Joseph Morton

You guys put out amazing work! Can’t thank you enough for what you do. However, what really surprises me here is that Cabral Gold (CBR), a company in which you profiled for quite some time. Didn’t make this list? Especially considering their most recent discovery in one of the most prolific gold mining areas in the world!

Can you explain why not? Thank you!