It’s important to keep a magnifying glass on-hand when investing in blockchain, according to Jag Sidhu. “You can’t invest in just anything.”

As the CTO of Blockchain Foundry (BCFN.C), Sidhu can parse when a blockchain-based program is sound. He also knows when an idea is not sound, or is, what he calls, froth.

“Obviously, when there’s such a disruptive technology, some of it’s not froth. People actually think they’re solving these problems in a way that will work but a lot of times they don’t. The game theory is this: there’s really only one or two truths to any of these systems, when they work, under pressure,” he says.

Sidhu’s company, Blockchain Foundry, is a company which offers users access to its online marketplace, a unique cryptocurrency and data storage.

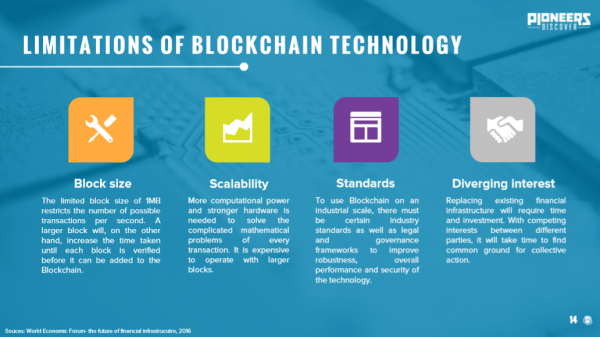

When Sidhu was invited to speak at the Vancouver Blockchain Conference in late August, it wasn’t froth on his mind, but scalability. “It’s basically the hottest topic in the industry,” he said.

Economies of scale

Simply put, scalability is the question of how well something holds up as it grows. As an example, Visa can process 24,000 transactions per second. On the other hand, Bitcoin can handle between 3 to 7 per second, a paltry number when considering the 22 million bitcoin wallets in existence today.

The issue is throughput increases, or increases in traffic. Simpler payment-processing systems such as Visa have no issue with large volumes of transactions, but designing a blockchain system which can match a company like Visa in pound-for-pound processing speed, while maintaining its immutability and its decentralization, is no small feat.

“The problem with decentralized systems is, if you need everything on the blockchain and you need it available at anytime, it just won’t scale,” Sidhu said. “It’s too much data.”

Because each node in the blockchain has to agree on a contract’s validity, and since each node is a computer hooked up to the blockchain system, every computer will have to run every contract on the system.

User Vitalik on GitHub.com argues that blockchain systems can have two of these three properties at most:

- Decentralization: defined as the system being able to run in a scenario where each participant only has access to O(c) resources, ie. a regular laptop or small VPS

- Scalability: defined as being able to process O(n) > O(c) transactions

- Security: defined as being secure against attackers with up to O(n) resources

The strain on bandwidth and latency is only expected to increase as the user-base for these programs grow. When millions of users are constantly “syncing up” with each other to verify data hosted on-chain, the process slows down as the reams of data requiring authentication expands.

Solving scalability isn’t just for the benefit of Bitcoin users, however. This issue affects every program and add-on which uses blockchain as a foundation

Going off-chain

Ethereum World News wrote about the ways industry-movers are making scalability possible in a piece from 2017.

In the crypto-community world it is known [in general] now that for solving scaling issues, a combination of off-chain and on-chain solutions are required to have success…

Ethereum does have a very bright and promising future – however it does have the need to be ‘quicker’.

Sidhu said developers could get around this bottleneck by removing as much data as possible from the blockchain where it will require less resources, like keeping your schoolbooks in a locker instead of carrying them around all-day: “If you push it off-chain, you still have the benefits of the blockchain.”

On-chain items such as Blockchain Foundry’s decentralized marketplace, and anything related to a user’s identity, could potentially be thrown off-chain to improve scalability. Anchoring data on the blockchain and verifying it through the timestamp method which would save resources, according to Sidhu. If it can work for his company, it can work for enormous companies like Amazon which hope to use the blockchain for storage.

“That would scale to internet of things (IOT) levels for whatever needs very large throughput but still needs the immutability of the blockchain backing it. That’s what we’re researching in terms of solving that problem so we can bring that to our customers,” he said.

“We can sell them the off-chain solution because there’s no gaming it, they can control the process. All you’re doing is providing the cryptographic proof that something did or didn’t happen.”

Blockchain Foundry’s pitch

As Equity Guru’s Chris Parry wrote in August, Blockchain Foundry’s creators started SYSCOIN, a blockchain-enabled platform which included its own cryptocurrency and the world’s first decentralized marketplace in which to spend it.

Blockchain Foundry offers a number of servers and programs to deliver users access to their marketplace, alongside the cryptocurrency-management programs and messaging systems.

The marketplace was backed by built-in escrow services, encrypted messaging and end-user verification as a means of securing transactions.

Improving scalability is a key component of the recently released Blockmarket Desktop 3.1. The program a “provides significant user experience and user interface improvements.”

Sidhu said his company is always seeking to make its offerings more scalable, with SYSCOIN serving as proof of that: “The thing we’ve done recently is create an asset tokenization platform that lets you transfer cryptocurrency in real-time within a 10 second window for point of sale. So, in terms of scale, we can push the Visa type of transaction levels for throughput.”

While important, Blockchain Foundry’s CTO admits his company’s advances in scalability don’t solve the entire problem, but they’re a big step in the right direction. Given the rate at which internet connection speeds are advancing, scalability is becoming increasingly possible.

“Again, all this data is still on the blockchain. In terms of scaling for bandwidth and disk costs, it’s not there yet, but there’s already innovations that are happening in those fields. We’re going to have fiber networks and terabyte connections very soon,” Sidhu said.

Navigating blockchain as an investor

Blockchain companies have been taking a beating recently. Parsing out which companies are worth buying into and which aren’t can be a daunting task.

In regards to investing in blockchain in general and his company in particular, Sidhu doesn’t expect potential investors to take his word that Blockchain Foundry is a fiscally-sound company with a real game plan.

The company has more than CAD$2.7 million in cash assets to date. Net losses for Q2 were just over $6 million, and Blockchain Foundry is working to expand its user base and commercialize its product line.

With SYSCOIN-related apps like Blockmarket Web and Pangolin slated for release in 2019, near term revenues are expected to be generated from consulting work.

Sidhu insists investors do their homework on blockchain companies like his, to look past the froth and to focus on what they’re doing and what their practical applications are.

“You need to put your business hat on and your developer hat on. Right now, the developer hats are more needed because we’re at a ground level. If people are looking to get into it, they should get someone that’s experienced that has the time to investigate,” Sidhu said, fully welcoming the scrutinizing gaze of a shrewd investor. Sidhu is confident his company’s resume speaks for itself.

Full disclosure: Blockchain Foundry is an Equity.Guru marketing client

FYI, Blockmarket Web is not currently slated for release in 2019. This might be out of date info. If that plan changes though I’m sure Blockchain Foundry will communicate such.

Source: dude who knows the general lay of the land (works at BCF)

So when is Blockmarket web coming out ???