Long time readers know we’ve written a fair amount about the business model of ExeBlock (XBLK.C), a client company of ours in the blockchain space that is developing apps specifically for the Peerplays network.

Exe has one dApp in testing, a 50/50 tool for charity fundraising, and another nearing that point in FreedomLedger, a dApp designed to facilitate the changing of currency and cryptocurrency in the Peerplays world.

For their trouble, and for agreeing to develop more dApps besides, which will bring them a fee whenever used by other developers and end users, the company was given a hefty chunk of Peerplays tokens by the network itself, worth millions at today’s prices.

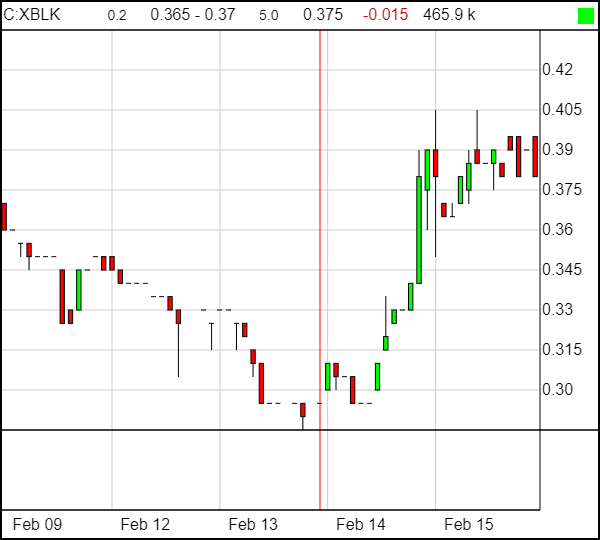

That’s great. And the share chart would indicate ExeBlock is on the rise.

Well.. the 5-day share chart would indicate that, as seen above.

Take the trend a bit longer and… oy.

That’s a cratering. A shitkicking. An implosion. A sustained self-off that would indicate, if you go back through the timeline of the company, that pre-listing stock that was bought at $0.35 per share in October was being booted out the door by early investors for profits.

And, while that was happening, the company was quiet. They watched it happen. From December 19, when they ran news of their deal with Peerplays to develop four new dApps in the coming two years, until today, there’s been one piece of substantive news (in early January).

During that time, the stock dropped from $1.30 or so to $0.30.

And guess what came today? 25% more of its pre-listing $0.35 financing stock went free trading.

Jesus Christ on a handcart, this is not what you like to see, especially if you got in after it went public at just about any point in its timeline.

Now, Exeblock is a client of ours and our job is to make the market aware of the stock, but that doesn’t come with a blanket immunity from the consequences of stumbling out of the gate. The execution of Exeblock to this date has been poor, and we’re not about to hide from that.

Primary among the failures has been an ability to express what the company actually is, does, and owns.

Peerplays is a blockchain network designed to incorporate transparent, secure online gaming, but XBLK can’t really go too deep into that business in its marketing because it flies close to the regulatory sun. If they develop a dApp that helps run a 50/50 for a non-profit in a way that improves upon the standard practice, that’s great – and potentially profitable, and legal. And if FreedomLedger helps dApp developers exchange currency from one to the next, quickly, securely, transparently and cheaply, with XBLK earning a fee on those transactions, well that’s also a great thing, and absolutely legal.

And if online casinos and bookmakers use those tools to do their business, the same way they use ISPs and servers and phone lines and banks, Exeblock stands to make a lot of money on those transactions, the same way ISPs and server hosts and phone companies and banks do.

But they can’t SAY that. You have to read between the lines and ‘between the lines’ is tough to market.

“We’re not a gambling platform!” is the constant refrain from HQ, and that’s true. They’re not. And the concern is that if the common perception is that they are all about gambling, the regulators will throw a hissyfit.

This concern is not without foundation. Exeblock founder Jonathan Baha’i stepped out of the C-suite back in the day because he’s also involved with Peerplays proper and the company wanted to keep things copacetic. No conflicts, no concerns.

And if you actually read the white paper on the 50/50 dApp, it’s clear this is legit business, and legit biz is in short supply in the blockchain sector in general.

[pdf-embedder url=”https://e4njohordzs.exactdn.com/wp-content/uploads/2018/02/eXe5050_DApp_Whitepaper_v1.0.pdf”]

So if the company is doing legit things, but talking about those legit things becomes a regulatory minefield if done in any way incorrectly, then you’re obviously going to find these situations arising where the stock is headed in the wrong direction, and can’t be tackled with news that hasn’t gone through the wringer in respect of legal review.

That’s a tough call for a new public company.

Also, if your stock is getting murdered, there’s a line of thinking prevalent in the business that there’s simply no point wasting good news on a bad cycle. That is, if folks want to sell your stock cheaply, let them do so, and when they’re done – that’s when you start pounding the desk with your plans.

That’s not stupid thinking. Clearly there’s been so much selling that anything short of game changing news wouldn’t have stemmed the tide to this point.

But, as an investor, you HATE that. Patience is not our strong point when a 5x rolls back to a 1x.

So here we are, with $0.35 stock that hit the market in the midst of the superstupidblockchain wave and landed at $1.40, then went up to $1.80, booking 5x paper profits that made the early guys feel clever.

Now it’s back to $0.37 with more paper coming out today.

If you think it’d be silly to buy into that churn, I can’t argue with you. And if nobody’s buying, that’s when you get the shredding XBLK has had in the last month.

SO WHAT NEEDS TO HAPPEN TO MAKE EXEBLOCK TURN A CORNER?

- A new website. Dear god, a new website, that accurately and cleanly explains what the company does – develop dApps that will bring revenue when used by anyone on the Peerplays system and beyond.

- Bring on some news. Not just ‘progression’ news, because we expect that, but actual new business. I want partners and clients and vendors and moves made. I’m fine with not burning that news for a few days, but let’s give people a reason to not just buy the stock, but hold the stock.

- Grow the business outside of Peerplays. Hey, it’s a nice base currently and will no doubt generate revenue at some point, but I want to see this company own and build things outside of that one party, specifically in areas that they can loudly and proudly talk about.

- Show me insiders buying. The people at the wheel know more about the reality of this deal than anyone else, and if they’re registering insider buys at this price, that’ll help me feel like I’m not an idiot if I join them.

- Start talking. The markets will fill a vacuum with cynicism and short seller fuel. You have to get out ahead of that, with updates and plans. Not ‘why should I buy?’ but ‘why should I hold?’

Crypto prices have begun to shift upward again. Blockchain deals are starting to go green again. And when I called the company just now to ask them if they have any plans to address these needs, all I could get out of them was, “We have some very important things we’re working on that we believe will justify patience.”

That’s code for, “We can’t talk about it yet and you can’t make us.” It’s also, in my opinion, a positive sign.

We don’t do buy, sell and hold calls here. That’s on you, your broker, your god, and, most importantly, your wife. But even though this stock is at a low that’s about as far down as we would think makes any sort of sense, and though the chart is showing a week of high volume buying, we’re not buying in.

Let’s see how the company gets through tomorrow, and let’s see some real news emerge to demonstrate just how oversold it is.

Exeblock: Your court.

— Chris Parry

FULL DISCLOSURE: Exeblock is an Equity.Guru marketing client.

Good boy. You say things which are true. They are not making progress. They need to. XBLK is losing money. It is sad. I am sorry for the investors which have bought this company. It seems like pump and dump. They need to stop talking about tunnel and show us light. XBLK is long shot.

Read the white paper. PPY was just a way for the CEO to raise real $ and to suck those real $ into his various office rental and IT hosting operations.

According to the white paper, he’s making 15K a month for “services” whether the system succeeds or not so all he has to do is keep that up for 3 years and he’s up half a million US while all the PPY holders are all holding worthless tokens.

Think about it. The longer he can spool it out the more he makes. Which probably accounts for why it takes to so long to get anything done – or to release the source code.