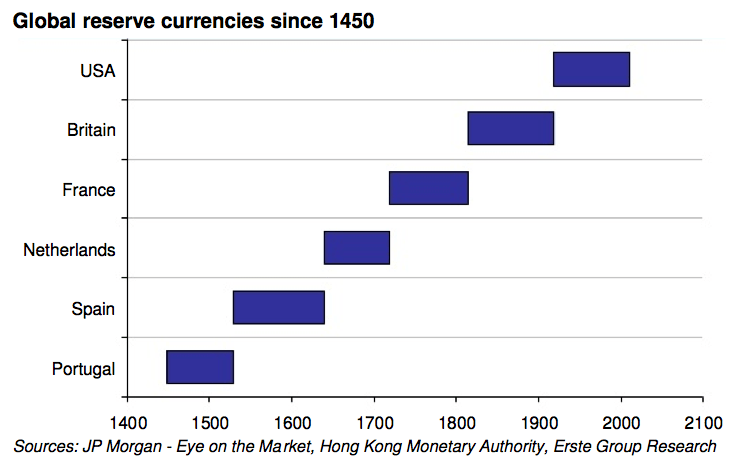

The US Dollar is getting a lot of discussion in the financial media, in politics, by billionaires, and by a lot of market participants and fund managers. For good reason: it is the reserve currency. Ray Dalio has been speaking about world powers and reserve currency status for quite sometime. His ‘paradigm shift’ and us being in the 7th inning of a debt crisis, has been raising a lot of heads. Human history is cycles of hard/stable money and fiat/soft money. Many reserve currencies begin with hard money and then shift to soft money where they inevitably decline. Perhaps the Byzantine Solidus being the most resolute of them all, and maintaining hard money throughout their time of empire.

Recently, Ray Dalio warned: “In my opinion, we’re near the end, in the late stages, of our reserve currency system – it’s a fiat monetary system. Not only do we have negative rates, but we’re going to have much bigger deficits…and that’s not half the story. Because the larger story is the unfunded liabilities…those are pension liabilities and debt liabilities.”

If you follow my work this is what I have also been speaking about regarding economic history and principles of classical economics. Central Banks are stuck because we are at the end of this soft money cycle. Digital will be a way to keep this going which I have wrote a lot about.

This means the US Dollar should have your attention. It certainly has mine.

The Dollar is important to what is occurring currently and where we are going not only economically, but geopolitically. I have spoken about Russia and China attacking US Dollar demand. I will discuss more on this further below.

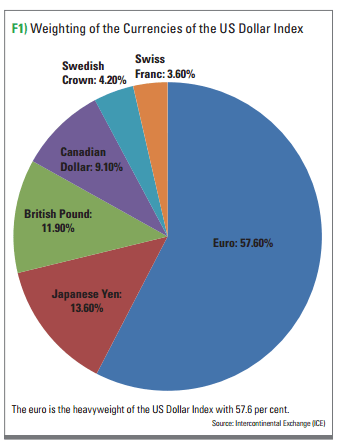

Let’s look the the DXY. For those that do not know, the DXY (pronounced ‘Dixie’) is the US Dollar Index, what many people use to ascertain US Dollar strength. It is the chart I have at the top of this blog post. There is one issue with the DXY. It is heavily skewed to the Euro in terms of weight:

As you can see, the Euro makes up over 50% of the DXY composition, meaning any moves in the Euro currency, will affect the Dollar. This is why the DXY is seen as the Inverse of the EURUSD. It has an inverse correlation, and traders us a break in one as a confluence for the break in the other.

The Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, and the Swedish Krona make up the rest of the DXY.

A lot of people have given their opinion on why the Fed is cutting rates. Are they cutting just for caution as Fed chair Powell makes it seem? Is it to meet inflation targets? By the way the Fed is considering moving their inflation target to 3% to make up for ‘missing’ inflation in the past and opens the door for further rates cuts in the future. My readers know where I believe rates are going.

So there are 3 reasons on why the Fed is cutting rates:

- Perhaps they know a recession is coming (inverted yield curve) and are cutting to prevent this. They have been saying they are cutting in order to prolong and support this economic expansion…

- To handle the debt load of the US government and the consumer really. An article just came out showing that world debt is now at a record 250 TRILLION. To put this into perspective, the total world economy of the 193 or something countries in the world is just under 90 trillion (around 88 trillion). Again more debt is required to just sustain where we are currently. Cutting rates allows the debt to be serviced and helps out the consumer who are already up to their heads in debt. Again the way the media sells this is by saying: “Consumer credit is expanding” rather than saying “Consumer debt is at all time highs/increasing”. Notice the difference in mood?

- Finally, and perhaps the most important and relative to this blog post, is the Fed is cutting rates in order to weaken the US Dollar.

Why? So yes, a lot of central banks are cutting rates, and are trying to weaken their currency to handle their debt and to create a wealth effect with inflation. Essentially to keep assets propped, especially real estate. It will take more weaker currency to buy a home, however, people’s purchasing power does not change. Gives a fake wealth effect. It is a race to the bottom and the Fed is being taken advantage of.

Really though, the world and its problems will worsen and exacerbate with a STRONGER dollar.

Many emerging markets have dollar denominated debt. Since interest rates in the US were low compared to interest rates in their home country, US debt was borrowed. When the Dollar gets stronger, it becomes tougher for these nations to use it and manage their dollar denominated debt. This is the problem that will occur if the dollar is not weakened.

Geopolitically, the Russians and the Chinese know this. I have speculated that they are propping the US Dollar (although they do not need much help; more on why the Dollar will get stronger below). They know the higher the dollar goes more nations will be forced to drop it. Recently, Turkey and India have been buying Iranian oil because Iran takes any currency except the US dollar for their oil. The Indian Rupee and Turkish Lira have gotten decimated due to the stronger dollar. They cannot afford to use it as the Petro Dollar. European nations, Japan and South Korea also did this, but stopped when the US told them to do so.

What this does, is it takes away market share from the Saudi’s. Eventually, if the dollar gets stronger, buying from Iran becomes more appealing and favourable because one does not need to use the US Dollar. The Saudi’s may even eventually decide to drop the Dollar if this continues. President Putin is getting close with Mohammed Bin Salman, and perhaps if he becomes King in the future, he will drop the US Dollar with Russian military protection guaranteed. The Saudi Aramco deal is not getting the bids it wants for their valuation. I would not be surprised if Russia and China have said to the Saudi’s that they will be willing to pay the valuation the Royal family wants, but under one condition: steps are taken to drop the US dollar for oil payments.

This is really why Iran is key for the Russians and Chinese on the geopolitical chessboard. It is their node for de-dollarization. Another node is Venezuela. The Russians and the Chinese have invested a lot of many to bring Venezuelan oil production back to optimal and regular capacity. They support Maduro because I believe their condition is that once this oil comes back online, Venezuela must not accept the Dollar for oil payments. Meanwhile the US backed Guaido would accept Dollars for oil. Interestingly, at time of writing, South America is on fire. Protests in Argentina, Brazil, Colombia, Chile, Bolivia, Peru, Venezuela of course, and Ecuador. Cannot help but think perhaps it was a way for the US to destabilize this region so it makes it tougher for the Russians and Chinese to operate there, and many nations will then stick with the Middle East and other nations for their oil needs. A tic for tac on the geopolitical chessboard.

Remember, the US Dollar is the reserve currency meaning it has artificial demand which allows the Americans to print as much of it as they want without needing to worry about debt. The French called this ‘exorbitant privilege’. This is why the US Federal Reserve is seen as the central bank of the world, as they can print dollars to bail others out like they did with Europe and Canada during the Great Financial Recession of 2008. If this demand is hampered, all this excess dollars will return and then American debt becomes real and we will see signs of massive inflation (even hyper) due to the confidence lost in the Dollar.

This is why Russia and China are attacking US Dollar demand. Yes, their currencies also will weaken with a stronger dollar. But both nations have a large Gold reserve meaning that even though their currency weakens against the US dollar, Gold priced in their currency increases. This is essentially how the Russian Central Bank fought off US sanctions and has maintained themselves in good shape.

Now you might be asking why is this called a tale of two dollars? Well the US Dollar has made all time new highs…

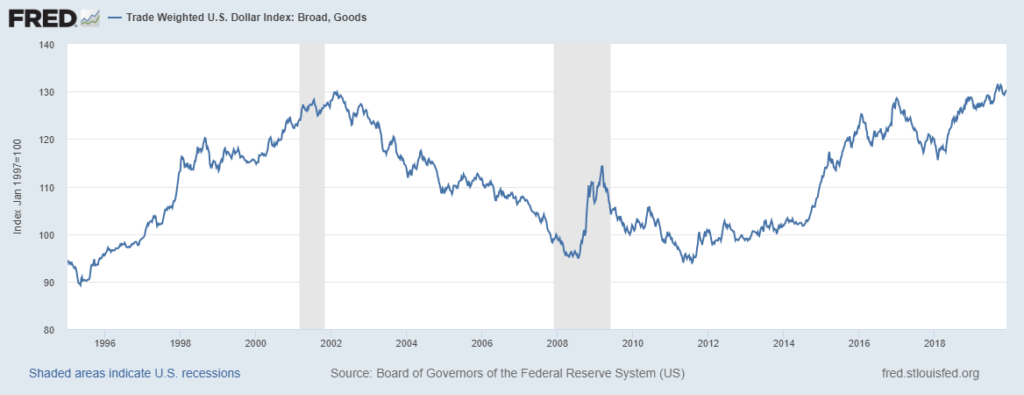

This is a chart of the Trade Weighted Dollar Index which can be found here.

This is generally called the ‘second’ Dollar index and is: A weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners.

Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

As you can see, much more broader than the DXY AND takes into account emerging market currencies which are crucial to understand how the Dollar will wreck havoc on the world.

If you look back on this chart, we have broken above 2002 levels taking us into new highs. This is the chart I believe the Fed accounts for when determining whether they should cut to weaken the US Dollar. As you can see we may have created a some what double top pattern with price moving down recently.

Here is where it gets interesting.

I believe if the Fed goal is to weaken the US Dollar, then they will fail. Why?

The dollar will get a bid due to:

- It being the reserve currency so it is still seen as the safe haven currency. Many argue if you can even assume this in today’s world but again, the US has the strongest military which can enforce dollar demand if need be, and the reserve status is still intact. If we see unrest and other crisis’ around the world, which I have spoken about on this blog, the Dollar will strengthen. Note, the US Dollar and Gold can both strengthen during a confidence crisis.

- In terms of the western world, there really is nowhere better to go than the US. The US is seen as the dirtiest laundry in the clean laundry basket, or as Martin Armstrong says, the prettiest sister of the three ugly sisters. The Japanese Yen perhaps? Japan is stable and their currency is backed by their high savings rate, but then again they have negative interest rates. The Swiss Franc? Switzerland is always seen as the safe haven due to their laws, small government, and what I believe to be the real reason the Franc is see as a safe haven: they have a large Gold reserve proportionate to their currency, a some what off the record gold backing.

- Perhaps the most important, and why the Fed may have shot themselves in the foot attempting to weaken the dollar, is the US has the best yield. If you are a Fixed Income trader say in Germany, you will only buy German Bunds because you think you can sell them to another bigger fool. However, US treasuries still provide a decent yield compared to other western debt. Money will flow into the Dollar for treasuries. Also, with the fact the Fed has made the stock market the only place to go for yield now by cutting rates, money around the world will flow into US stock markets. A trend which will get even stronger due to the fact the US markets have made all time new highs and continue to do so. You will need to buy dollars to participate in this, and I have spoken already on European money coming into the US given the Brexit and broader EU concerns.

This means that the Fed are trapped and will fail in attempting to weaken the Dollar. The outcome can be two scenarios. First, the US actively announces Dollar intervention to weaken the US Dollar. It will not be popular with the people, and if Trump does this, he will guarantee lose the next elections. Americans will wake up to find their dollar and purchasing power has weakened. Other nations around the world holding dollars will become very upset, and the US will lose credibility and allies… which will naturally affect US dollar demand which would mean trouble for the US.

The second scenario is that the Dollar keeps on rising in price that it does worsen the problems in the world and wrecks havoc on emerging market nations. The world will get together and demand action…Russia and China saying I told you so and becoming champions of a multi-polar world. The world then gets together for another Plaza accord where the US Dollar is devalued. It was devalued 40% during the Plaza accord.

This is what I see coming with the US Dollar, and it will affect everything. It is the key for geopolitics currently, and I am expecting a run higher than fall which coincides with the Dollar likely losing reserve currency status.

-Special Contributor, Vishal Toora