The British Columbia Liquor Distribution Branch (LDB) signed MOU’s with 31 licensed cannabis producers yesterday. Most of the big names made the cut, however, there were a few notable local companies that got the snub.

The most notable of the LPs left off of yesterday’s list was local outfit Emerald Health Botanicals (EMH.V). Emerald Health currently has a market cap of $444.49M CAD, the largest of any LP with all of their properties in British Columbia. Emerald was one of the first producers to be licensed in BC, recieving their cultivation license more than four years ago on February 5th, 2014. Emerald has an active grow space and license for sale in Victoria, but is unclear about the size of that facility. Early press releases measure it at 29,000 sq/ft, but their ongoing disclosures are thin on specifics. The company is being planned around 2 greenhouse facilities in Delta, BC; one under-construction facility that is wholly owned, and another that is a joint venture with vegetable producer Village Farms (VFF.T). Village contributed the greenhouse to be retrofitted, and Emerald contributed the money. If the JV exercises all of its options, VFF’s greenhouses are built out, and all licenses are secured, Emerald shareholders will have exposure to 2.9 million sq/ft of marijuana factory. Go big or go home.

Emerald Health was the subject of a Marijuana Datajam post back in March. Our analysis was unable to come up with any evidence that the company actually grows any of the weed it sells. We remain of the opinion that most if not all of Emerald’s sales are the re-sale of weed bought from other LPs.

Emerald Health(EMH.V): too cool for an MOU

Today, in the wake of their non-inclusion in the BC Liquor list of preferred suppliers, Emerald published a news release to “update their differentiated strategy and progress.” The buzzword-heavy release is the Emerald special; an impression of a company who knows something about the cannabis-market-to-come that we don’t. It isn’t a very good impression, and the act is getting pretty tired now that the market appears to be arriving and they don’t appear to be involved in it.

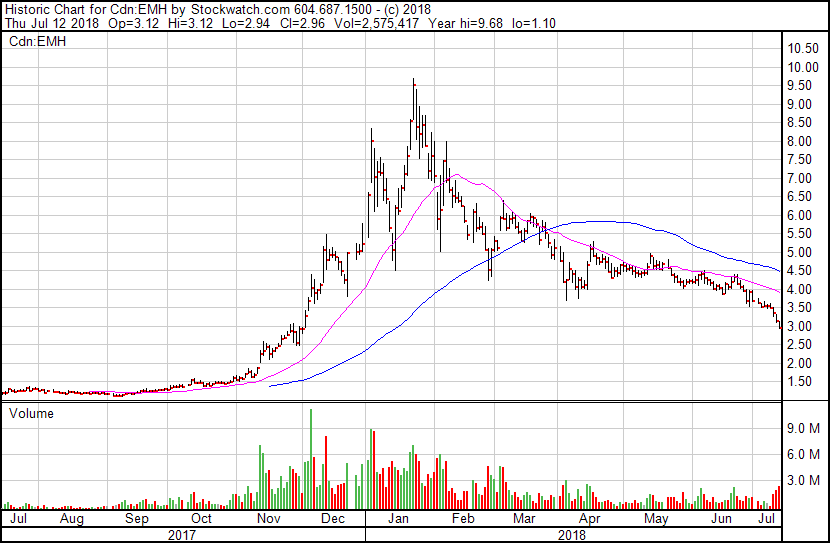

The street hated this release, dumping 3 million shares on EMH and sending it down -7% to $2.94.

Ignoring the ‘sales’ part of ‘branding and sales’

Emerald wasn’t in on the Alberta announcement of preferred suppliers either, and hasn’t announced any supply agreements with any provinces, export deals or anything of the like. The lack of contracts is consistent with our un-verifiable observation that the company has no commercial production of their own. If that’s the case, no amount of “serving the unmet needs of individuals seeking medicinal and wellness benefits,” or articulated knowledge of a market in which they do not participate is going to help them. The rogue strategy of ignoring opportunities to move product has Emerald off 69.4% from their 52 week high.

The other BC dropouts

Other BC licensed producers pubcos conspicuously absent from the BCL news release include:

Bliss Co Holdings (BLIS.C) – Received cultivation license March 29, 2018

Good Buds Company -Received cultivation license June 8, 2018

Potanicals Green Growers – Received cultivation license October 13th, 2017

Pure Sunfarms – Received cultivation license March 2nd, 2018

Tantalus Labs – Received cultivation license May 26th, 2017

We Grow BC – Received cultivation license August 25th, 2017

Valens Groworks too. They got nada.