Welcome to our twice monthly look at the shorts activity here in Canada. The big glaring bit of news is calgary based Enbridge (ENB.T) rocketing to the top of the shorts activity chart. Thanks to what looks to be a protracted battle over pipelines, it seems as if everyone sees betting against Enbridge as a sure thing.

All of the data comes from the fine folks at shortdata.ca

Ceci ce n’est pas un pipeline – what’s up with ENB

As it is such a blatant play – there is instructive value in looking at ENB and pointing out what’s happening, and how you can make a potential play here.

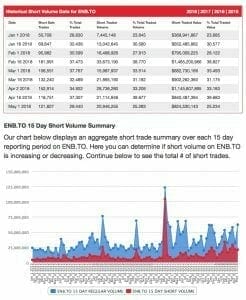

Here’s the Short Volume summary for ENB for the last few months.

The spike you see in February coincides with Enbridge’s announcement of an ex- dividend on Feb. 14. When the company pays out cash, the stock takes a dip, so why not short? The bean counters and pencil pushers factor this dip into their models, but that doesn’t stop opportunists from jumping in.

Since then the stock has been on a yo-yo as opposition to pipelines continues with much of public opinion in BC (where the damned pipelines have to run to get to the pacific) is split with the urban areas dead-set against, and rural (non-native) areas looking for development and resource jobs.

Enbridge is in the middle, and is getting knocked around. Even other analysts who began this latest cycle started positive but are slowly wondering if the room isn’t filling with smoke and getting uncomfortably hot.

Finally, this back and forth isn’t likely to end soon – the trend chart below shows the volume of short activity is increasing overall.

So what to do – right now, ENB is still a nice plump stock with plenty of room to short, if you can time it right. Every time there’s a headline about pipelines, or even worse an actual spill it can mean big bucks if you shorted these guys.

If you have nerves of steel, or friends in the know in Ottawa, playing the yo-yo short game with ENB could be profitable,

The Big Picture

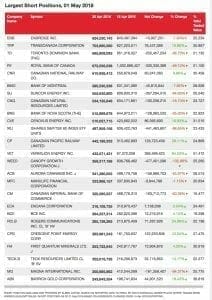

As always here’s the big picture on the largest short positions on the TSX, TSXV and CSE

TSX

As mentioned above, Enbridge and fellow traveller Transcanada (TRP.T) are the energy punching bags this week. However, the banks are still fighting in there. It’s also nice to see two Cannabis stocks Aurora (ACB.T) and Canopy (WEED.T) on the board.

The reality is the market is still betting the maniac-in-chief or Canadian real estate will deal the overall economy a serious blow, hence the big bets on resource, bank and other old-money sectors such as transportation.

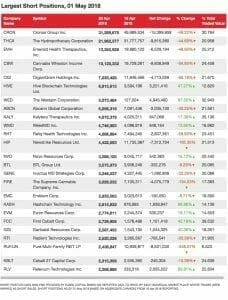

TSXV & CSE

TSXV

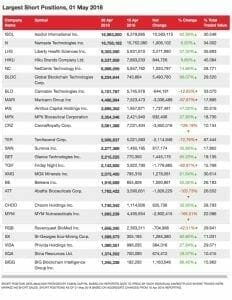

CSE

Both smaller cap boards are where the weed and crypto companies are living these days. I’ve covered Hydropothecary (THCX.V) a lot in the last year, and seeing 20 per cent of the company’s cap being traded as short activity must be an awesome feeling for their C-suite.

The CSE has some of our favourites. I must warn all of you who are betting on HIKU (HIKU.C) to pay off, I don’t think you’re right on this one, but you do you my fine friends.

Fundamentally, the story this time is the same one it’s been for a while – Big money is betting against the overall economy, and the small-cap short activity is basically the growing pains of a mature market.

The anomaly is a storm of political and financial which made ENB the darling of the short sellers. The savvy investor will always watch for these confluences, for this is where opportunity lies.

FULL DISCLOSURE – I don’t own stock in any of the companies mentioned, but HIKU brands is a client and some of the team does own stock.

What happened to the short position on GLH? I don’t see it here, and the CSE has it at 0, which can’t possibly be correct. It usually has about 12M short thanks to Peter Saladino (with friends like that…). Did it fall into a wormhole? Can you investigate?