Trade ideas and discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

We will finally be entering a period where the combination of monetary policy and fiscal policy will be present in order to keep equities propped. It came out at 1 am EST that a stimulus package deal had been reached between the Senate Democrats and Republicans. This stimulus is to be , “the largest rescue package in American history”, and will sum up to 2 Trillion dollars. The Senate could vote for this stimulus as soon as Wednesday, but it would still require the House to pass the bill before it reaches President Donald Trump.

As of now, details have not been released. However, one can ascertain that the package would include assistance and aid to companies, States and Municipals; checks somewhere between the amount of 1000-2000 dollars to most Americans; loans for small businesses to prevent major layoffs; mortgage, tax and student loan deferrals.

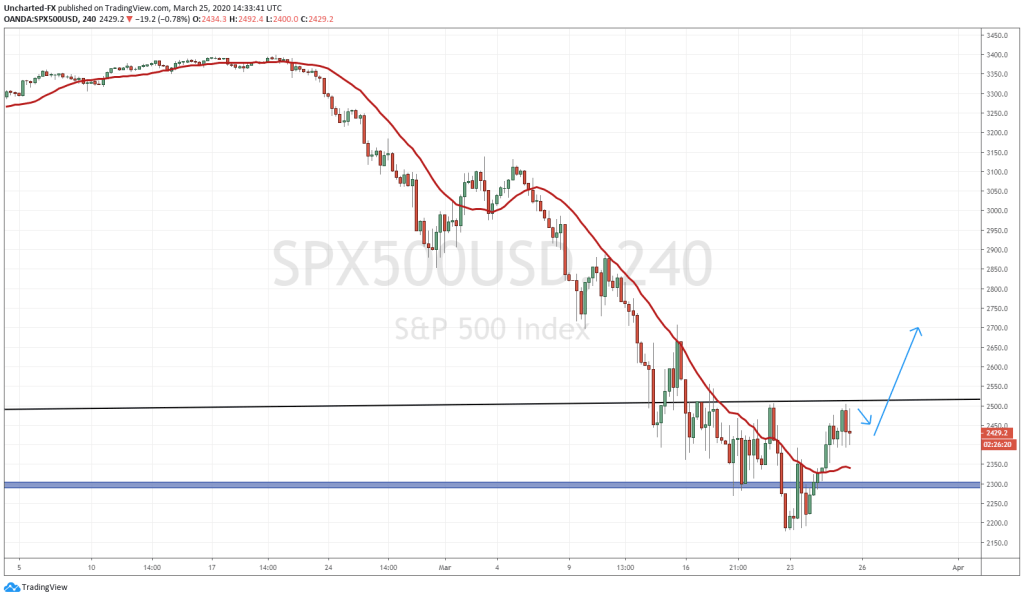

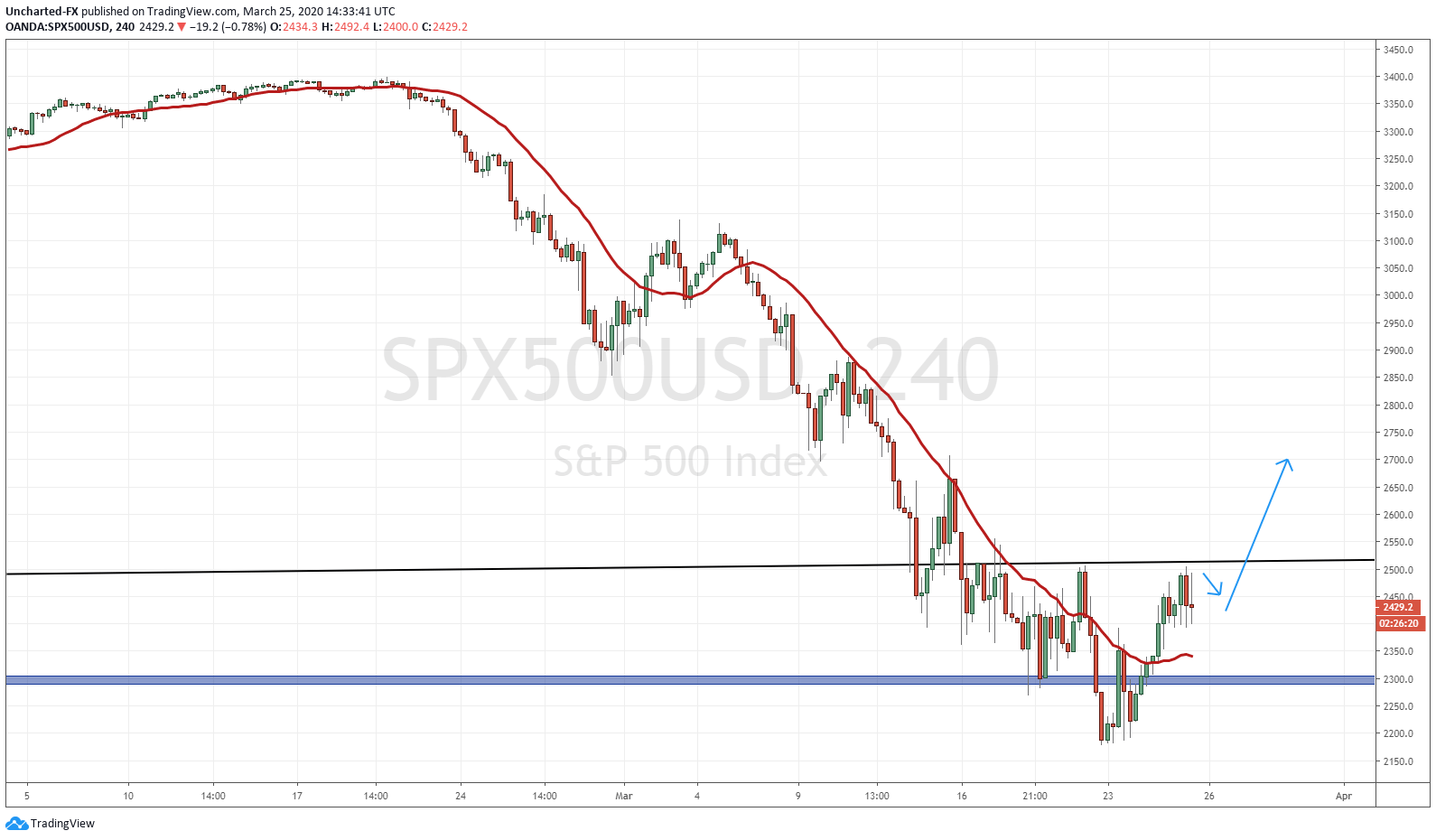

Taking a look here at the S&P chart, we have reached an important resistance (price ceiling) zone that we tested with the strength of yesterday’s green rally day. This 2500 zone is key, as it is not only an important psychological number for the market, but it is the previous lower high swing point that we are working with. Just basic market structure theory: as long as we maintain the swing (either a lower highs or higher low), we remain in that trend. Once broken, the trend is officially over. To add to the confluence, this zone also intersects with a large weekly trend line that many investors/traders are watching that goes back to the lows of 2009.

We discussed the potential reversal patterns on the equity charts on the discord. I even posted the Japanese Nikkei and German Dax charts yesterday, two trades that went well for us. On the discord, we have been watching certain US equity charts for a potential reversal pattern called the head and shoulders. We have what appears to be a head and shoulders pattern developing here on the S&P. All this pattern indicates is the possibility of a reversal, it shows the transition from one trend to another. It creates the shape of two shoulders and a head protruding in between. What will confirm this pattern is a break and close above the 2500 zone. We have not had that yet. Perhaps once details on the deal start coming out, and if indeed the Senate does vote for the bill today, that would provide us with the catalyst to break above. Once this stimulus package passes, and markets still remain to fall even with both monetary and fiscal policies being implemented…it would mean bad news for the equity markets and have larger reverberations on the world.