To survive and thrive as a new entry in the cannabis arena, you need more than a production license from Health Canada, though that might be a good start. With over 100 Licensed Producers out there and a blur between who produces what, and how … you need to be innovative in your strategy. You need to surround yourself with like-minded individuals, people with specific skill sets that compliment your own; people at the height of their intellectual abilities… people who know how to ride a momentum wave.

The company…

Pure Global Cannabis (PURE.V) – the upshot of an amalgamation and reverse takeover with predecessor ‘PureSinse’, a life science cannabis company based in Toronto – enjoy a clear distinction, one which separates them from the rest of the pack (author’s humble opinion).

In assembling a team of movers and shakers – pharma industry chiefs, a renowned plant geneticist, supply chain and capital market execs – the company is well positioned to carve out a niche for itself in the fasting growing weed sector.

This is one of the better, more innovative business plans I’ve come across in the cannabis arena.

Before we delve into their ultra-modern production facility that’s currently under construction, and the company’s plans to aggressively double down on that production space immediately after its first build-out phase is completed, it’s important to note that this team managed to obtain a production license from Health Canada without demonstrating prior cultivation capabilities. This is a first in the weed industry. It speaks to the intellectual prowess of this group.

This allows the company to buy weed wholesale, rebrand it, and sell it as their own – a strategy known as ‘white labeling’.

There are significant cost and time saving advantages in this tactic. The company can to shop around for the best quality bud, at the best possible price, and create brands that will stock retailers shelves all over the world, establishing a near-term revenue stream. This gets the ball rolling. At the very least, it fills in the gap until their own cultivation facility comes online later this year.

A word on management…

This is the definer, and one of the more interesting aspects of Pure Global Cannabis.

Malay Panchal, RPh, BScPhm, Founder & CEO, is a seasoned pro with more than twenty years experience in pharma B2B technology, retail and mail-order pharmacy, pharma branding and clinical trials.

As well…

The Pure Global team includes seasoned pharma-industry experts, including Chairman Dr. Chandra Panchal, PhD, whose distinguished resume includes acting as Director for MaRS Innovation, as a senior scientist at John Labatt Ltd., and as Chairman, President and CEO at Procyon Biopharma Inc. The team also includes Nader Gheshlaghi, PhD, a world-renowned specialist in plant genetics and commercial-scale indoor and greenhouse horticulture, and Michael Lavergne, a sustainable supply chain and operations professional with 20 years of multinational experience in fast-moving consumer goods (FMCG) and retail.

One super-solid crew, this.

The production facilty and schedule…

Q3 2018…

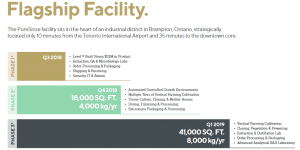

As you can see, phase 1 kicks PURE into gear in Q3 of this year. Hey, that’s like… now. Everything from vaulting the bud purchased wholesale, to extraction, to order processing and packaging, is set to go.

Q4 2018…

This 18,000 square foot production facility – strategically located only 10 minutes from the Toronto International Airport and 35 minutes from the downtown core – is slated to begin production in Q4 of this year. Significantly, it will employ three innovative growing technologies that will grow more plants, in less time, and at a lower cost (more on this below).

This initial 18,000 square foot growing space is expected to produce 4,000 kilograms of high-quality flower per year.

Q1 2019…

Having purchased a warehouse adjacent to its current facility, PURE will be adding an additional 22,000 square feet of production, processing, packaging, research, and laboratory space. Production is expected to ramp up to 8,000 kilograms of high-quality bud per year. Completion of this expansion phase is set for early 2019.

Is it just me, or is 8,000 kgs a lot of weed?

The innovations…

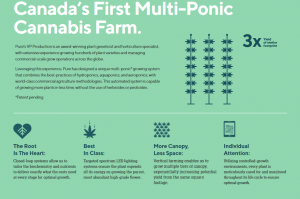

PURE is about to cut the ribbon on Canada’s very first Multi-Ponic Cannabis Farm.

When the company talks about ‘Automated Controlled Growth Environments‘ they’re talking about employing the latest innovations in hydroponics, aquaponics, and aeroponics.

Equity Guru’s Lukas Kane gave us some decent insights into PURE, including a summary of these “three hot trends in agriculture”, earlier this month.

- Hydroponics is a method of growing plants with no soil, using mineral nutrient solutions in water. Normal plants (buried in the ground) can only extract nutrients from the earth. Nutrients in hydroponics can utilize exotic materials like duck manure.

- Aquaponics combines conventional aquaculture (raising aquatic animals in tanks) with hydroponics in a symbiotic environment. Water from the snail tank is broken down by nitrifying bacteria and then recirculated back to the aquaculture system.

- Aeroponics is the process of growing plants in mist environment without the use of soil or any aggregate medium.

When the company talks about and ‘Multiple Tiers of Vertical Farming Cultivation‘, this is what they’re talking about…

Obviously, these multiple stacked tiers will allow the company to maximize their floor space, increasing yields – perhaps exponentially – while lowering costs. It would appear that the number of layers the company can stack is limited only to the height of the facilities structure itself.

The facility, the expansion, the funds to make it all happen…

PURE is brand spanking new. Their facility in Brampton (near Toronto’s Pearson International Airport) is fully funded via a $9,207,000 financing (27,900,000 Subscription Receipts priced at $0.33 per Receipt).

Valuation…

As mentioned above, the company is new.

The company’s timing in launching its stock was unfortunate. The entire weed sector has been showing some price pressure/vulnerability of late. The above price chart is no reflection of the PURE’s underlying fundamentals IMO. It’s the market.

The company has 147,844,801 shares outstanding giving it a current market-cap of $36.9M Cdn (based on a $0.25 share price).

It’s difficult valuing companies in this space at the best of times. Measuring one company against another can be like comparing apples to oysters.

Generally speaking, companies boasting 18K of growing space, those who both cultivate and sell high-quality bud, receive significantly higher valuations by the market.

PURE may have some catching up to do on the valuation front if all goes according to plan.

A buddy of mine over on ceo.ca put this cannabis sector watchlist together. Aside from linking company specific details, it highlights their valuations based on current trading patterns. It’s a good place to start when drawing comparisons between companies (many thanks ‘EvenPrime’).

Still on the topic of valuation, there are some well informed, albeit biased, opinions out there…

Expectations…

The more I examine this company, the more I like it.

Management’s expectations might be in line with the sentiment expressed in the following quote from a May 2018 BMO report titled, Canada Leads the Global Cannabis Paradigm Shift…

Over the long term, we believe consumers will develop a better understanding of cannabis and be able to segment products based on perceived quality. As a result, although a strong brand may encourage initial trial, there must be perceived product quality and a consistent user experience to validate the brand and generate repeat purchases.

It makes sense. Once we find our brand, we tend to stay loyal to it. I know a number of cannabis consumers, both medicinal and recreation, who consider themselves connoisseurs – arbiters of quality and taste – who simply will not settle for second best.

Final thoughts…

Management expertise, their innovative approach to maximizing every square inch of growing space, not to mention the company’s potential for near-term revenue, warrant a much closer look if you’re interested in uncovering value in this rapidly evolving arena.

END

~ ~ Dirk Diggler

Full disclosure: Pure Global Cannabis is not currently an Equity Guru client. The author owns shares in the company.

Postscript: The company’s shares are attempting to carve out a bottom off of yesterdays lows…

(feature image courtesy of news.vice.com)

Are you still holding this one? Do you think it has a good shot?