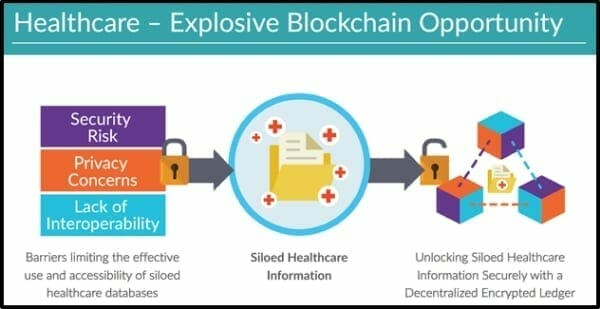

According to the U.S. The National Library of Medicine (NLM), “sources of electronic patient information (laboratory data, pharmacy data and physician dictation) reside on many isolated islands that are difficult to bridge.”

“Much of the data required by the advanced functions of an Electronic Medical record (EMR) comes from physicians, and this information has yet to be domesticated,” stated the report, “Multi-site organizations are desperate for the EMR because there is no way to move a single paper chart to the multiple sites that require it.”

The above report was written in:

a. 2017

b. 2007

c. 1997

Yup – you guessed it. The answer is “c”.

The lack of centralised medical records is a problem so old that the candles cost more than the birthday cake.

In an era when you can shoot and edit a feature film on a Smart-Phone, Chicago nurses are still faxing medical reports to their colleagues in other institutions.

The current system is clumsiness elevated to an art form.

VitalHub (VHI.V) – is a healthcare technology company marrying medical information networks with blockchain technology.

VHI is using blockchain to try and smash this inexcusable, ridiculous and deadly technological logjam.

They are doing this partly by acquiring other companies, working on the same problem.

In fact, VitalHub gobbles up other companies more frequently than we clean our gutters.

On May 08, 2018 VitalHub announced that they signed a Marketing Agreement with Ernst & Young (“EY Canada”).

VitalHub and EY Canada’s Health practice have formally agreed to work together on a co-marketing initiative to bring WellLinc to market on a global basis.

According to the press release, “VitalHub’s WellLinc solution uses blockchain technology to enable the secure and interoperable exchange of electronic health data, across the continuum of care.”

Some of the potential benefits derived from WellLinc include increased access to health information, leading to improved quality and appropriateness of care, which could lead to better overall health outcomes, and lowered costs in the delivery of care.

“We believe the healthcare market is ready for an impactful Blockchain solution like WellLinc,” stated Dan Matlow, CEO of VitalHub.

EY’s Global Health Sector connects a network of 4,000 sector-focused assurance, tax, transaction and advisory professionals with a range of healthcare and business backgrounds.

All VitalHub’s business activities satellite around this central star: the electronic collecting and sharing of medical data.

As Chris Parry wrote on April 11, 2018, “Telemedicine is what happens when doctors climb out of the 19th century and, instead of asking their patients to leave their sick beds and come into the office for an examination, they simply allow technology to take over, employing wearables, mobile phone apps, patient family members, and home-based monitors to send vital information back to the doctor, allowing her to see the vitals of many patients from her desk.”

“If you’re relying on Aunt Gayle to measure her own blood glucose levels in the middle of The Young and The Restless,” wrote Parry, “and then adjust her meds accordingly, she’s more likely to end up face down in a bowl of hard candy.”

On April 18, 2018 VHI published financial results and an operational update.

“2017 was focused on progressing our acquisition strategy, raising capital, and assembling the key ingredients for long-term success,” stated Matlow.

VitalHub revenue for the three months ended December 31, 2017 was $699,489, representing an increase of 471.8% over revenues of $122,329 in the same period last year.

Company revenue for the year ended December 31, 2017 was $1,146,391, representing an increase of 134.9% over revenues of $488,135 from the previous year. This increase is primarily attributable to the inclusion of revenue resulting from the B Sharp acquisition which amounted to $533,516 for the period October 5, 2017 to December 31, 2017.

For the year ended December 31, 2017, the Company raised total gross proceeds of $7,481,930 from various offerings, comprised of one brokered private placement which closed on September 12, 2017, two non‐brokered private placements which closed on October 24, 2017 and December 19, 2017, and the issuance of debentures which closed on December 7, 2017.

As we wrote a couple of months ago, “VitalHub has a robust two-pronged growth strategy, targeting organic growth opportunities within its product suite, and pursuing an aggressive M&A plan.

According to the Decision Research Group, “Industry projections expect the global Blockchain Healthcare market to grow to $2.3 billion by 2021, up from roughly $340 million in 2017.”

Usually, when everyone agrees something should be done, it’ll get done.

Not so, with medical records.

President Obama’s HiTECH Act funnelled billions of dollars of bonus payments to doctors to use electronic records. The 1st stage of those payments was for simple adoption. The 2nd stage is about interoperability: giving doctors financial rewards for actually sharing the records.

The HiTECH initiative failed for two reasons:

- Centralised healthcare records used in hospitals/doctor’s offices/healthcare facilities, all have proprietary software. Since the source code is closed – it doesn’t work as a universal information sharing system.

- Interoperability creates financial risks for hospitals because it makes it easier for disgruntled patients to take their business elsewhere. Interoperable records “remove the friction” associated with switching providers.

As so often in life, the problem is money.

The dream of universally (or at least nationally) centralised medical records is – at this point – still a dream.

If the solution does indeed reside in the world of blockchain, then VitalHub – with its sector pole position and minuscule $13.7 million market cap – will go to the moon.

p.s. We think the CEO, Dan Matlow, is a genuine visionary; you can watch him on YouTube, being interviewed by James West, who runs The Midas Letter.

Full Disclosure: VitalHub is an Equity Guru marking client, we also own stock.