On November 5, 2018 Aurora Cannabis (ACB.T) announced a $20 million investment in Choom (CHOO.C). The investment is convertible into common shares of Choom at $1.25 per Share, with a 4-year maturity date.

Aurora has also secured the right to acquire up to 40% of CHOO at $2.75 per share.

The mechanism for additional investment: 95.7 million warrants issued at an exercise price of $2.75, allowing Aurora to increase its equity interest in Choom to approximately 40%. The warrants are exercisable by Aurora at any time prior to November 02, 2020.

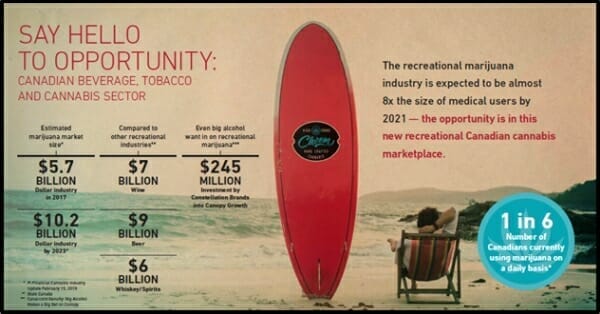

Choom is currently trading at .92 with a market cap of $164 million. Choom has planted its flag in the rapidly growing legal cannabis industry in Canada with its own brand of high-grade handcrafted herb.

Choom was inspired by a group of buddies in Honolulu during the 1970’s who loved to smoke weed—or as the locals called it, Choom. The “Choom Gang” included former U.S President Barrack Obama, who’s behavior was “right out of a buddy stoner flick,” according to Adam Sorensen at TIME.

Choom knows how to make pot look sexy:

However Choom’s ability to advertise its brand in Canada is significantly constrained by the Canadian government’s “General Prohibitions on the promotion of cannabis”.

Unless authorized under the Cannabis Act, it is prohibited to promote cannabis or a cannabis accessory or any service related to cannabis:

- by communicating information about its price or distribution

- by appealing to young persons

- by depicting a person, character or animal – real or fictional

- by evoking a positive or negative emotion

- by promoting glamour, recreation, excitement, vitality, risk or daring. [Subsection 17(1)]

So, Choom will have to tailor its branding campaigns to fit a regulatory framework that is still in flux in Canada.

A peek across the border gives a hint at how this may play out: in the U.S. Colorado allows print, radio, TV and Internet ads if the weed company can produce “reliable evidence that 70% of the audience is over 21”, while Washington state requires ads to contain advice about responsible usage.

“Choom recognizes that we’ve just started paddling into a wave that will only build momentum once legalization is in place,” stated Choom’s CEO Chris Bogart, “In every major market, Colorado, Washington, California, we’ve seen adult-use grow year over year by double digits. Choom sees the same growth potential in a legal adult-use market for Canada.”

Aurora booked $55 million in 2018 sales – about 300% higher than 2017. ACB is currently trading at $9.23 with a market cap of $8.8 billion.

Vertically integrated and horizontally diversified “across every key segment of the value chain”, Aurora is involved in facility engineering, genetics research, cannabis and hemp production, wholesale and retail distribution.

ACB’s $20 million investment in Choom signals its belief that Choom’s brand will not be nullified by the advertising regulatory environment.

Choom is currently developing a network of retail stores featuring a curated selection of products from various licensed producers with a strong focus on elevated customer experiences.

Choom has the rights to 45 retail opportunities across Western Canada, rapidly expanding its commercial presence in premium locations.

- 45 applications submitted

- 27 development permits

- 18 building permits received

“Through this strategic investment, Aurora further diversifies its retail strategy, with additional retail opportunities across Western Canada,” stated Terry Booth, CEO of Aurora, “We are pleased to increase our stake in Choom and support them as they execute on introducing their unique retail brand to Canadian cannabis consumers.”

ACB has a funded capacity of 500,000 kilograms per year and sales and in 19 countries across five continents. Its purpose-built facilities are defined by automation and customization, resulting in the massive scale production of high-quality product at low cost.

Last quarter, Aurora’s cash cost for dried cannabis sold was $1.87 a gram, down from $2.09 a year earlier. The decrease was caused by “efficiencies from automation and yield expertise.”

If Aurora was selling coconut water, it would do what do what big consumable-product companies always do.

- plaster the billboards

- blanket the internet

- buy up the shelf space

- out-spend the little guys

But Aurora can’t do that efficiently in Canada now. That’s one of the factors driving its investment dollars into smaller players like Choom.

“Will the bigger players be forced to lobby hard for relaxation of current rules, or will they look overseas for where they can actually do profitable business?” asked Equity Guru’s Chris Parry in The Cannabis Shake-up, “Will the separation between Canada and the US stand, or will the walls begin to crumble?”

With the investment from Aurora, Choom intends to accelerate its sophisticated retail channel expansion in the Canadian adult use market, and is committed to establishing Choom as a dominant national cannabis retail brand.

“This investment helps accelerate our growth and expand our retail footprint,” stated Chris Bogart, President & CEO of Choom. “Aurora’s continued confidence and investment allows Choom to provide high quality cannabis to a broader market of consumers across the entire country and expedite our expansion and the roll out of store openings.”

Full Disclosure: Choom is an Equity Guru marketing client, and we own stock.