One of the most ignored aspects of the recent blow up of blockchain and cryptocurrency stocks has been the value inherent in alt-currencies being held by companies in the space as they do their work.

While the market chases the market, and moves en masse to whatever is blowing up this week, valuations go nuts and fall off in a heartbeat, while actual business seems to serve only to discount a company’s actual worth.

I received a text from someone connected to HIVE Blockchain (HIVE.V) this week that was VERY happy with what they’re holding financially. I asked if they were referring to their recent batch of raised private placement doughbucks but was told, “No, I’m talking the value of what we’re mining – and have mined.”

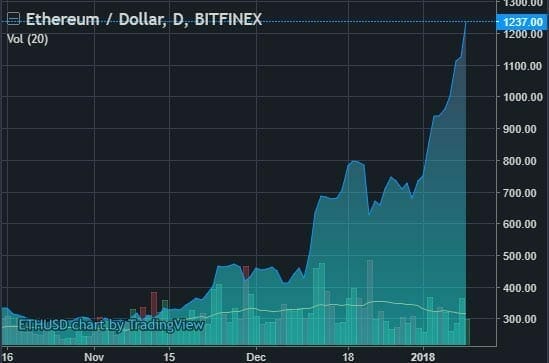

Earlier financials were released with just a few weeks of actual mining shown, good for $180k at the time the numbers were figured, but those numbers were from September 2017. A lot has happened in the crypto currency world since then.

Consider this: Hive’s $180k of Ethereum in September of last year, is now worth $761k, based on today’s ETH prices.

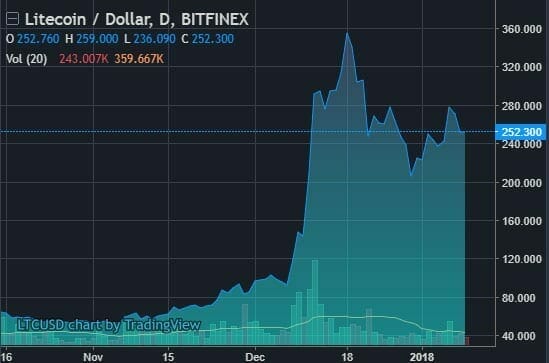

If they were mining Litecoin (LTC) in the time since, that’s gone up by an 11x multiple.

If HIVE has only mined at the same rate it did back in September 2017, two weeks into business, it’s sitting on about $10m in ETH today, by my estimation.

But it hasn’t been mining at the same rate – it’s been adding data centres worth tens of millions since that time, and has raised buckets of PP cash into the bargain.

And while that was happening, alt currency values were jumping.

What HIVE might be sitting on now, in USD terms, is anyone’s guess. But little Calyx Bio-Ventures (CYX.V), which hasn’t turned a profit in the several years it’s been public as it pivoted from biofuel development to seed-to-sale weed software, to b2b ecommerce and messaging platforms, to blockchain, went break even on it’s first small foray into digital mining, and saw a stock increase of 6x over a few months.

The company recently dropped another sub-$1m on more miners, which execs tell me they rushed into installation and are now benefiting from, and which will push the company to profitability as they continue to develop their legacy business assets.

There are a lot of vaporware blockchain deals churning big valuations from the promise that one day they’ll have a business model that’ll be ‘really big, so big’, but the ability for companies in the space to literally ‘print money’ has been much overlooked.

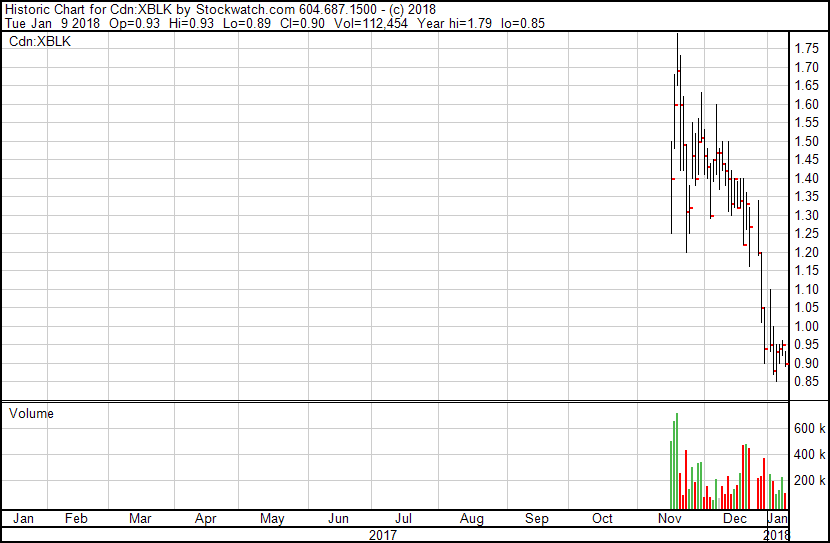

eXeBlock (XBLK.C) owns 900,000 Peerplays (PPY) tokens, good for around 20% of all available tokens of that kind, which it recently received in an agreement with Peerplays to develop four DApps for that platform. The value of those tokens is tough to nail down, because each exchange buys and sells based on the needs of their userbase.

eXeBlock (XBLK.C) owns 900,000 Peerplays (PPY) tokens, good for around 20% of all available tokens of that kind, which it recently received in an agreement with Peerplays to develop four DApps for that platform. The value of those tokens is tough to nail down, because each exchange buys and sells based on the needs of their userbase.

CoinMarketCap.com says PPY is valued at $11.22. DataCoinz.com says $20. The likely number would split the difference, but we do know the PPY is up by around 4x, similar to ETH’s run, since early December.

Here’s the kicker: The way PPY is set up is, it’s specifically designed for online gaming. So when gambling DApps are created on that network, every time someone places a bet, all PPY owners receive a tiny piece of the ‘rake.’

If we head over to PeerplaysProfitCalculation.com and take a look at the estimated returns based on a 900,000 token holding, assuming $500m of gaming occurs on the platform, XBLK’s dividend would be $3.1m per year.

If we head over to PeerplaysProfitCalculation.com and take a look at the estimated returns based on a 900,000 token holding, assuming $500m of gaming occurs on the platform, XBLK’s dividend would be $3.1m per year.

In addition, because XBLK is actively developing DApps for the platform, they’ll also receive a piece of any profits that come from other developers incorporating their usability into their own DApps.

This week, eXeBlock announced it has released its first DApp, eXe50/50 on Testnet, which is a necessary step toward having the software approved for release into the wild.

eXe50/50 would allow groups engaging in 50-50 draws to use blockchain tech to handle the process of selling tickets, handling the draw, dealing with compliance, and paying winners. its functionality is a short jump toward offering the same for lotteries proper.

eXeBlock’s next DApp working its way through the approval process is designed to allow for simple exchange of PPY to other currencies and back, which will be damn useful to just about anyone who is planning to execute their business on the PPY platform.

This means XBLK benefits every time PPY’s value goes up. It benefits every time someone uses the platform for its designed use. And it benefits every time someone incorporates their tools into their own apps and sites.

I can’t tell you what that value will be because the PPY universe is new and untested. Also, it’s not alone in its pursuit of the gaming market. LottoGopher (LOTO.C) has recently gone on a nice run after it announced it was using the blockchain to develop lottery based solutions as part of its existing business, which allows for online lottery ticket sales.

As part of their move, they plan to hold an ICO.

By the end of the first quarter of 2018, LottoGopher expects to draw on talent in both the U.S. and Europe and recruit blockchain developers to finalize GopherChain’s architecture. LottoGopher is currently working with established experts to determine best practices for an Initial Coin Offering/Token Generation Event targeted for the fourth quarter of 2018.

This is great fodder for the market, and has seen the LOTO share price double in a week. But what I found interesting was this sign-off:

Additionally, LottoGopher’s CEO, James Morel, is pleased to begin inviting other lottery services to join GopherChain as strategic partners. Mr. Morel, commented, “GopherChain will benefit not only LottoGopher, but also other lottery services, and I’m pleased to invite other lottery interests to work with us as strategic partners.”

This wouldn’t be the first time, if it happens. NetCents (NC.C) aligned with Lottogopher in July of last year. It’s since risen from $0.35 to $2.69.

For me, the eXeBlock strategy is a great real world business move, with revenue streams all over, $16.5 million in PPY holdings as of today’s assumed price, DApps hitting the testing circuit now, rather than some time next year, rising valuation in their assets rather than depreciation, and when you tack on the potential for some other blockchain interests to align with them over the coming year, rather than battle them, we could be really onto something.

Every single sector in the world can and will be transformed by blockchain tech at some point. That gaming is becoming one of the first battlegrounds for it tells you there’s profit potential out there.

But hey, I know your next question is going to be, “But all the blockchain deals are silly valuations – what’s the point in getting in now?”

The cheap paper has taken its profits and gone. A new floor has been set.

If you’re on the fence, might be time to make a decision.

— Chris Parry

FULL DISCLOSURE: eXeBlock and Calyx are Equity.Guru marketing clients. The author holds a stake in those companies, as well as HIVE and Lottogopher. Do your own due diligence, as we have done ours.

NB: Pursuant to a resolution passed by the directors dated Nov. 27, 2017, Calyx Bio-Ventures Inc. changed its name to Calyx Ventures Inc. effective as at Feb. 5, 2018. The ticker symbol CYX is unchanged.