On July 26, 2018, DMG Blockchain (DMGI.V) announced that it is installing an 85-megawatt capacity transformer and electrical substation to power the expansion of DMG’s Canadian cryptocurrency mining facility.

A transformer transfers electrical energy from one circuit to another without changing the frequency. The main function of a transformer is to increase or decrease AC voltage in circuits.

You’ll see these puppies around your neighbourhood, up on poles.

“This facility will become DMG’s flagship crypto mining operation in Canada and further expand its mining-as-a-service (MaaS) capacity,” stated the press release, “Deployment of its new 85-megawatt substation will increase DMG’s hosting capability by more than 20 times.

DMG is not a one-trick pony.

As well as the crypto-mining side, DMG uses artificial intelligence (AI) and machine learning (ML) technology to monitor cryptocurrency exchanges, examining the currency flow through the blockchain in order to establish the “provenance and destination of crypto wallet funds.”

Blockchain Forensics & Analytics Group has secured contracts from several international auditing and consulting firms.

On July 3, 2018 we published an article summarizing DMG’s Q2, 2018 financials.

Key Second Quarter 2018 Highlights:

- Completed listing on the TSX.V

- Revenue of $3,344,699 (552% quarter-over-quarter revenue growth)

- Purchased 2,650 new mining rigs

- Completed acquisition of Blockseer

- Constructing flagship data center with up to 85 megawatts of mining capacity

- 40 megawatts project to come on line in Q3.

- Appointed Charlie Lee, creator of Litecoin to DMG’s advisory board.

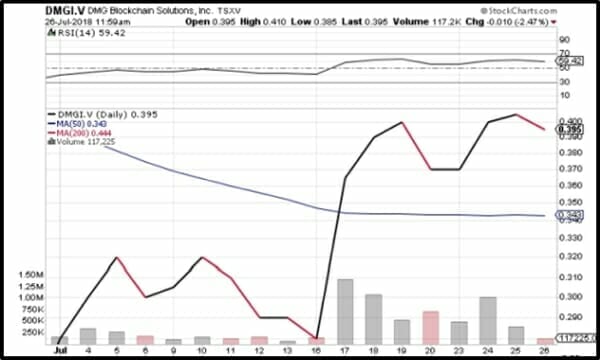

Since then, the stock price is up 58% – from .24 to .38.

On July 18, 2018 DMG authorized the purchase of up to 4.6 million shares in a share buy-back program.

DMG believes that the Company’s shares are undervalued in the marketplace. This provides an opportunity for DMG to purchase common shares at attractive prices; the purchases are an appropriate use of funds, which will enhance value of the common shares held by remaining shareholders.

DMG has a long trek back to it’s lofty Feb 15, 2018 high of $1.91 – but the recent surge is encouraging.

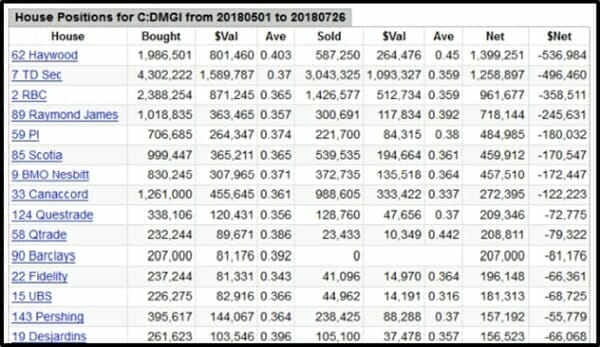

Late in 2017, Canaccord lead an 80-cent $10 million financing with 24-month .80 warrants. The clients they put into that financing are currently underwater, with out-of-the-money warrants.

Many of the big brokerage houses have been averaging down. Since May 1, 2018 Haywood and TD have added significantly to their positions in DMG.

Daniel Reitzik, CEO & Director explained that most of DMG’s current revenues come from “hosting and management of Bitcoin mining facilities on behalf of 3rd parties”.

“DMG continues to build its presence both in Japan and North America thanks to its expanding mining operations and development of blockchain analytics tools,” stated Reitzik, “DMG received an order in excess of $3 million from Japanese based ‘Forside’ for mining hardware purchases and set-up.”

“Building and managing a cryptomining operation at an industrial scale requires a world-class supply chain as well as direct access to local government and electricity providers,” stated Sheldon Bennett, DMG’s COO.

When completed, DMG’s flagship mining facility will be among the largest in North America.

DMG’s crypto mining facilities have dual uses:

- For its Mining-as-a-Service (MaaS) clients

- For DMG’s own use.

This hybrid approach allows DMG to scale more rapidly than a typical cyptomining model “by balancing the capital requirements and investor returns of the traditional mining model with the low capital needs and steady revenue generation of the MaaS model.”

“Substations” manage electricity between the generating station and the end-user, often incorporating transformers.

DMG expects its substation to be connected to the utility power grid and fully operational by September, 2018.

Full Disclosure: DMG is an Equity Guru marketing client, and we own stock.