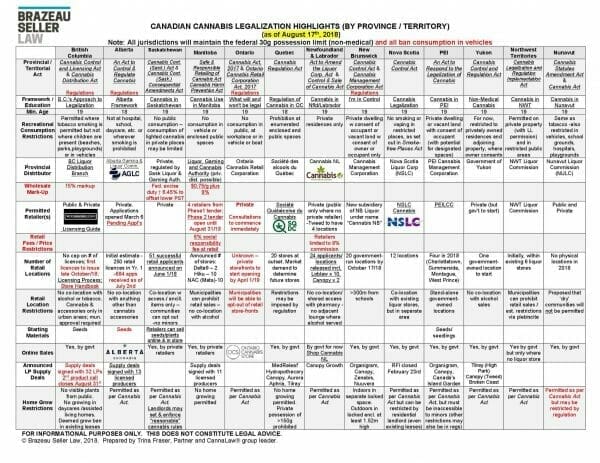

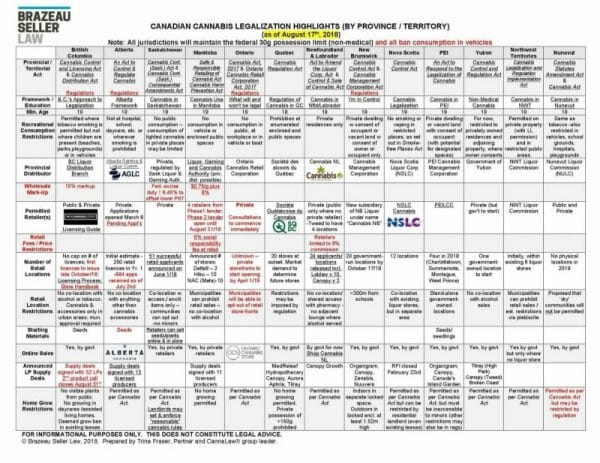

Cannabis companies aiming to operate non-medical dispensaries in Canada will face local governments with wide-ranging restrictive powers as decided by their respective provincial legislatures.

Recreational cannabis is in a pre-retail period which provincial governments are navigating with varying speeds and intentions. As “Creatures of the Province,” municipalities are only able to apply restrictions afforded by their provincial governments such as zoning restrictions.

There are exceptions of course, with certain provinces having more say in the approval process. Here’s what those municipal powers are and what they mean for cannabis companies province-by-province in order of descending population.

Ontario

Nicole Stewart, a representative of Ontario’s finance ministry, addressed cannabis authorization at the Association of Municipalities Ontario conference this week. With a combination of government-run and private retail locations, Stewart said local governments would have a one-time “opt out” period from hosting a dispensary in their city.

“Municipalities will have a one-time opt out window under which they can choose to opt out of permitting physical cannabis stories within their boundaries. The opt out window will be a one time period and the government will communicate the specific start and end dates within which the municipality can opt out. If a municipality chooses to opt out, it could in the future decide to opt back in… The government is considering the details of how opting out would work,” Stewart said.

Ontario’s provincial government is continuing the consulting process with municipalities and finalizing details on the opt out process.

Quebec

According to Bill 157 of the National Assembly of Quebec, section 69 states that municipalities have the authority to appoint an inspector to verify a dispensary’s good-standing.

a local municipality may, except in respect of workplaces and public bodies, authorize any person to act as an inspector for the purpose of verifying compliance with Chapter IV and the regulations made under it. In such a case, the municipality must inform the Minister that it has done so.

An inspector appointed by the municipality, as opposed to one deputized by the province, has far fewer powers, but is still authorized to: enter into any place where cannabis smoking is prohibited, to demand a dispensary produce documentation for examination and to take photographs of equipment, property or products.

BC

Applications for non-medical cannabis retail spaces in BC must first be submitted to the provincial Liquor and Cannabis Regulation Branch (LCRB). Once received, the LCRB notifies the local government which would oversee the prospective dispensary of the application and awaits its approval.

The municipal government or Indigenous Nation can terminate an application by withholding approval, but the LCRB is not required to grant a licence simply based on a municipality’s recommendation.

The LCRB requires local governments which desire a recreational dispensary to first gauge public receptiveness by way of referendum, public hearing, written notice or, in the case of an Indigenous Nation, another method deemed appropriate.

Municipal governments have the ability to impose zoning restrictions, licensing bylaws, signage and operating hours regulations and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative feed regarding the applications examination.

Alberta

In addition to observing bylaws, recreational-use dispensaries in Alberta need one of these authorizations under the provincial Gaming, Liquor and Cannabis Act:

- A development permit from a municipal government

- Approval from an Indian reserve’s band council

- Approval from a Metis settlement’s settlement council

Recreational dispensaries must also be over 100 meters away from a provincial health facility, school, school reserve or a “boundary of a parcel of land on which the building is located.” Municipalities can vary this distance at their discretion.

A municipality in Alberta is also authorized to restrict a dispensary’s hours of operations, but this cannot be done on a case-by-case basis: this ruling on hours of operation would uniformly affect all dispensaries in the municipality.

Manitoba

The Safe and Responsible Retailing of Cannabis Act outlines a Manitoban municipality’s recourse against the granting of a recreational cannabis license.

Exception for plebiscite on cannabis sales

165(1.1) A municipality may hold a plebiscite under section 160.1 (plebiscite on cannabis sales) before January 1, 2022, on a date specified by the council of the municipality. On or after that date, a plebiscite may only be held on voting day.

If approved, the plebiscite to prohibit the local sale of cannabis stops the issuance of licenses and revokes already approved licenses six months after the plebiscite. Plebiscite’s can be held on any day chosen by city council before January 1, 2022. Any plebiscite’s after that date must take place on voting day.

Furthermore, municipalities in Manitoba can vote to prohibit the sale of cannabis at approved stores on Sunday.

Saskatchewan

When surveyed on whether municipalities should be given authority to pass bylaws for the further regulation of cannabis, 33.1 percent of respondents, the largest respondent group, said they “strongly disagreed.” vocal opposition to municipal restrictions may be the reason for this statement by the Provincial government:

Municipalities already have broad authority through bylaw, land use and zoning, and business licensing to deal with a variety of business related issues, including where businesses can be located. They can decide how best to use this existing authority regarding cannabis wholesalers/distributors and retailers.

-Government of Saskatchewan

Nova Scotia/New Brunswick/Newfoundland & Labrador/PEI

Municipalities in Nova Scotia have the ability to restrict where cannabis smoking in public can take place and how many cannabis plants can be cultivated in a home.

Details on the municipal powers afforded by the other Maritime provinces aren’t readily available, nor are any extra provisions for municipalities included in their respective cannabis-control legislation.

The Municipal Guide to Cannabis Legalisation does outline the standard restrictive powers municipalities hold which entail:

- Zoning (density, location)

- Retail locations

- Home cultivation

- Business Licensing

- Building Codes

- Nuisance

- Smoking restrictions

- Odours

- Municipal workplace safety

- Enforcement

- Regulations around public consumption

- Personal possession

- Municipal cost considerations related to local policing

Northwest Territories

Much like in BC, dispensaries need community approval before they can be permitted to open. Notice must be provided by the provincial minister to either the municipal council, the band council or both if a municipality has both.

Communities in the Northwest Territories are also free to hold plebiscites on the establishment, replacement, modification or cancellation of a cannabis restriction or prohibition of dispensaries.

Where BC and the Northwest Territories differ is in the limitations of the plebiscite. Section 14 of the Cannabis Legalization and Regulation Implementation Act which states:

If a cannabis store operates in the community, no question may be asked in a plebiscite initiated under section 13 that would, if supported by the voters, authorize the making of a regulation that would have the effect of prohibiting or restricting the sale of cannabis at the cannabis store.

Additionally, temporary prohibitions on dispensaries can take place during a “special occasion” within the community or if circumstances exist which make it advisable to prohibit the dispensary within the community.

Yukon

The Province’s Cannabis Control and Regulation Act does not include any provisions for municipal or band discretion regarding the approval of dispensaries beyond the aforementioned stipulations including zoning and licensing.

Dispensary license applications by province:

Information on which cannabis companies have been granted approval to open dispensaries is sparse, but here’s what we know:

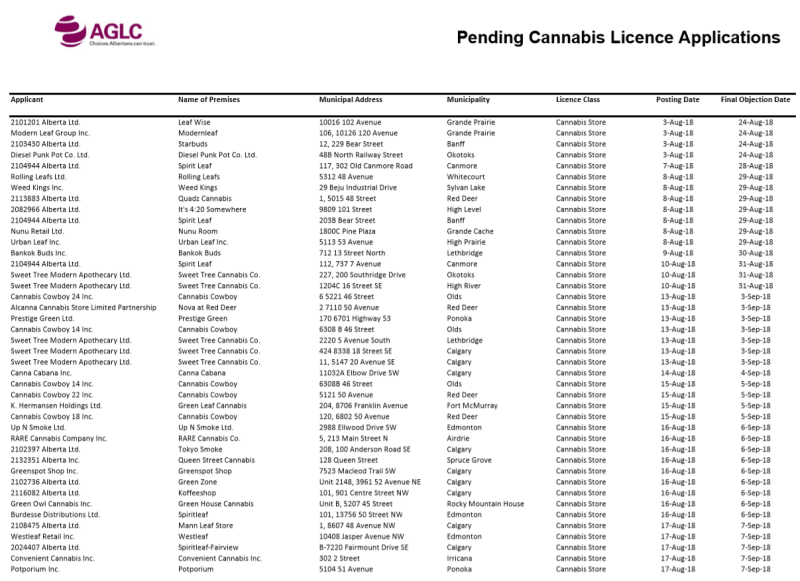

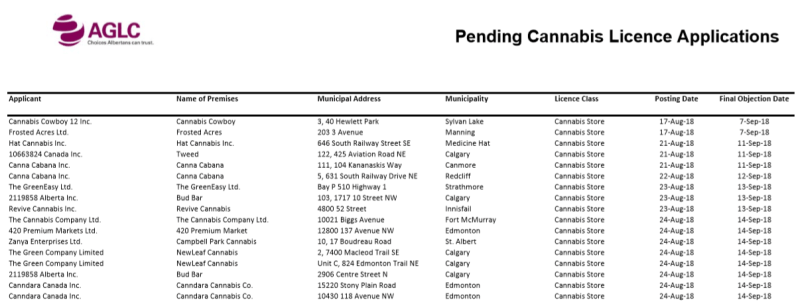

Alberta

Manitoba

Consortium of Delta 9 Cannabis Inc. and Canopy Growth Corporation – Delta 9 operates an 80,000-sq.-ft. production facility in Winnipeg and expects to hire approximately 100 people for production and retail in the first year, and an additional 100 the following year. Canopy Growth is headquartered in Smiths Falls, Ont., and operates numerous production facilities across Canada and around the world with over 700,000 sq. ft. of production licensed under Canada’s medical cannabis framework.

National Access Cannabis – Operating medical cannabis care centres across Canada, National Access is committed to adapting its established medical clinic model to meet the needs of the Manitoba retail market and deliver secure, safe and responsible access to legal cannabis.

Tokyo Smoke, a wholly owned subsidiary of Hiku Brands Company, in partnership with BOBHQ – As part of Hiku’s goal to establish a retail cannabis presence across Canada, Tokyo Smoke plans to build a network of design-forward retail cannabis stores in Manitoba with a focus on customer experience, product selection and consumer education.

10552763 Canada Corporation – The corporation is a new entity featuring Avana Canada Inc. of Ontario, Fisher River Cree Nation of Manitoba, Chippewas of the Thames of Ontario, MediPharm Labs of Ontario, and US-based retailer Native Roots Dispensary.

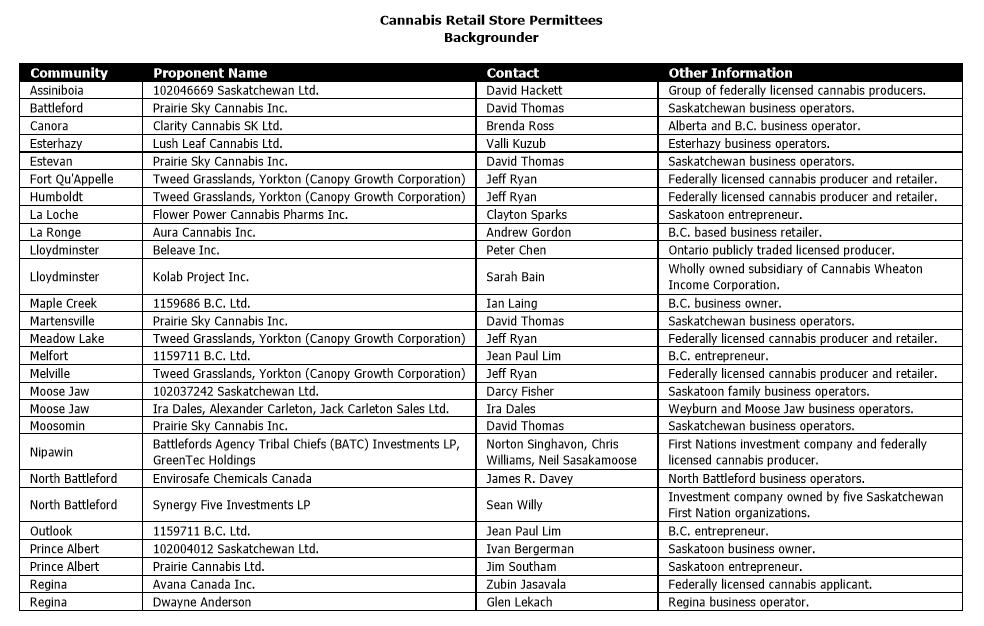

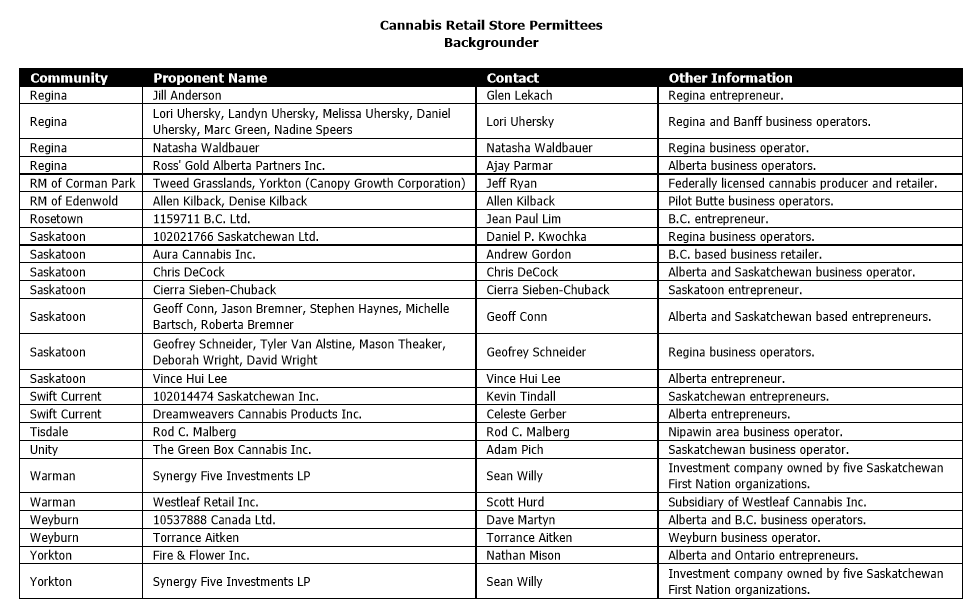

Saskatchewan

Notable names on the list are Canopy Growth with three locations, and Fire & Flower and Beleave with one apiece.

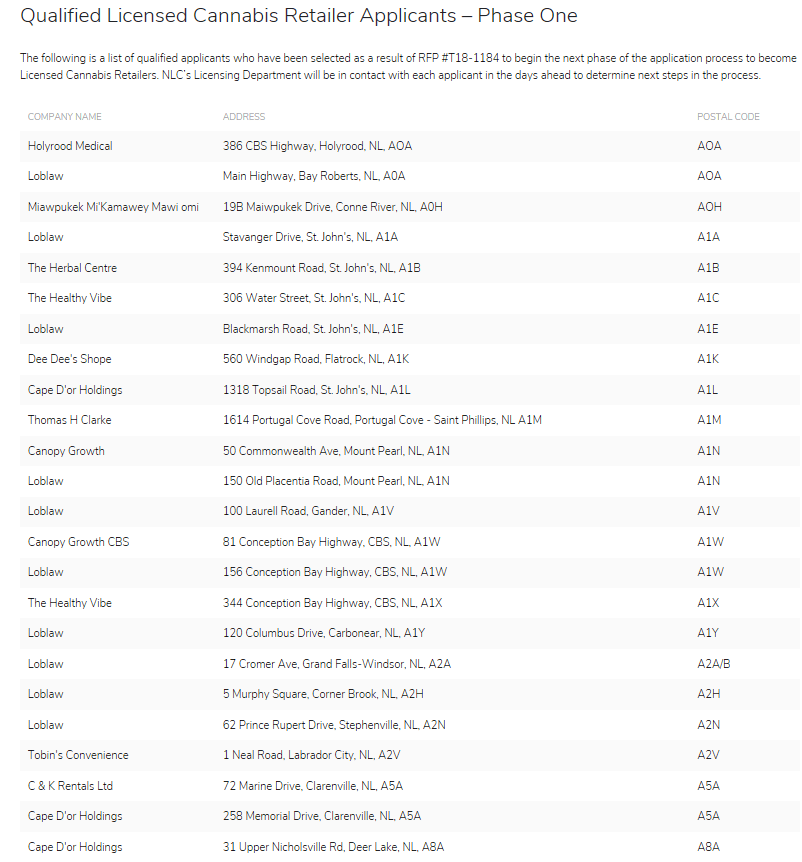

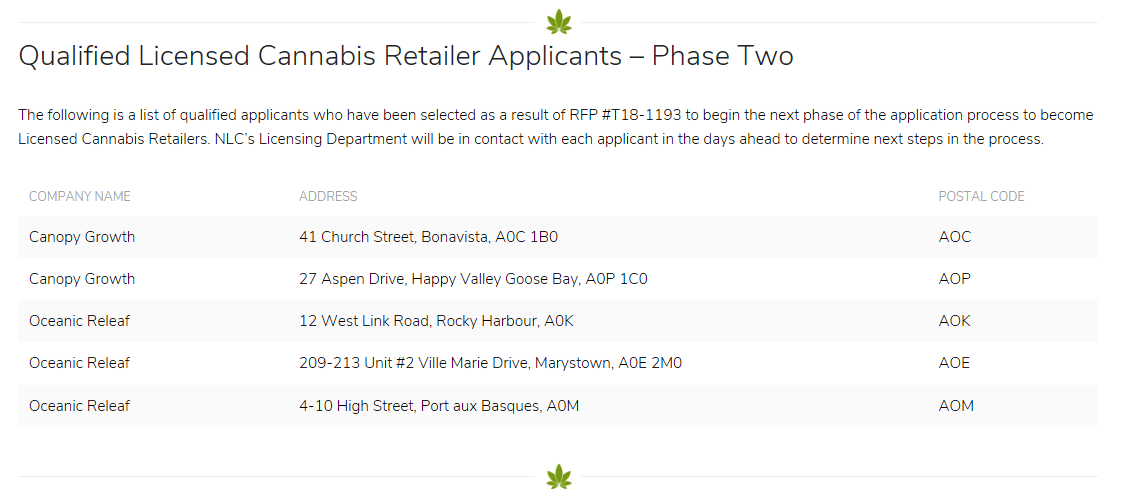

Newfoundland & Labrador

The government of Newfoundland & Labrador awarded 24 private retail dispensaries to a number of companies, including Canopy Growth(WEED.T) and Loblaw (L.T).

BC and Ontario

BC and Ontario

With all other provinces having disclosed their received applications or electing to sell cannabis through their respective liquor boards, BC and Ontario remain outliers.

Statistics Canada found that Canadians aged 15 to 64 spent an estimated $5.7 billion on cannabis in 2017, while purchases for alcohol totaled $22.3 billion in 2016.

With cannabis spending in Canada equalling one quarter of spending on alcohol, the ratio of dispensaries to liquor stores could theoretically be 1:4.

Ontario has 660 LCBO stores and 212 LCBO agency stores. In 2015, BC had 196 BC Liquor stores and 670 private liquor stores. Using rough estimations, and taking the ratio of cannabis to alcohol spending into account, both Ontario and BC could require over 200 dispensaries to satisfy Canadians’ growing appetite for cannabis.

Disclaimer: ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.