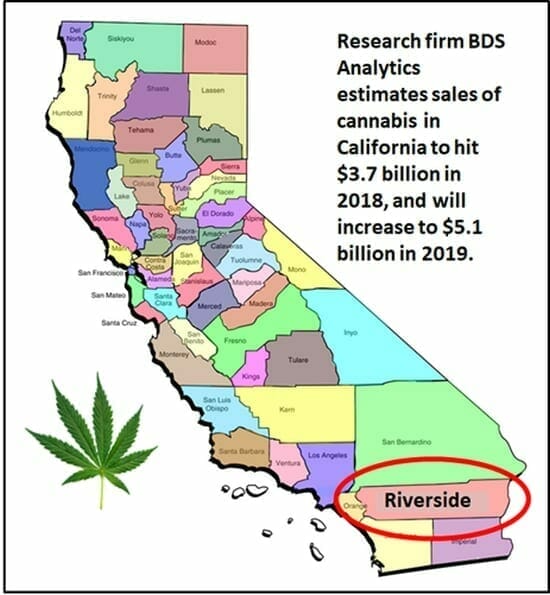

On February 5, 2018 Tinley Beverage (TNY.C) announced that its intended Phase I cannabis production facility has completed a municipal cannabis inspection in Riverside County, California.

Riverside (pop. 325,000) is working to diversify beyond the booming housing industry into manufacturing.

It’s a very good location for a weed facility.

According to the press release, the facility “has now completed an inspection for cannabis production by the municipality’s fire department and City Planning Commission”.

There are still three permitting hurdles to go: fire department, health and police.

“Upon successful completion of these remaining inspections, and receipt of final permits, Tinley intends to consummate the agreement with the facility that it has agreed to in principle.

The Company continues to expect the initial batches to take 2-3 weeks to complete upon receipt of such permits. Initial products include the Tinley Margarita and the Tinley ’27 Coconut Rum”.

When Chris Parry first wrote about Tinley on October 6, 2016, he pointed out that a week earlier, “you could have snapped up this stock for $0.06 a throw. Today? $0.115. That’s a near double, and the story isn’t even really out there yet.”

Readers who thought they were “too late” – were wrong.

“I talked to Tinley boss Jeff Maser yesterday, while the weed world was on an absolute tear,” wrote Parry, “and I could barely hear him for the phones ringing in the background. Maser tells me brokers are beating on his door, looking to get involved with the new plans, but that he’s not getting carried away.”

“We’re currently doing test runs at a large convenience store chain and we’ve been picked up in 50 stores in 6 states, plus 2 major web stores, all in our first month,” Maser said.

He added, “We believe the de-alcoholized drinks are a game-changer. Nobody enjoys someone busting out a joint at dinner, but now you could enjoy a drink with your friends and get a comfortable high instead of getting your drunk on.”

How you feel about Tinley now, depends on when you purchased the stock.

Tinley is up about 700% from our initial recommendation.

On January 2, 2018, Tinley was trading at $1.98 – it’s fallen back to .70 since then but is still up considerably since we bought it to your attention.

We think this is a real company, in a good market, with genuinely sexy products.

Tinley has completed about 20% of the planned production run of its updated Hemplify products. The remaining production is expected this coming week.

The company has launched a new lemon-lime flavor and an updated version of its berry flavor. The tropical flavor remains unchanged.

All three flavors will have updated packaging which reflects the shift in distribution from head and smoke shops to premium health and natural grocery stores.

Tinley’s primary distributor has ordered stock for additional stores.

This writer does not normally drink hard booze or smoke pot.

But something about this concept (or maybe it’s the packaging) creates a palpable desire to consume liquefied cannabis.

Next time I’m in L.A – I’m gonna pour some down my throat.

As of January 23, 2018, Tinley has about $4.6 million in cash and liquid securities, representing an increase of approximately $800,000 last financial quarterly release on September 30, 2017.

The capital will be used to producing the Tinley ’27 batches planned for its temporary facility, bringing its long-term bottling facility into operation, marketing and working capital.

FULL DISCLOSURE: Tinley Beverage is an Equity Guru marketing client, we also own stock.