With the blockchain sector still not being discussed in polite company after early 2018’s stock price meltdown, it’s easy to miss that companies are still actively doing business out there.

Software developer LeoNovus’ (LTV.V) recently released Q2 financial statement shows cash assets in excess of US$8 million, despite a six-month loss of $1.97 million, giving the company a solid two years at current spending levels before they’ll need to go raise more.

But in the meantime, they’re getting work done on locking down tech and clients, which is where the money is being spent.

https://equity.guru/2018/06/27/make-money-blockchain-invest-people-real-business-not-crypto/

The company’s financial disclosure showed a four-fold increase in net loss which is understandable for a company in the middle of ramping-up its scope of operations.

Since our financing closed in December, 2017, the company has grown to 32 employees and will grow to approximately 40 by the end of 2018. Significant effort over the past six months to productize our technology and gain awareness with channel partners is beginning to show results.

–LeoNovus CEO and Chairman, Michael Gaffney

Because of the nature of LeoNovus’ product, sales cycles range between 12 to 18 months. The company expects revenue to being rolling in starting Q3 of this year.

Currently, there are fifty companies in the company’s sales pipeline with a gross annual revenue potential of more than $8M CAD. Applying a twenty-five percent sales probability model to these opportunities results in the potential for $2M in annual recurring revenues. The sales cycle is twelve to eighteen months, which means this revenue, except for current proof of concept invoices, would begin to appear in 2019. The current sales forecast includes only Canada and the USA.

The goods

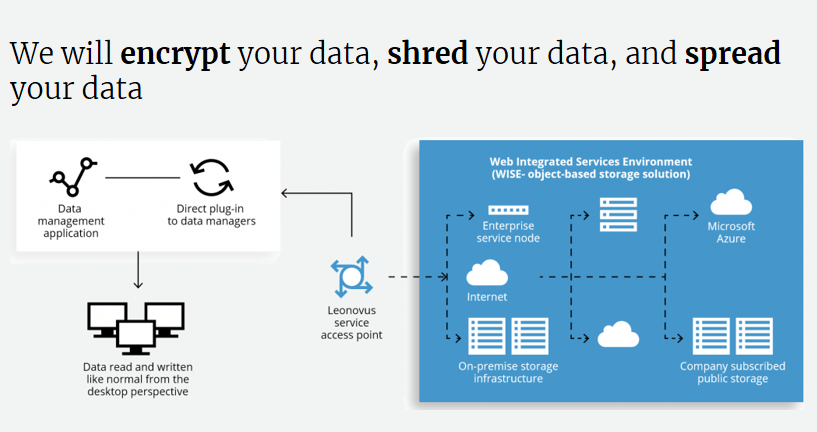

So what does this company do? LeoNovus uses blockchain technology and multi-cloud storage to protect users’ data. Information is stratified and stored across a number of different spaces to prevent tampering or theft.

The company’s website claims that information secured by their software is even safe in the face of a successful network breach. This is because of the LeoNovus’ two-pronged approach to data storage.

- LeoNovus’ storage system silos data across multiple storage nodes. Simply compromising one does not grant access to the rest.

- Information stored in individual nodes is fragmented and incomplete. Like a jig-saw puzzle, simply having half of the pieces will not be enough to construct a coherent data-set.

LeoNovus goes big-game hunting

Companies promise security and top-tier defence all the time. Whether the sales pitch delivers results is another thing. That said, the caliber of a company’s clients is a good litmus test of its efficacy and LeoNovus was able to bring home a pretty good scalp in June: the Canadian government.

EG’s Lucas Kane covered the story:

What distinguishes LTV from many of its peers is that it has a focused business objective that has already moved well beyond “Proof of Concept”.

The application of its technology is almost unfathomably wide.

For instance, LTV identified a potentially profitable opportunity in the law enforcement data management market – which is changing rapidly due to the widespread adoption of vehicle and body cams

The Chicago City Police Force has 12,000 officers. Body cams record 29 frames per second. Back-of-the-envelope math – and you get about 50 billion images that have to be catalogued and archived every week.

That’s one police force – for one week. The ability to archive those images securely is vital for the prosecution of criminals and the protection of the officers from frivolous lawsuits.

Equity Guru’s Chris Parry says there are three important questions to ask about blockchain companies:

- Is the company doing the actual work that blockchain promised would be important a year back?

- It is undervalued/oversold?

- Is there a plan to move forward and emerge from this doldrums stronger for the experience?

LeoNovus isn’t just out to sell paper if their Canadian government contract is anything to go by.

The company is drafting the GALAXA Whitepaper for its ICO as we speak and plans to unveil a new product offering in the coming weeks, which should help potential investors understand where the value in their business model lies.

In a disrespected market sector where blockchain companies are largely still focusing on crypto, LeoNovus is forging on ahead in the real work of blockchain, with real organizations with real world needs. Not too shabby if you ask me.

~~Ethan Reyes, with file by Chris Parry

I wish more of these blockchain companies had such a solid plan and vision that LTV has going forward. This what CYX and many other blockchain co’s should be emulating otherwise they’ll be at the mercy of BTC price. If BTC does spike like some have forecast they might look like hero’s but if it doesn’t there could be a lot of companies going to zero.

This dog will never hunt. From secret internet technology about to be bought by Cisco, settop computing box running linux, to distributed storage in hotels, to scalable computer processing, to iOT products. Each with a big potential pipeline, each flopped. Now blockchain…..this company has pivoted so many times it should be 10 feet under by now.