Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

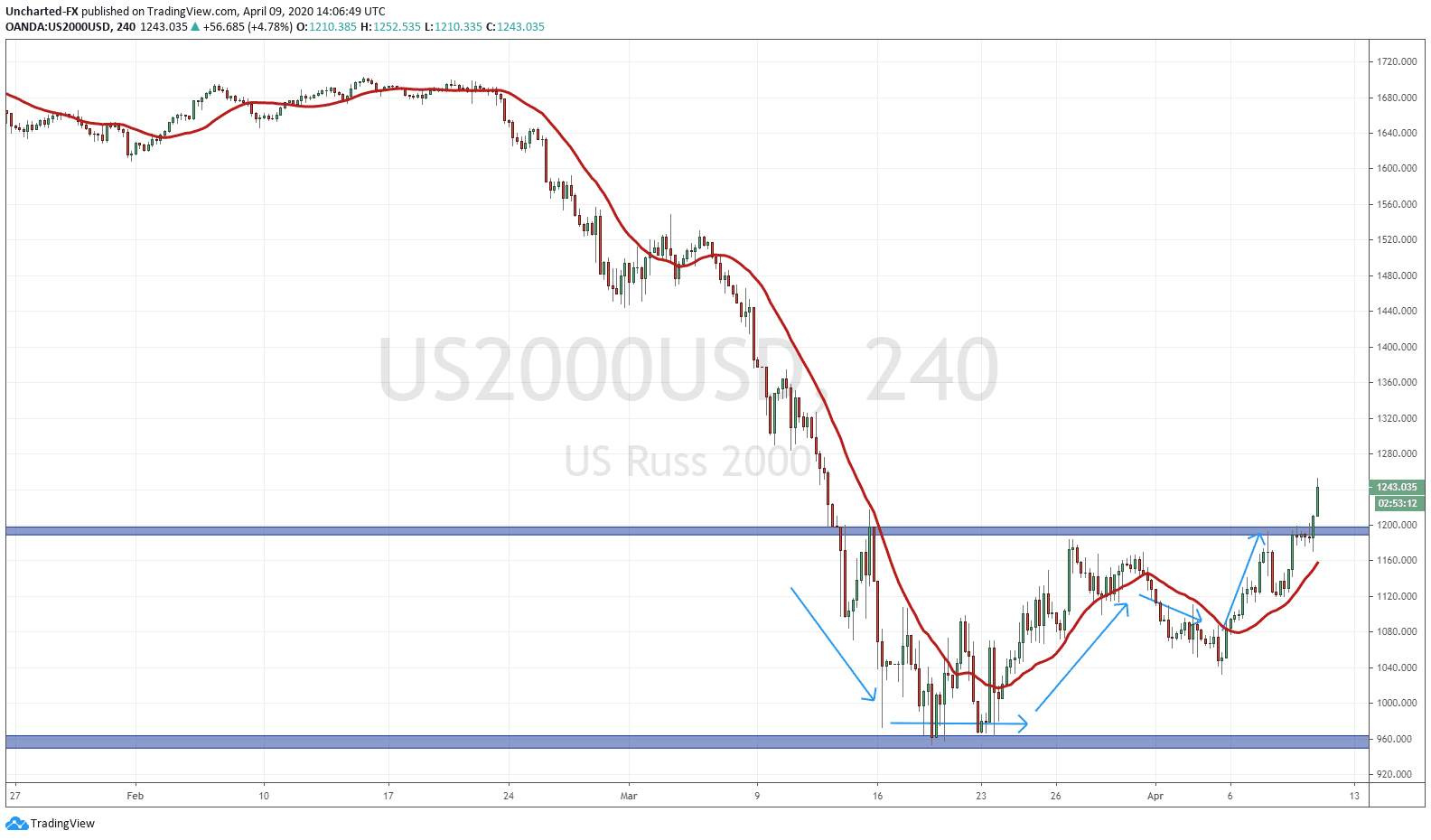

World equities have been on watch all this week, and on the discord channel, I did talk about how we had a 4 hour break out on most indices. The big red sell off candle we had on Tuesday, was normal, and adhered to price action pertaining to break outs. When an asset breaks out higher, it generally has the tendency to pull back and retest the break out zone before moving higher. This is where stop losses are fished out, with many forex/cfd brokers at times hunting for their clients’ stop losses.

At time of writing, all major US equities have broken above the levels we have been watching since Tuesday and have continued higher even though we got more bad jobless claims data, coming in at 6.6 million. However, the Fed has thrown more money into the system unveiling a $2.3 Trillion initiative plan which includes:

- The Main Street Lending Program will “ensure credit flows to small and mid-sized businesses with the purchase of up to $600 billion in loans.” This means that the Paycheck Protection Program will likely be expanded by an additional $250BN to reach a total of $600BN.

- Expanding the size and scope of the Primary and Secondary Market Corporate Credit Facilities and the Term Asset-Backed Securities Loan Facility to support as much as $850 billion in credit

- A Municipal Liquidity Facility which will offer as much as $500 billion in lending to states and municipalities, by directly purchasing that amount of short-term notes from states as well as large counties and cities

- Starting the Paycheck Protection Program Liquidity Facility: “supplying liquidity to participating financial institutions through term financing backed by PPP loans to small businesses”

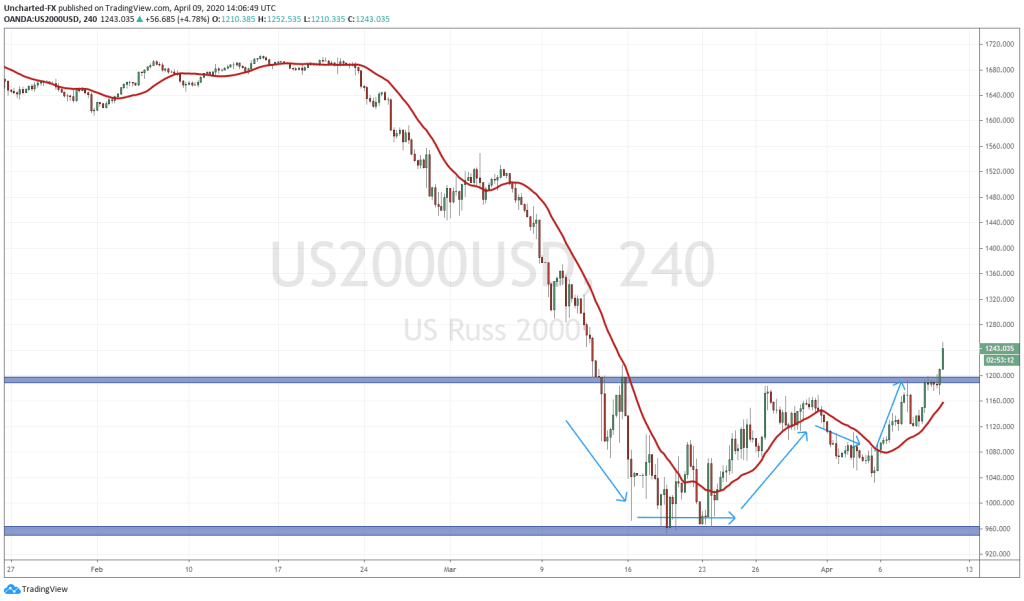

A lot of European charts are showing similar pre-breakout patterns which I will likely discuss next week. Today I want to cover the US midcap index, the Russell 2000.

We have our breakout on the 4 hour chart and this pattern can be described as a cup and handle pattern. Very simply, a cup and handle looks like the body of a cup, and then a small handle being formed on the right side (follow the blue arrows I drew). This is significant because the right handle gives us the break out which confirms also a higher low swing level signifying the beginnings of an up trend.

It seems that the Fed and Government are doing everything to keep the equity markets propped. Throwing as much money as they can, and exhausting their tool boxes at the same time. A lot of people are confused on why the midcap index is moving higher when many of the companies are hurting, are closed and a recession is still around the corner. You have heard me say this many times now, but there is a disconnect between the markets and the real economy. Equity markets remain the only place to go to hunt for real yield. And you should really consider who is buying at these levels…

We also have the OPEC Plus meeting today, and the Oil chart may be setting up to create the pattern I have been expecting. More on that next week. Oil is important for the equity markets as it does help the banks, thereby seeing the energy and financials-two large sectors in the stock market-in turn do a great deal to move the entire market up. Just a reminder that today is the last trading day of the week. Markets will be closed on Good Friday. If you are a trader, do be careful of the positions you are holding over the weekend. A lot can happen in three days.