Welcome back after a holiday hiatus to Eat my Shorts, our semi regular column looking at short activity. This month I’m looking at the big weed players. Aphria (APH.T), Canopy (WEED.T) and Aurora (ACB.T). Volatility and overvaluation is like catnip to short sellers and the cannabis sector has it in spades.

Roller coaster..(WHOOP WHOOP) of weed… (WHOOP WHOOP)

Looking at the latest short summary data from shortdata.ca all three companies ranked worryingly high in both the largest short positions and in trading activity. All of this has happened before and all of this will happen again…

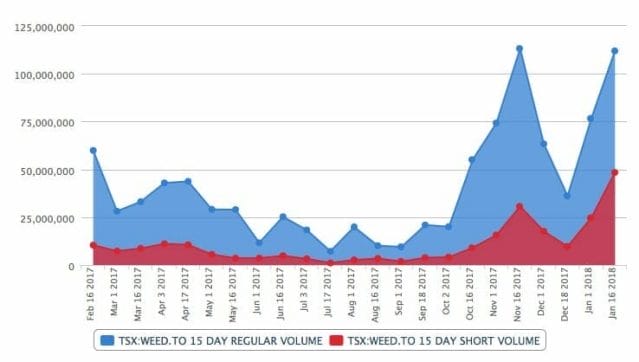

Look at Canopy. Its stock looks like a math textbook.

The red part of the graph shows short activity rising and falling along with the overall movement of the stock. Remember last time we talked about the Squeeze? A chart like this one says to me, there hasn’t been one on the stock yet.

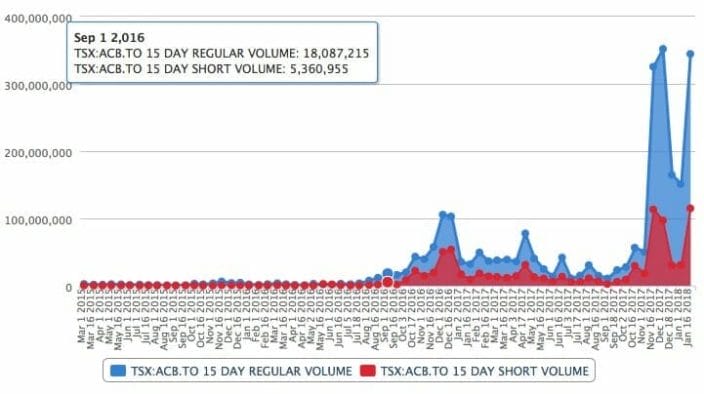

Compare this to Aurora’s (ACB.T) stock chart.

Note the asymmetry in November, as the price shot up, the short activity declined. To me a sure sign the spike was partially driven by short sellers covering their positions. why did it happen, and how can you as a savvy, gorgeous, brilliant investor take advantage of the next one?

Glitches in the Matrix

To begin with if you are holding anything on the shortdata listing, you need to watch the stock like a hawk. Either because you need to see a big sell-off coming and take your profits — Or you ride or die, and try to time the squeeze.

If you are a short seller, this is your nightmare. What it looks like is the short sellers were happy to go along with the stock and bet Aurora would tank, and then…. this happened. And then this.

Aurora’s announcements were the moment of truth for the short players. If the market turned its nose up at either the merger news, or the warrant offer, the company is pooched. However the cannabis hype was strong and the market pushed its chips in.

Suddenly Aurora wasn’t ridiculously overvalued, it was the next InBev of weed! as the short sellers scrambled to cover, the price went from red to white hot.

Of course like the rest of the weed market, there was a correction and another inflation, yada yada yada. (Compared to crypto volatility, this still looks as stable as IBM in 1955)

The point is if you want to play the short game you need to watch for these misalignment of activity. If you hold a stock that little window of arbitrage is your key to big bux.

See the pattern Be the Pattern.

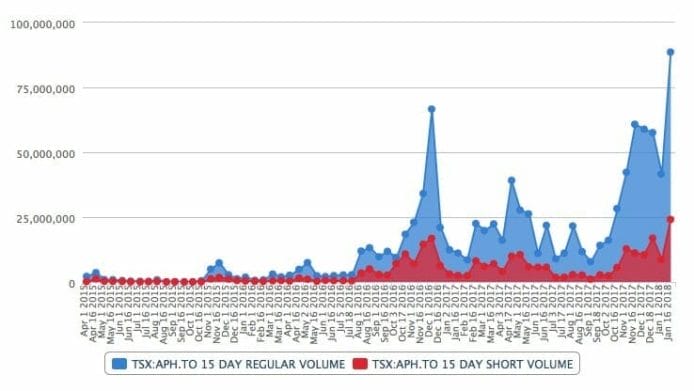

Here’s the chart for Aphria (APH.T) — Still red hot with a bullet on Shortdata.

Two squeezes between October 3rd and December16th. More in November. The current sky high price is ripe for another. If I held any of this stock (and I don’t) I would be watching very carefully for news.

If some announcement gooses the stock in any positive way, it could trigger a squeeze. if not, I’d still be watching because Whoof, thet’s a really high price for lots of potential.

Wild Wild West

I will keep reminding all of you out there. We are on the cutting edge here people. Fortunes will be made and lost, and you will need savvy, guile and guts made of steel to survive. Bonus points if you can figure out how to buy crypto currency with graphite ore and invest it into cannabis.

All are cool, all will be a crazy wild ride, knowing what you’re looking for can let you profit, not perish from the squeeze.

Next time – we’ll update who to watch and try to peg a reason for why they are on the list.

FULL DISCLOSURE: I don’t own any of the stocks mentioned in this piece, nor are they clients. I own shorts. Some have pockets,