Chemesis International (CSI.C) set to purchase 19.9% of the outstanding common stock of GSRX Industries (GSRX.Q) and gain a foothold in dispensaries across the U.S.

GSRX is primarily focused on is acquiring and operating retail cannabis storefronts in Puerto Rico and California.

Alongside its e-commerce site, the company has “five additional prequalified dispensary locations at various phases of development” in Puerto and is currently in the midst of launching two hemp-based CBD dispensaries in Tennessee and Texas.

In return for 7,291,874 common shares of Chemesis, GSRX will broaden Chemesis’ footprint and give it an immediate entry into U.S. states and territories where it is already established.

Besides ensuring Chemesis’ brands are guaranteed shelf space at the Puerto Rican and Californian dispensaries, Chemesis also has a right of first refusal to manufacture “current and future production requirements in all jurisdictions” as long as Chemesis can meet local demand.

“Led by seasoned retail veteran Mr. Leslie Ball, GSRX has developed a retail strategy that fits incredibly well with Chemesis and complements its extraction and manufacturing abilities.”

–Edgar Montero, CEO of Chemesis

Ball has had an extensive career chairing major companies, most notably as the CEO of Macy’s Midwest, a division of department store giant, Macy’s (M.NYSE).

Apart from his 22 years with Macy’s, Ball recently served as CEO of Corral West Ranchwear, a retail store which expanded its footprint to 140 locations throughout the U.S. while under his leadership.

“With the exchange, GSRX ensures an ongoing, quality supply chain for its growing family of dispensaries, while Chemesis is guaranteed retail distribution access in key markets that only GSRX can provide. Both companies win, and our shareholders benefit from this alliance as well.”

–Leslie Ball, CEO of GSRX

What we know

GSRX has a market cap of $59M. Thanks to stronger-than-anticipated sales, the company recently raised its Q1 2019 consolidated revenue guidance from USD$2.7M to $2.9M.

The company’s Q3 2018 highlights included $706 thousand in revenue, doubling its Q2 2018 performance.

Additional Q3 2018 highlights:

- Gross profit was $255,052, a 66.6% increase from Q2;

- Sales from Puerto Rico operations increased by 298% over Q2 sales and gross margin increased by 2% quarter-to-quarter, from to 41.71% to 43.79%;

- Sales from California operations increased 2% over Q2 sales and gross margin increased 4.55% quarter-to-quarter from 53.42% to 57.97%;

- Operating expenses decreased 42% to $2,198,056 compared to $3,809,311 in Q2;

- Operational net loss from operations attributable to GSRX decreased to approximately $1,555,745 or $0.04 per share and net loss in Q2 was $3,483,701 or $0.08 per share.

The company recently completed construction on its seventh medical cannabis dispensary in Puerto Rico, with operations set to begin once approval from the Department of Health of Puerto Rico has been received.

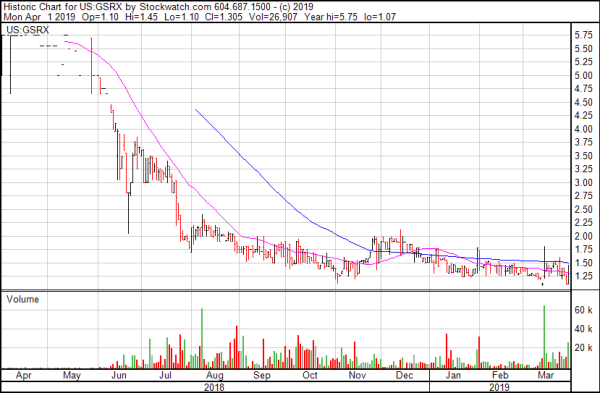

GSRX is up 18.6% by on today’s news and SP came to rest at $1.3. Chemesis was up 2.3% and closed at $2.21.

–Ethan Reyes

Full disclosure: Chemesis International is an Equity.Guru marketing client.