The MVIS Crypto Digital Assets 10 Index tracks the performance of the 10 largest and most liquid digital assets including bitcoin. In 2018 it has lost about 75% of its value.

In the same time frame, Bitcoin has fallen from $20,000 to $6,000.

Bitcoin’s underlying technology, blockchain, has also lost favour with investors.

It is worth picking through this wreckage to see which blockchain companies have strong revenue and viable business models.

DMG recently installed an 85-megawatt capacity transformer and electrical substation to power the expansion of DMG’s Canadian cryptocurrency mining facility.

A transformer transfers electrical energy from one circuit to another without changing the frequency. The main function of a transformer is to increase or decrease AC voltage.

“This facility will become DMG’s flagship crypto mining operation in Canada and further expand its mining-as-a-service (MaaS) capacity,” stated the press release, “Deployment of its new 85-megawatt substation will increase DMG’s hosting capability by more than 20 times.

On September 27, 2018 DMG Blockchain (DMGI.V) provided an update on this flagship mining facility in eastern British Columbia.

“DMG has completed construction of all essential components of its 85-megawatt substation,” stated the press release.

DMG began commissioning its substation in mid-September, with the intention of meeting the requirements of the regional utilities and power authorities. This process is expected to be completed in mid to late October.

“As soon as the commissioning process is completed, DMG is ready to energize,” stated DMG’s COO, Sheldon Bennett.

DMG is now talking to industrial mining customers for its Mining-as-a-Service offering.

When the facility comes on line next month, DMG can host in excess of 30,000 units of industry-standard bitcoin miners.

As DMG has constructed its own private substation, it does not anticipate impacting the power needs of the local community.

“DMG can meaningfully contribute to the local economy and to be a new source of employment in this region,” stated CEO Dan Reitzik.

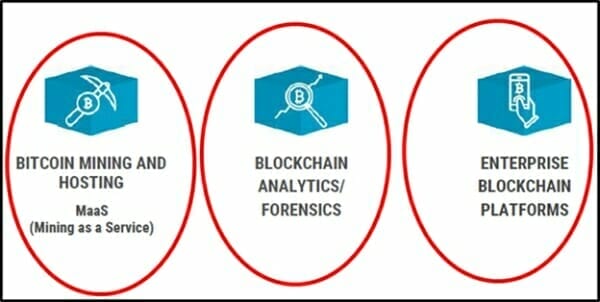

DMG is not a one-trick pony.

As well as the crypto-mining side, DMG uses artificial intelligence (AI) and machine learning (ML) technology to monitor cryptocurrency exchanges, examining the currency flow through the blockchain in order to establish the “provenance and destination of crypto wallet funds.”

Blockchain Forensics & Analytics Group has secured contracts from multiple international auditing and consulting firms.

On July 18, 2018 – believing that DMG shares are undervalued in the market place – DMG authorized the purchase of up to 4.6 million shares in a share buy-back program, to enhance value of the common shares held by remaining shareholders.

Key Second Quarter 2018 Highlights:

- Revenue of $3.3 million (552% quarter-over-quarter revenue growth)

- Purchased 2,650 new mining rigs

- Constructed flagship data center

- Appointed Charlie Lee, creator of Litecoin to DMG’s advisory board

- Completed acquisition of Blockseer

Part of DMG’s fight back is a guy named Dr Danny Yang,” explained Equity Guru’s Chris Parry, “for the last two years he’s been working on Blockseer.”

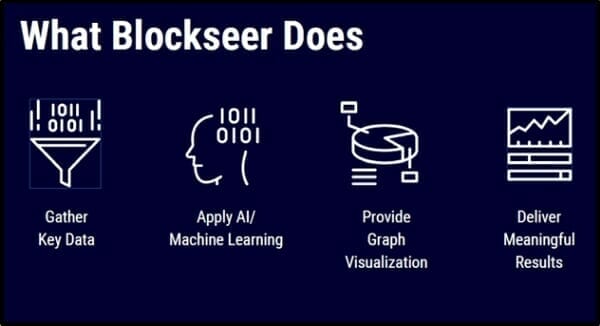

“BlockSeer’s mission is to make blockchain data and applications accessible to everyone by providing valuable analysis of patterns, useful metrics, clear visualizations, and actionable intelligence,” wrote Parry.

Blockseer provides the analytics tools for these transactions and applications on the blockchain.

You want to look up who has the most Dash? Blockseer is going to let you. Want to track the Ethereum you’re getting from its origins? Blockseer. Want to see whether that dude who is promising to buy your bike actually sent the money for the last three he bought? Blockseer.

Exchange transactions: Blockseer.

Dark web transactions: Blockseer.

Accounting forensics: Blockseer.

Real time trade data: Blockseer.

Bitscore, the world’s second largest e-wallet, is using Blockseer.

A February 2018 academic paper, Fraud Risk Assessment Within Blockchain Transactions, reveals the scope of fraudulent and non-compliant blockchain transactions.

“Selfish mining” – for instance – is a strategy that can be used by a minority pool to obtain more revenue. A pool of selfish miners can keep its blocks private while honest nodes continue to mine on the public chain.

DMG’s technology can help solve the problem of Selfish Mining.

“We have the tools for real-time analytics,” confirmed Simon Padgett, DMG’s Director of Forensic Services. “We were recently appointed by MNP, a major auditing firm, to assist with an urgent blockchain audit verification requirement.”

In the September 27, 2018 press release, DMG announced that will exercise an option to purchase its flagship facility comprised of 34 acres of land with an existing 27,000 square foot building, located in British Columbia.

The implosion of the blockchain investment sector, closely mirrors the dot.com crash (an 80% haircut).

Yet – internet shopping is still a thing.

Twenty years from now, blockchain will also still be a thing.

Based on their intellectual DNA and diverse revenue streams – we believe DMG blockchain will be one of the survivors.

Full Disclosure: DMG Blockchain is an Equity Guru marketing client and we own stock.