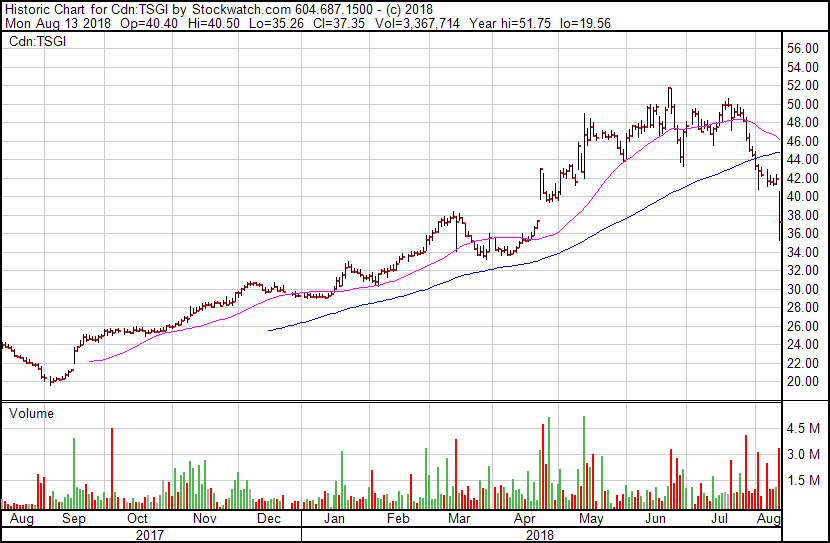

Online gambling company The Stars Group Inc. (TSGI.T) fell nearly 10% yesterday, and closed today at $36.63 (off another 2%), as the street was unimpressed with yesterday’s earnings release.

Stars is in the process of expanding their online reach in an attempt to grab a share of the legalized online sports betting market that is slowly opening up in the United States in the wake of a Supreme Court ruling in late April.

The main analyst beef appears to be with capital availability. SimplyWallStreet notes that Stars’ EBIT to net interest payment ratio of 2.86 “suggests that interest is not strongly covered, which means that debtors may be less inclined to loan the company more money, reducing its headroom for growth through debt.”

Leveraging their shot

The US Supreme Court ruling in May 2018, which struck down federal law which prohibited sports betting nationwide, put Stars among the online betting companies that investors turned to in an attempt to capture part of an American sports betting market appraised at $67 billion annually.

TSGI shot up on the news that one of America’s favourite and most high-dollar activities was going to be legal nation-wide, gapping from $37.36 to $43.02 on the news April 23rd. Stars had just acquired mobile betting websites William Hill Australia in March for $315 million in cash and stock, and followed that up with the purchase of Sky Betting & Gaming in July for an approximately $4.7 billion in stock and an undisclosed amount of leveraged cash.

Targeting states which have passed sportsbook-friendly legislation, The Stars Group announced on August 2, 2018, the inclusion of online and mobile sports betting through their BetStars brand, adding to their preexisting online poker and casino offerings.

The Stars Group intends to utilize its existing and approved proprietary technology and player account management platform for its betting offering, providing customers in the state with a single account, common wallet, various online and mobile depositing and withdrawal options, and a seamless offering of betting options along with the company’s popular poker and casino products. The Stars Group intends to draw upon its technology development, management, marketing, and sports book trading expertise to provide New Jersey customers with an innovative, compelling, and robust mobile-led sportsbook. The company anticipates providing over time, subject to required regulatory approvals, a wide range of betting products including in-play wagering, bespoke accumulators, and live streaming, as well as an ecosystem of free-to-play products and promotions and sports content, for dozens of sports, including professional and NCAA football, basketball, and baseball as well as horse racing, hockey, soccer, tennis and other sporting markets.

“As one of Pennsylvania’s leaders in entertainment, offering internet sports wagering and gaming and partnering with The Stars Group is the obvious next step for us to continue diversifying our casino offerings,” said Vincent Jordan, Vice President of Marketing & Gaming Operations, Mount Airy Casino Resort. “Introducing internet gaming through The Stars Group will provide compelling opportunities for our customers, particularly our younger customers, who are ready to experience the next gaming challenge.”

The Stars Group intends to utilize its existing and proprietary technology and player account management platform for its offerings in Pennsylvania, providing customers with a single account, common wallet, various online and mobile depositing and withdrawal options, and a seamless offering of betting and gaming options.

Roadblocks in sportsbook rollout

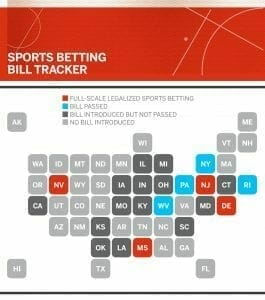

With deals in Pennsylvania and New Jersey signed, TSGI has begun its expansion into the world of American online sports betting. The company is moving state-by-state, as quickly as state-lawmakers will allow, but US betting laws don’t appear to be moving as quickly as investors would like them to.

As of August 1st, only Nevada, New Jersey, Delaware and Mississippi have implemented legalized sports betting. William Hill users stateside must visit authorized locations in Nevada to activate their online betting apps before use, while Sky Betting & Gaming’s terms and conditions state that “residents of or persons located in the United States must not use any of the Services.”

The company’s total debt as of June 30, 2018 exceeds $2.73 billion while its revenue for Q2 is over $411 million. International betting revenues from Stars’ betting properties exceeded $19 million while betting in Australia accounted for over $61 million.

Despite an initial surge in interest for The Stars Group, two acquisitions and three months later and the company’s stock price has returned to its pre-SCOTUS ruling price while the company itself carries more debt.

The ‘other’ game in town

With this in mind, the question remains: Where can investors who are interested in online sports betting in America put their money?

With the legalization of online sports betting now deferred to state legislatures, and with the rollout of individual state-based sportsbook sites still forthcoming, investors hoping to take a piece of the multi-billion dollar market may have to wait a little longer.

TSX.V listed The Score Inc. (SCR.V) also shot up in the wake of the SCOTUS ruling, and has oscillated sideways ever since. The Score is a media company with sports-related online and television properties that stand to benefit from the advertising dollars that the companies who do capture that enormous US sports betting market will end up spending to hold on to it.

ESPN’s David Purdum and Darren Rovell argue that some of the biggest winners in the move to legalize sports betting are the ancillary players surrounding the actual bookies.

Sports data companies like sports data aggregator Sportradar are in a prime position to catch some of the revenue from online betting. The Swiss startup is still private, valued at $2.4B and recently got the backing of the Canadian Pension Plan.

In an interview with Variety, Evercore ISI analyst Anthony DiClemente said sports betting could drive $7 billion in incremental US ad spending in 2019, estimating that half of the money going to digital advertising.

Furthermore, Barclays analyst Ross Sandler estimated that sports betting ads in 2019 could contribute up to 4 percent and 7 percent to Google and Facebook’s revenue, respectively.

The expansion of legalized online sport betting is still in its early stages but one thing is for certain: the money is there. The trick is knowing where to find it.