Welcome one and all again to Eat My Shorts, our ongoing review of short selling data and trends in the Canadian markets. Our data comes from shortdata.ca – who is not a client, just a great resource for raw numbers.

This week it looks like the big money continues to bet the pillars of the economy will continue to shake. So far in 2018, the TSX short action has largely abandoned sectors such as cannabis, crypto etc. and is focused on old-economy stocks. Banks, transport, energy, insurance all in the barrel.

This week some of those chickens came home to roost, but the more interesting trend to me, is the doubling down agains the banks. Let’s focus on the TSX and why that might be.

Tick Tick Tick BOOM. Housing could blow the banks to bits.

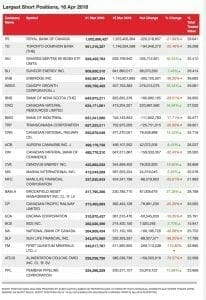

The big short money is doubling down on Canadian banks. like a skipping stone, they go in, cash out, go back in again and cash out again. Here’s the list of largest short positions on the TSX big board.

So do you see every single big bank is on here? All of them. Ten years ago the financial crisis nearly destroyed the U.S. banking system thanks to an out of control housing market collapse. At the time, everyone said look at Canada, their banks are regulated, they aren’t in trouble like us.

Well, it turns out our banks might not be so smart after all. If it was ultra-low interest rates and foreign money sustaining our housing market, all of those taps are being turned off. Canadian banks could be facing crazy real estate exposure, even with Canada Mortgage and Housing Corporation insurance on most loans.

The Elder Gods of short selling and market analysis know this. As Toronto and Vancouver real estate begins correcting, the banks are going to be in a world of pain. So the money left a lot of other old world stocks and flooded into the banks, betting they are gonna take a big hit.

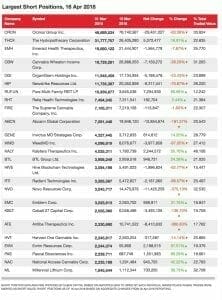

Here’s the activity on who cashed out on the TSX

You can see the big targets getting liquidated and some banks already feeling the pain – something I suspect will accelerate as Canadian housing numbers continue to drop.

Betting agains the housing market is what we see on the big board, but in small cap world, things haven’t changed much.

O, Hai Markets

Both the TSXV and CSE short markets are all in on Cannabis. Someone seems to have started a stampede for the doors. Good. get rid of the fish I suppose, because Cannabis is going to come roaring back once the psychological mark of July 1 passes.

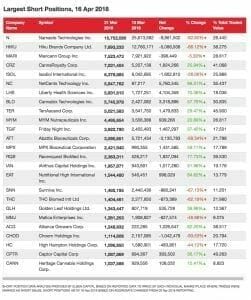

Here’s the largest positions for the TSXV and CSE

TSXV

Both are stuffed to the gills with cannabis stocks. I guess the Illuminati had a meeting in the last two weeks, and said lay off crypto and energy metals, let’s beat up on weed.

Cannabis is pushing out energy metals and crypto. The CSE is pretty much already all weed. Counterintuitively, this is really a good thing for the market – if not for the companies themselves.

The Big Bull Bounce for Bongs

I think the smart money is taking short term profits. A cannabis renaissance on the horizon, means the days of easy panic on weed stocks are numbered.

A huge wave of media and public interest in legal weed buying will roll across the country in July. Cannabis stocks are going to surge scaring away the short selling crowd.

If I’m wrong, you can point and laugh. but I don’t think I am.

FULL DISCLOSURE: Some of our clients are on these lists.

Thanks Stephen! Great Writeup!