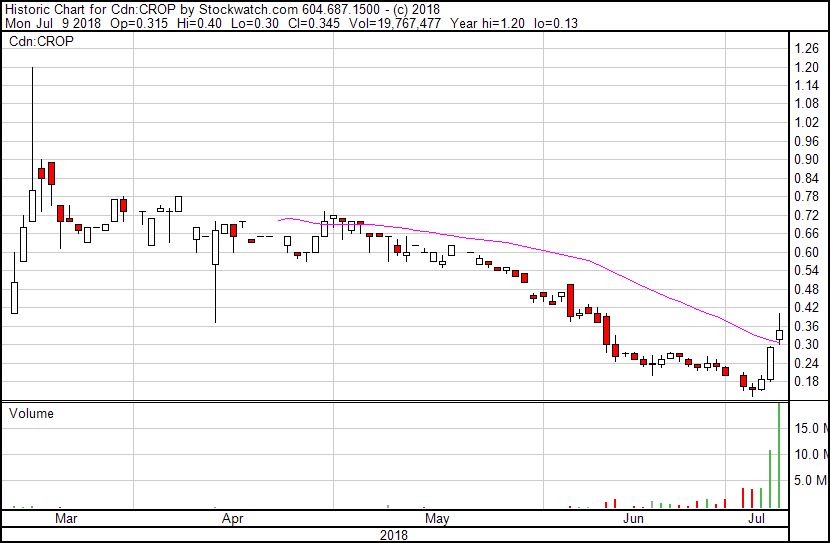

CROP Infrastructure (CROP.C) burst out of the gate this morning at $0.32 CAD, hitting a high of $0.40 CAD in the first hour of trading, before closing at $0.34 CAD, up 19% on 17,489,136 shares bought and sold.

This was 30x its average trading volume of 578,590 shares, and doubled yesterday’s record setting 10m share volume day, which was itself a doubling of the previous record from a day before.

Six Shows, One Ticket

CROP is primarily engaged in the business of investing, constructing, owning and leasing greenhouse projects for cannabis producers. The owner/operator of the property enters into a fixed period leasehold & management fee structure.

CROP’s diversified investment business model gives investors exposure to six early stage cannabis businesses. These businesses cover the basic verticals within the cannabis space.

In the early phase of these businesses, there is still plenty of room for growth. Half of the businesses in CROP’s portfolio are in the application and construction phase. It’s also impossible to predict which brands will be successful at this point in the game, but they have a lot of chips in the middle.

The condition of Cannabis being recreationally and medically legal in a growing number of US states, but still illegal federally have given companies like CROP an opportunity to act as financier to many of these businesses. Federally regulated US investment banks aren’t yet lending to the cannabis sector, so holding companies like CROP are making this financing possible through the Canadian markets

CROP has put together a diversified portfolio that limits the downside risk while still giving exposure to the basic Cannabis business verticals, but the market hasn’t been co-operating.

The four month battle of short sellers vs. CROP

The shorts on CROP began coming in heavy in May where short volume jumped from 37.7% to 65.6%, and got heavier as volume hit 73% on July 2nd.

Although CROP has been putting out a significant amount of news lately, this epic bounceback might more likely be a case of shorts being covered.

| Date | Short Sale Trades | % Total Trades | Short Traded Volume | % Total Traded Volume | Short Traded Value | % Total Traded Value |

|---|---|---|---|---|---|---|

| Mar 16 2018 | 41 | 13.531 | 210,000 | 16.001 | $163,220 | 18.573 |

| Apr 2 2018 | 31 | 9.309 | 80,500 | 12.155 | $60,795 | 12.744 |

| Apr 16 2018 | 27 | 27.835 | 124,500 | 37.704 | $67,785 | 33.586 |

| May 16 2018 | 36 | 21.818 | 827,000 | 65.573 | $498,065 | 64.816 |

| Jun 1 2018 | 46 | 33.094 | 272,500 | 48.877 | $143,753 | 48.596 |

| Jun 18 2018 | 532 | 46.503 | 3,202,650 | 63.215 | $998,749 | 61.489 |

| Jul 2 2018 | 1,093 | 53.239 | 7,689,107 | 73.077 | $1,802,120 | 72.830 |

Did this start in March?

On March 2nd, 2018 CROP did their RTO by acquiring all of the issued and outstanding securities of DV Infrastructure Corp (DVI).d In connection with transaction, DVI completed a non-brokered private placement for aggregate gross proceeds of $4,956,520, consisting of 49,565,200 units at a price of $0.10 per unit. These deals typically have a 4 month hold, which leads us to July 2nd, 2018, where CROP was sold down to $ 0.165. This could explain the rationale behind the short sellers’ strategy.

Covering that many shorts over three days would certainly have a big positive move for a lightly traded company.

It is likely that CROP will continue to be active this week by putting news out to continue to drive the stock price back up and keep sustaining this momentum. With so many cannabis investors jumping on trends and playing Greater Fool with the crowd, there may yet be some fuel in the tank.

Today CROP Infrastructure Corp. (CROP.C) announced its tenant planted 20,000 square feet of recreational cannabis on its Humboldt County property after receiving final approval by the California Department of Food and Agriculture (CDFA).

We wrote an in depth piece last week on why CROP’s business has done well lately, even in the midst of a stock fall off.

The CROP portfolio consists of options on newly-operational or under-construction cannabis cultivation facilities, and a pair of retail dispensaries in San Bernardino, CA that are awaiting permits and licensing. Here is a brief summary.

The anatomy of each deal

CROP’s real estate portfolio:

| Property | Property Type | Location | Construction Status | Planned Size |

| Emerald Heights Retail | Retail outlets | San Bernardino, California | Application | 2 retail outlets |

| Humboldt Farms | Indoor growing | Humboldt County, California | 30,000 sq.ft complete | 30,000 sq.ft |

| Nevada | Outdoor growing | Nye County, Nevada | Production ready pending license | 315 acres |

| The Park | Indoor growing | Grant County, Washington | Completed retro-fit | 35,000 sq/ft |

| The Dozen | Indoor growing | Grant County, Washington | Construction Underway | 114,000 sq./ft |

| Italy | CBD extraction | Northeastern Italy | Outdoor planting to commence | 522,000 sq/ft |

Emerald Heights Retail: CROP entered into an agreement with Ocean Green Management LLC of California, to partner on multiple applications for Cannabis Retail locations with the option to purchase the commercial real estate. The Company has agreed to finance the purchase of real estate on the grant of a license.

Humboldt Farms: CROP entered into a membership purchase agreement of $2M USD for 30% interest.

Nye County Agricultural Property: CROP entered into a member interest purchase agreement with Elite Ventures LLC, of Nevada, to acquire a 49% member interest. CROP has agreed to pay $1,300,000 USD, in cash, for the member interest and has paid $600,000 to date.

The Park: CROP advanced $2M USD in exchange for 30% member interest.

The Dozen: CROP gets a 60% preferential payback from its tenant grower via land management, leasing, licensing, and branding fees. The company will retain 30% interest after they have recouped their investment.

Italy: CROP has committed to provide an initial investment of €500,000 for 30% ownership.

Investors looking for exposure to a diversified portfolio of properties handled by a team who can clearly keep the newsflow coming, and appear to care about shareholder relations will surely be taking a close look at $24M market cap CROP.

— FULL DISCLOSURE: CROP Infrastructure is an Equity.Guru marketing client