CROP Infrastructure (CROP.C) expanded its California legal cannabis market footprint when it inked a distribution deal with an emerging licensed retailer in the state.

Antler Retail operates an international cannabis dispensary chain from its Vancouver headquarters and like tech-giant, Apple (AAPL.Q), strives to make pleasurable purchase experiences for customers by utilizing high-end storefronts based on modern design and aesthetics.

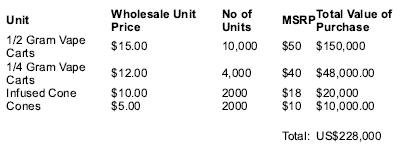

CROP signed an agreement whereby Hempire and CROP would sell the following finished packaged goods under the Antler brand:

Antler Retail was recently awarded a permit to sell cannabis from a retail location in Desert Hot Springs, just 18.2 kilometres northeast of longtime resort community, Palm Springs.

Antler was also granted rights to deliver its brand across the state, giving the company an advantage over other retailers legally bound to their brick-and-mortar locations.

The company has three secured locations in British Columbia, California and Jamaica.

Antler’s mandate focuses on the distribution of high-grade cannabis products, including topicals, edibles, dried flowers and concentrates.

Who’s steering this ship?

William White, Antler CEO and co-founder, has a deep history in safety and logistics compliance for the long-haul transport sector.

Penny Green, Antler’s other co-founder and director, is well known to the legal cannabis community and has been recognized on PROFIT Magazine’s W100 list of top Canadian female entrepreneurs.

The co-founder, president and CEO of Yield Growth (BOSS.C), also co-founded Merus Labs (MSL.T), which was acquired by Norgine B.V. in July 2017 for approximately $342 million.

CROP and Hempire have agreed to provide Antler its homemade brand outside of what the company has already planned to offer from self-branded cultivators across the Golden State.

The supply agreement will be amended as Antler enters additional states, allowing CROP and Hempire to bring even more Antler Home Brand products to new markets across the U.S.

As payment for the initial order, Antler Retail issued 1.5 million units at CAD$0.20 per unit to be converted into shares in Antler.

Each unit consists of one common share and one common share purchase warrant at $0.75 exercisable up to 12 months after issuance.

California’s post-legalization stumble provides opportunity

CROP’s deal with Antler is important as the legal cannabis industry in California is going through some serious growing pains as it deals with slow licensing and post-legalization regulatory challenges.

The Los Angeles Times reported over 80 cities in the state turned their noses up at hosting a cannabis store and out of a possible 6,000 sales licenses, only 547 stores have been given the go ahead to sell pot on a permanent or temporary basis.

Despite this, the legal cannabis industry in California is expected to pull in $5.6 billion by 2020, that’s more than Colorado, Washington and Oregon combined.

The distribution deal also helps to get Hempire out of a holding pattern as it continues to wait for cannabis retail licensing from the City of Vancouver.

However, the all-share transaction and sales agreement do little for shareholders until Antler is able to successfully market CROP and Hempire’s products under its own brand to California’s emerging pot marketplace.

That said, Antler has a tremendous head start in Cali in regards to licensing and stands a good chance of establishing a solid market share before the competition has time to spin up.

It’s all down to execution, but isn’t it always?

CROP was in the news recently when the Nevada tenant of its 49%-owned subsidiary, Elite Ventures, secured 2019 hemp handling and cultivation licenses covering 1,350 acres of the company’s 2,115 acre Nevada land package.

Shares in CROP remained level on low volume since yesterday, sticking at $0.325 by afternoon trading.

Currently there are 152,518,727 issued and outstanding shares with a market cap of $49.5 million.

–Gaalen Engen

Full Disclosure: CROP Infrastructure is an Equity.Guru marketing client.