There’s an old adage in stock promotion (now delicately called “IR”): “Investors buy the story – not the stock”.

The story needs to feel specific – but be general enough that it can be easily applied to every company in the sector.

Gold: money printing will devalue paper currency

Potash: fucking & eating demand driver

3-D printing: Manufacture an artificial limb on your home printer

Blockchain: fancy math will replace all traditional data processes

Weed: end of prohibition catalyses exploding frontier market

Great macro stories always attract dodgy, over-hyped companies. Some these companies are now crashing down to earth.

Other companies, like 1933 Industries (TGIF.C) have been unfairly caught in the sector-wide gloom.

1933 has a strong retail foothold in the State of Nevada, and it is now building distribution networks in California – with a total of 500 retail shops in the US.

Further expansion targets include Oregon, Arizona and Canada. According to a recent press release, a foothold in the Canadian market, “could open distribution channels into the European markets”.

“1933’s subsidiary Infused is adding an average of 50 new wholesale accounts added every month”, stated the press release.

On New Year’s Eve, the company claimed that “our strong financial results of $12.6 million in sales revenue for our fiscal year 2018 are a testament of our sound operational management and diligent business practices.”

“There were a number of key priorities that we were able to deliver on,” stated 1933 President and CEO, Brayden Sutton.

Highlights:

- Infrastructure build-out

- expansion of wholesale capacity

- strengthening product pipeline

- increasing sales revenue quarter to quarter

- Management talent recruitment

1933 Industries has first-mover advantage in the medicinal and adult-use cannabis market in Nevada.

That is a big deal.

Nevada’s 46 million annual tourists love weed. The first year of legalized recreational pot raised nearly $70 million in tax revenue, including $27.5 million for schools and $42.5 million for a state “rainy day” contingency fund.

Key Nevada Highlights:

- First licensed cultivator

- Expanding real estate portfolio

- Strong foothold in CBD and THC products

- Hemp-processing and CBD extraction vertical

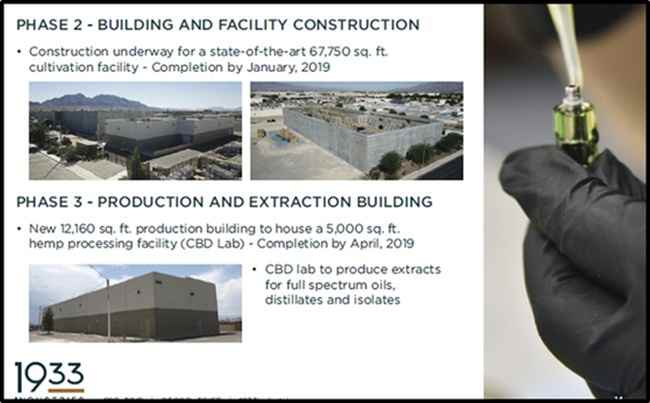

- New 67,750 sq. ft. cultivation-only facility

- Expanding production space to 12,160 sq. ft.

- CBD processing facility for oils, distillates and isolates

Nevada has the potential to “become the world’s top canna-tourism destination” – so for cannabis growers and branders – Nevada is a very, very good place to be.

1933 Industries’ penetration of U.S. legal markets hinges on its projects in Las Vegas, Nevada.

Construction on TGIF’s new 67,750 sq. ft. cannabis grow-op is about 75% completed and is on track to wrap-up next month. Plant clones are being readied for transfer into the new facility to ensure a smooth ramp up in cultivation.

1933 also owns 91% of both Alternative Medicine Association and Infused MFG. and 100% of Spire Global Strategy. It is expanding its footprint in California and Colorado.

“Friday Night boss Brayden Sutton begun to realize that, as good a brand as Friday Night was, for partiers on the Vegas Strip, perhaps there was a bigger audience out there for people who were less into Affliction t-shirts,” wrote Chris Parry, who appreciated 1933’s “nod back to the year prohibition ended.”

This year, 1933 Industries purchased of 2.78 acres of raw land next to AMA’s new state-of-the-art 67,750 sq. ft. cultivation facility – bringing the total land package to 4.17 acres.

We’re not talking desert.

The land is located on a major thoroughfare in Las Vegas.

All necessary permitting was secured during the year and the new cultivation facility is expected to be operational during the first quarter of 2019, where it expects to cultivate approximately 800 – 900 lbs/month to significantly increase flower cultivation to support AMA’s own line of cannabis-based products and white-label extraction.

AMA’s 12,160 sq. ft. building adjacent to the cultivation facility, will be utilized for cannabis production, processing and extraction – increasing the size of the current facility by 600%.

“We plan to replicate our successful business model in Nevada in other favourable jurisdictions across the U.S. and Canada,” stated Mr. Sutton.

Any time a sector (like weed) catches fire, you’ll find a simple compelling story pushing the entire sector forward.

As investor tears mingle with dust into a melancholy play-dough – we expect 1933 Industries to rebound hard.

Full Disclosure: 1933 Industries is an Equity Guru marketing client, and we own the stock.