Markets:

Stock markets in China closed down for the 4th straight week, as trade tensions increased between the Arrogant Middle Kingdom lead by a much-loved dictator and the Fading Decadent Superpower lead by a controversial conman.

This week, the Shanghai Composite closed down 1.9% to 2,882 – better than last week, when it fell 5.7%. The CSI 300 – an index that replicates the top 300 stocks on the Shanghai and Shenzhen stock exchanges fell 2.5 % to 3,648. In Hong Kong, the Hang Seng closed down 1.2% to 27,946.

Adding gasoline to U.S.-China trade war fire, Cadet Bone Spurs (CBS) barred Chinese telecom monster Huawei from buying technology from US companies.

There is a fear that Huawei could use its technology to spy on foreigners.

To give CBS some credit, at a recent business dinner in Beijing, Huawei was described to this writer as “a branch of the Chinese military”.

Financial pundits chatter excitedly about who has the upper hand in the on-going spat between the leaders of the world’s two biggest economies.

The 2019 U.S. deficit is on track to reach $1.4 trillion – that’s a new (additional) $9,000 debt incurred for every U.S. taxpayer.

Typically, when an economy grows and unemployment falls, budget deficits shrink, because the government collects more tax, and pays less welfare. But in the U.S. the opposite is happening. The 2019 deficit is expected to be about 5.1% of the U.S. GDP.

China is also stimulating its economy. Business and personal taxes will be cut by 1.3 trillion yuan (USD $194 billion) in 2019.

China’s 2019 deficit targets were recently raised to 2.8% of GDP from 2.6% in 2018.

Foreign investors have been withdrawing money from China, selling a total 5.61 billion-yuan (USD $622 million) worth of equities this week.

Media:

Over the last half decade, foreign visitors to China have noticed the depressing sight of Starbucks franchises springing up – first in Shanghai, then Beijing – and now frequently in 2nd and 3rd tier cities.

There are currently about 3,500 Starbucks outlets in China. Yup – Starbucks coffee in China is just as shitty & over-priced – as it is here in North America.

Chinese people are still crazy about tea – but young urban Chinese nationals have a developed a taste for coffee. Naturally – local companies are eye-balling this space.

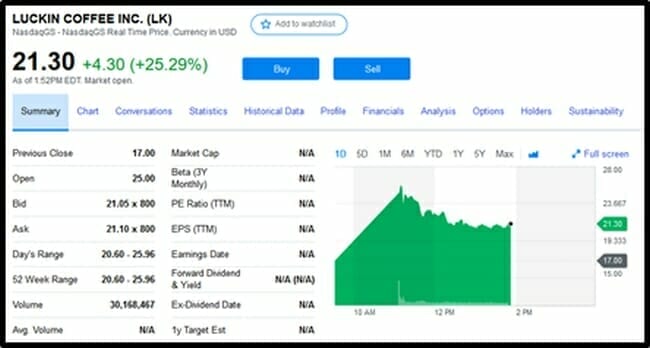

On Friday, China’s Luckin Coffee (LK.NASDAQ) went public stateside with an initial public offering at $17 per share.

Lukin’s coffee is about 25% cheaper than Starbucks. Ordering is done through an app. More than 90% of Luckin’s stores are tiny “pick-up” stores located in business districts or near university campuses. There’s nowhere to sit down. You just grab the coffee and go.

The 2-year-old Chinese coffee chain operates 2,400 stores across China and is planning to open another 2,500 locations in 2019.

“China’s coffee market is highly underpenetrated,” Luckin stated in its IPO filing. “Inconsistent quality, high prices and inconvenience have hampered the growth of the freshly brewed coffee market in China. We believe that our model has successfully driven the mass market coffee consumption in China.”

Luckin was valued at $2.9 billion after its last funding. The company hopes to raise about $590 million from the Nasdaq IPO.

Last year, Luckin lost $475 million on revenue of $125 million. For the first three months of 2019, it posted a net loss of $85.3 million.

Despite the heavy losses, on its initial day of trading, North American investors hurled buckets of money at Luckin’ praying that hyper-speed market penetration will morph into profitability.

Mayhem:

The beautiful, elegant Fan Bingbing (Lost in Beijing, Buddha Mountain, Iron Man, X-Men) is China’s biggest female movie star.

A few days ago, Fan flew to a charity event in Tibet, but was hospitalised because of severe altitude sickness (swollen gums, nosebleed, loss of appetite)

Altitude sickness is a common health problem for tourists in Tibet, the region Fan visited is 3,656 meters above sea level.

Despite her medical affliction, Fan dragged herself out of bed and attended the charity event.

This is big news in China, because Fan has been invisible for almost a year, after being caught inking a tax-avoiding “yin-and-yang contract”.

“Yin-and-yang” contracts have one version with the real fee, while submitting a different (lower) number to the tax authorities.

Fan was ordered to pay an 800 million yuan (USD $162 million) fine.

After months of house arrest, Fan resurfaced – issuing a public apology on social media for “not setting a good example for society and the industry,” while admitting that she felt “ashamed and guilty.”

“Fan’s arrest sent shockwaves through the film industry,” stated one entertainment reporter.

“It triggered a crackdown on tax evasion in the Chinese entertainment industry,” stated Mathew Alderson, a Beijing Entertainment lawyer. “Many are closing the offices they opened in regional tax havens.”

After her house arrest, fine, and public apology, the Chinese government “considers Fan rehabilitated”. They do not want to burn her at the stake. As a massive international celebrity, she is considered a national “soft power asset”.

Fan’s altitude sickness at the charity event in Tibet was greeted with scorn by Chinese netizens.

“She was widely criticized for trying to gain sympathy ahead of her showbiz comeback,” stated one media outlet, “with many netizens pointing out that that her friend would not upload the hospital-bed photos without Bingbing’s permission.”

Fan is about to appear in a new spy thriller “355” alongside Penelope Cruz and Marion Cotillard.