Buried in a news release discussing a shares-for-cash payment to an acquisition target, Emerald Health (EMH.V) stated Monday it is losing a board member over Health Canada security clearance concerns.

Punit Dhillon is a self-described ‘life science thought leader‘ who likes to give TED Talks and has been involved with several biomedical companies on North American markets.

He was also recently implicated as part of an SEC investigation regarding a US-based disclosure-free paid promotion scandal that saw 27 individuals and companies charged with misleading investors.

Dhillon was never charged in that investigation, but it wasn’t a good look.

In the SEC complaint targeting Lidingo, regulators describe frequent communications between OncoSec CEO Punit Dhillon and Lidingo’s Bjorlin and Singh in 2013. The SEC cites emails in which Dhillon sends notes and suggestions for articles to Bjorlin and Singh. The articles were then created and published under fake author names, says the SEC. Dhillon was not charged by the SEC. He did not respond to an email seeking comment.

Until today, he was also a director at Emerald Health, but has reportedly stepped aside until his security clearance isn’t a drag on the company.

Separately, Punit Dhillon has temporarily stepped down as a director of the company in order to potentially expedite Emerald licence applications to Health Canada while Health Canada processes Mr. Dhillon’s previously submitted normal course application for security clearance to meet the requirements for company directors under the Cannabis Act.

Fair enough – some folks have deeper pasts than others and holding the company’s progress up while Dhillon navigates this process makes little sense.

But what makes less sense is that, according to Emerald’s news release, Dhillon is not really out at all. He’s just sitting quietly in the back of the room, and will go get a coffee and make himself scarce if Health Canada shows up.

Mr. Dhillon will continue to serve as an observer to Emerald’s board of directors and will be reappointed as a director upon his security clearance being finalized.

Now, this is clearly problematic. Whatever an ‘observer to the board of directors is’, it’s clearly close enough, and inside enough, that it should be actively considered as a senior role in the company when Health Canada processes the licensing Emerald says it’s waiting for.

And if Dhillon’s background is chequered enough that he’s holding things up for Emerald, why wasn’t it problematic every time Emerald has looked to get a new Health Canada license approved previously?

Just last week, Emerald received a license as part of its Pure Sunfarms JV with Village Farms (VFF.T), a project Dhillon is also a director of. It received another in Quebec six weeks previous to that, an amendment to the JV license a month before that (it’s 7th), an expansion of it’s licensed production area in January, product licenses a month before that, a license change for the JV in August of last year, and their sales license showed up a month before that.

And that’s just the license decisions they’ve been involved with over the last twelve months.

If there’s reason not to clear Dhillon for whatever application is on deck currently, the question should be asked – why now?

If there is no reason to be concerned and all this is a mere formality, sending him to the sideline seems unnecessary. Shareholders should feel justified in asking for more information, either way.

To be clear, Dhillon’s past corporate life has been a mix of personal success and, often, shareholder peril. His two career highlights outside of Emerald were, well, not exactly wins.

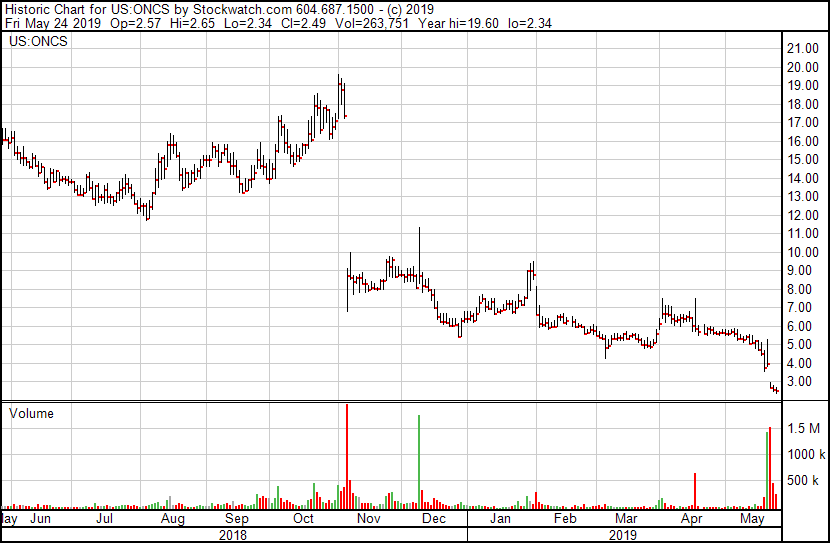

Stock charts tell the story: Here’s Oncosec (ONCS.Q), one of the companies at the heart of the aforementioned SEC probe.

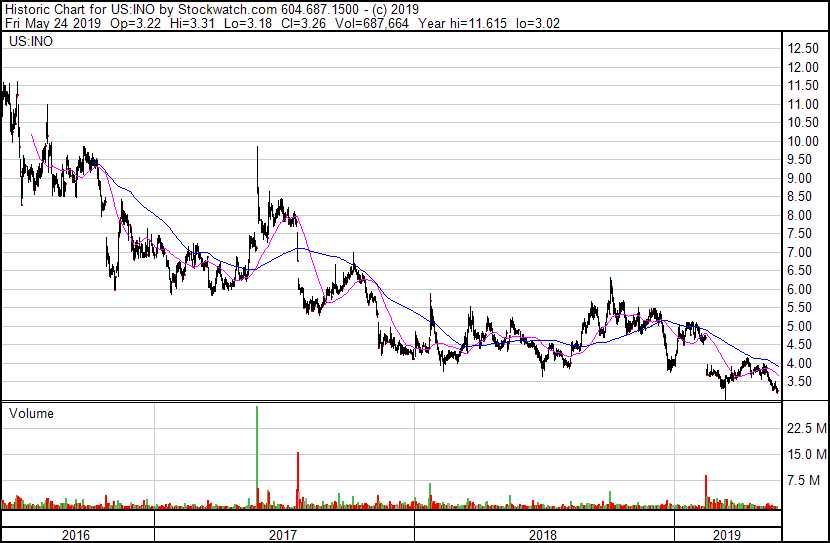

Here’s Inovio Pharmaceuticals (INO.Q):

And those are just the two companies Dhillon likes to put on his bio.

Mr. Dhillon is a director of OncoSec Medical Incorporated, a leading biopharmaceutical company developing cancer immunotherapies for the treatment of solid tumors. Prior to OncoSec, he served as Vice President of Finance and Operations at Inovio Pharmaceuticals, where he raised more than $160 million through multiple financings and several licensing transactions.

Dhillon’s uncle, Avtar, is Chairman of Emerald Health, and was President and CEO of Inovio while his nephew was serving as VP.

He had trouble last year from his involvement in Vitality Biopharma (VBIO.Q), which also ran into promotional issues with the SEC.

The U.S. Securities and Exchange Commission has halted Vitality Biopharma Inc., an OTCQB listing with links to the Vancouver area. The SEC says that there are questions about undisclosed control persons and cites a potential manipulation of the stock. A halt is necessary to protect investors, according to the SEC.

[..] The SEC has not given any specifics of the manipulative activity, but Vitality Biopharma did have the misfortune of appearing in a recent regulatory action targeting a U.K. man, Roger “Rocket” Knox. The SEC and prosecutors in Boston claim that Mr. Knox ran an offshore operation that allowed insiders to secretly dump shares in the midst of touting campaigns. One of the many companies that the SEC listed in the case is Vitality Biopharma. According to a complaint that the SEC filed against Mr. Knox on Oct. 2, 2018, somebody transferred shares amounting to 45 per cent of Vitality Biopharma’s outstanding total to Mr. Knox’s operation in 2015. Mr. Knox used 20 nominees to “aggregate” those shares, the SEC said.

The same day Vitality was halted, an ‘independent equity research’ report was issued by a group called SeeThruEquity, giving Vitality a $3.50 BUY target.

SeeThruEquity’s website is now listed for sale, and Vitality now trades on the ‘grey market’

for $0.20 per share. Avtar Dhillon stood down from the Vitality board of directors last month.

Again, the SEC laid no charges on anyone in the Dhillon family, but this quiet move to limit the admitted involvement of one of the Dhillon’s in Emerald’s day to day business is not usual.

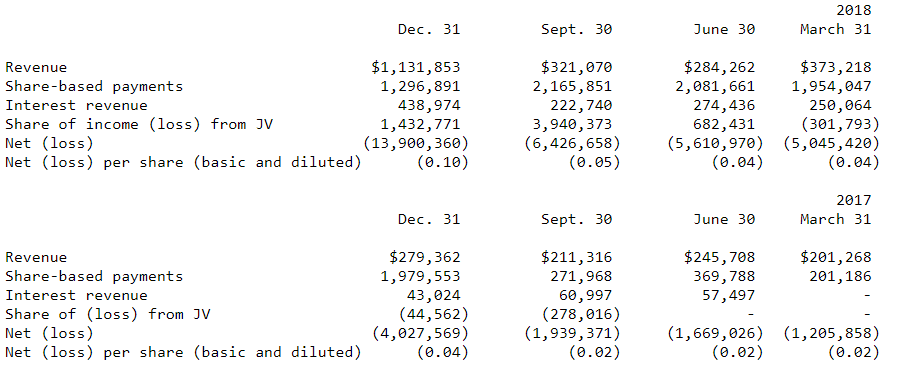

Emerald’s quarterly financials are due out in three days. The last time the company earned more revenue than it spent on share-based payments was in the quarter ending March 31, 2017.

It’s most recent quarter saw a $13.9 million loss on $1.1 million of revenue.

— Chris Parry

FULL DISCLOSURE: No commercial arrangement with Emerald, nor any stock position in the company.