On November 29, 2018 at 5 p.m. eastern time, cannabis retailer MedMen (MMEN.C) released a 65-page consolidated financial report, followed by a 63-page management discussion of its Q1, 2019 performance.

It’s dense reading, so let’s deploy an anecdote to explain what is happening.

Suppose, instead of MedMen’s chain of cannabis stores – you invest in a fruit stand.

Give $1,000 of your hard-earned money to a wanna-be fruit vendor to start his business.

He purchases a collapsible table, a truck load of fruit, a sign, a calculator and a sturdy wooden chair to sit on.

To protect your investment, you park on a hill opposite the fruit stand, and watch the vendor through a pair of binoculars.

Immediately, the first customer shows up and buys an orange, followed by a second customer who buys a 10 lb. bag of Asian pears.

By noon, people are lined up 5-deep in front of his table. $5 bills, $20 bills, $100 bills – waves and waves of cash are handed to the fruit vendor.

At dusk, a limousine pulls up, eight dudes in Armani suits get out. The fruit vendor hands them each a garbage bag – they get back in the limousine with their bags and drive away.

We’ll reveal the conclusion of the fruit vendor story in a minute, but first let’s review MedMen’s recent business activities.

In Q1, 2019, MedMen had revenues of $21.5 million representing 1,094% revenue growth over first quarter fiscal 2018.

MedMen’s “class-leading retails stores” booked a whopping $6,188 annualized sales per square foot.

That’s better than the sales-per-square-foot of the GAP ($321) Lululemon ($1,500), Tiffany’s ($2,951) and Apple (APPL.NASDAQ) ($5,546).

“Our first quarter performance underlines the successful execution of our growth strategy,” stated Adam Bierman, MedMen CEO.

MedMen has established a 5.3% cannabis market share in California.

Everything is almost perfect.

Looking back at Q1, 2019 – perhaps there were a few warning signs.

Two weeks ago, MedMen was forced to reduce an equity offering size from $120 million to $75 million and lower the offer price from $6.80 to $5.50. That same day James Parker, its CFO resigned.

Back in May, 2018 Equity Guru principal Chris Parry gently pointed out that “The god damned CFO is going to earn $5.75 million year one, and $15m over two years.” Parry also thought the compensation for the CEO was excessive.

MedMen threatened to sue Equity Guru for half a billion dollars. But they didn’t. And in fact MedMen adjusted its bonus system.

But the problem (of greedy management) does not appear to be fixed.

Despite Q1, 2019 revenues of $21.5 million @ $6,188 annualized sales per square foot, MedMen reported a net loss of $66.5 million ($1.42 per share).

That’s not an annual loss, that’s for one quarter.

During regular store hours, MedMen is losing $1,000 a minute.

The company is on pace for a 12-month loss of $264 million – about 85% of the current market cap.

In fact, 90% of cannabis dispensaries report that they are profitable.

So why is MedMen bleeding?

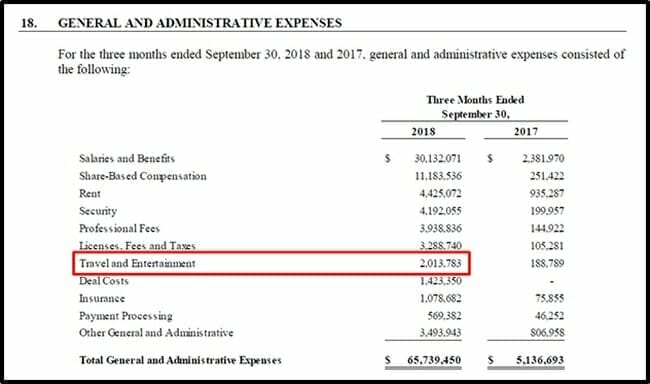

For one thing, there was a lot “traveling” and “entertaining”.

Strangely (actually uniquely) the management team is not listed in MedMen’s corporate presentation.

But let’s say there are 10 of them.

If they each flew business class from Los Angeles to NYC return every week, stayed in the Sheraton Executive Suite for 3 nights, went out for a $200 steak dinner 7 nights a week – then to a strip club where they tipped the pole dancer $100 – followed by an $80 cigar, the total bill would be $617,000.

But somehow, “Travel and Entertainment” totalled $2 million – which leaves $1.4 million unaccounted for.

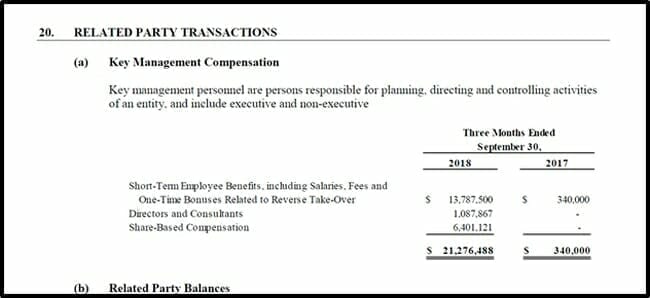

But here’s what’s more alarming: on p. 57 of the Q1, 2019 consolidated statements, it says that “Key Management Compensation” for the quarter is $21 million.

Again – assuming there are 10 “Key Managers” and they all work 7 days a week, that’s $23,000 a day in compensation for each manager.

In this game, ambient levels of greed are to be expected.

But that seems a little rich for a new unprofitable company.

By mid-morning, November 30, 2019, MedMen stock is down .38 (8%) to $4.27.

Now, let’s go back to the fruit stand.

You hustle down the hill to the fruit vendor – excited to receive your profits.

The vendor tells you, “There are no profits – in fact – I’ve lost your $1,000.”

“How can that be?” you ask, “I saw you take in mountains of cash”.

“I gave all the money to the guys in the limousine”.

“Who are they?”

“My friends”.

“Am I not your friend?”

“No”, says the fruit vendor, with just a hint of a smile, “You are a retail investor”.

Note to MedMen shareholders: you own part of this company, it’s okay to ask questions.