This month CUV Ventures (CUV.V) has had a series of news releases, which interesting in isolation reveal a grander plan when taken together. CUV is moving boldly to become a crypto-based payment solution for the Caribbean region.

It started with the announcement on the 4th of a license for crypto tech from CryptoLiquidity. Last week on the 22nd, they hoisted sail to Panama and acquired a payment and FINtech company with licensing deals in place.

Finally, today they announced their plans to bring the payment tech to the USA with high powered legal help.

A smart play and a secret weapon.

If you grew up in the 80s, you’ll remember Hannibal, leader of the A-Team. His famous maxim, “I love it when a plan comes together” came to mind watching CUV Ventures in the last little while. It’s been like watching a beautiful ballerina (salsa dancer?) pivot gracefully to a beautiful new position without losing grace or momentum.

Back in the day CUV had a strong niche market in one country and served the community well, through old media niche publications, travel services and all the ancillary activities. Life was good for a long time.

Then the digital wave began kill anything printed on dead trees.

Pivot

CUV seems to be managing what so many old media companies have a hard time doing. They are taking their old-world experience and using it to exploit the advantages of the new digital world.

When CUV first pivoted to crypto I recall raising an eyebrow somewhat skeptically on this very site. Let me be blunt. at the time it seemed like another company slapping ‘crypto’ onto its name and looking to rake in the big bucks.

I am pleased to be wrong. CUV has a plan. They are going to be a crypto-based alternative to the standard players and disrupt the expatriate payment market. This month’s announcements show they know exactly what they want to do and are moving aggressively to get there.

Across North America, there are extensive networks of Caribbean expatriates who still feel deep connections to their families back home and are frustrated with guys like Western Union. A lot of money flows back and forth, under the radar of the main banking system.

According to the world bank, $80 billion flowed in remittances (or individuals sending money back) to Latin America and the Caribbean last year, and they make up eight per cent of the Caribbean’s GDP.

Imagine getting even a small taste of that…

The Plan, Man.

CUV is clearly angling to exploit it’s cultural and marketing experience to tap into a very lucrative market. The icing on the cake is that if the network takes off they could even make more money with a good ICO.

Their long history in travel and marketing also gives them ready made networks to exploit for early adopters and real traction when all the licensing is sorted out.

On the ground, they’ve licensed good crypto tech and a digital FINtech company with the acquisition of RevoluFIN,

CUV has essentially bought itself a turnkey payment system. The only thing holding it back is navigating the bureaucracy in the US and Canada. So we come to today’s news release.

Where we at?

This brings us to today. I wish I could say they have the US licensing bit licked, but this release is an announcement to get people excited about their model, and to show the market they are serious about doing this thing.

They are meeting with lots of high powered legal teams to move this ball forward. Great, but maybe give us a sense of timelines here?

Even so there’s something of real interest in today’s release.

About three quarters of the way down they have this little gem tucked away:

“Introducing the RevoluPAY® Merchant App

Conceived, Designed and developed in conjunction with the consumer version of the Apple and Android apps, the RevoluPAY® merchant app will allow entities or individuals, at the destination, to seamlessly charge receivables to RevoluPAY® consumer app users worldwide. The transaction could be with a simple souvenir market stall vendor in, for instance, the Bahamas, or a multinational Restaurant chain, present in many countries. Once the merchant has been approved, their capacity to charge receivables to RevoluPAY® users will be enabled. The United States is a very popular travel destination and, the company estimates that, typically, a traveler will spend as much at their ultimate destination as they did for their entire travel arrangements. In some cases, local destination spending far exceeds initial travel costs, especially on short haul trips. The company considers this market to be extremely attractive and by forging the right merchant relationships with destination partners; the company will bring extended value to RevoluVIP members and, likewise, procure an expedited worldwide acceptance of RevoluPAY®, allied to significantly increased revenue.”

Gives you a headache no? That’s a lot of words to say – Our merchant app is ready.

That’s bigger news for me than any legal meeting.

The fact they have a merchant solution ready to go means they really are champing at the bit.

Here’s a nickel of free advice, now you need a dual track focus. The clear next step is to get those licenses, but now the proof is in the carnitas.

To get this to work, you’ll need to get traction in the real world, and that can take time. Having a solid group of early adopters, even just an email list of interested parties will be invaluable later on. If I were an investor I would want to see you have solid plans to exploit the networks I mentioned above.

Market Day

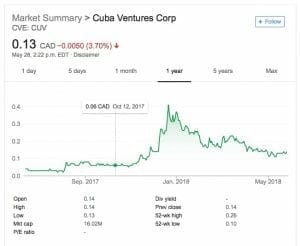

Looking at CUV’s performance over the last 12 months, you can see it getting swept up in the overall hype and fall. What is interesting is how is stabilized not at pre-hype levels, but higher. If you bought CUV on November 1st, what a ride my friend, but you’re still looking very good today with the stock trading 200-300 percent over what it was six months ago.

Since then the stock has been ping-ponging around 13-15 cents. it’s floating around during CUV’s major refocus, even with the news this month, no real impact.

This smells to me like a stock somewhat decoupled from the activity of the company itself.

Should I walk the plank?

This sorts itself out, it always does – the market is smart like that. What you need to ask yourself as an investor is: Can CUV pull this off? If they do, it’s pennies from heaven and yacht time. If not, the stock could deflate like a ruined souffle.

I’ve laid out what CUV is planning. If they get even one percent of the pie, that’s truckloads of cash. I’d love to hear the beep-beep-beep of the money truck so I’ll be watching their next moves very closely.

Oh yeah – I mentioned a secret weapon. I won’t say much except these guys can cover the whole Caribbean, opening heretofore closed markets. A hint is all over their name…

FULL DISCLOSURE: CUV is a client of ours, I do not personally own any stock, but other members of our team may.