Sitting on a train this week, I overheard two conversations that soon became one. The first was two guys talking about which cryptocurrency they thought would surpass Bitcoin eventually. The second, going on a few seats away from the first, was about how blockchain technology will change the financial world.

Here’s the thing: These people weren’t millenials on their way to a Foosball tournament. They weren’t neckbeard-wearing hipsters trying to show how clued in they were on the tech world. They weren’t making their assertions while laying out Pokemon cards and sipping chai lattes.

These were seniors taking transit. And they eventually merged their conversations into one because blockchain and crypto is all anyone seems to be talking about these days, and because it’s all so new, folks are interested to know what other people think.

So what is blockchain?

It’s not a bubble, despite what alarmists are saying. It’s not Tulip Mania, but it’s also not a thing you can hold in your hands. It’s not a literal thing.

It’s a way of organizing data. That’s it.

It’s ‘an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way,’ according to the Harvard Business Review.

Why is this interesting?

Because that’s not how the world has worked to this point.

In the financial world, data verification happens almost manually. It deals in an alarming amount of actual paperwork and folks running their finger down long columns of numbers.

“I sent you some money. Did you get it?”

“No. You sure it’s gone? Maybe it’ll show up overnight?”

“God. I’ll call the bank again.”

— Actual conversation in our office, three times this week, followed by hours on the phone

Let’s think about what happens when you send a wire transfer to someone through your bank. You have to go physically to the bank, the clerk has to jot down all the account info, fill in a form, take the money from your account, charge you a fee, then send it out on a system of interconnected banks.

Eventually, the receiving bank gets it (usually the next day) and deposits the money in your account (after a delay).

The transaction is slow, laborious, expensive, and if secured systems are breached, can be exposed to theft and fraud.

Blockchain technology does it differently. You make your transaction, and software being run by a wide network of users verifies the transaction as it takes place. If someone hacks one of those users in an effort to steal your cash, the others form a virtual verification supercomputer that ensures the theft doesn’t stick.

So blockchain is a concept in data handling, not a product. When you say you’re ‘investing in blockchain,’ you may as well be saying, “I’m investing in computer stuff.”

To be sure, a lot of companies are tossing blockchain into their names and business plans because there are a lot of people investing in blockchain, and making fat returns on doing so.

But eventually there has to be a reason to use blockchain. There has to be something that will be applied to real world business, in a way that makes money.

“Blockchain is the future!” isn’t enough. What you want to hear is, “This is how I’m going to utilize blockchain to take a dysfunctional real world business and improve upon it greatly.”

Not everyone is up to this task. Some have the technology but not the ability to penetrate existing business networks with it. Others have the access to potential clients, but no real technology to sell them. Others have neither – they simply know adding ‘blockchain’ to their business cards will bring investors who expect to double their money in a few weeks before heading back to weed.

There’s a company I talked to recently that, to me, has all the hallmarks of that rare ‘has the tech and has the network to employ it in’ opportunity that, frankly, we’re not seeing much of at the moment. That it’s inexpensive right now adds interest to the story.

But first, the backstory.

A couple of years back, I learned of a company that I figured had a pretty neat and original plan.

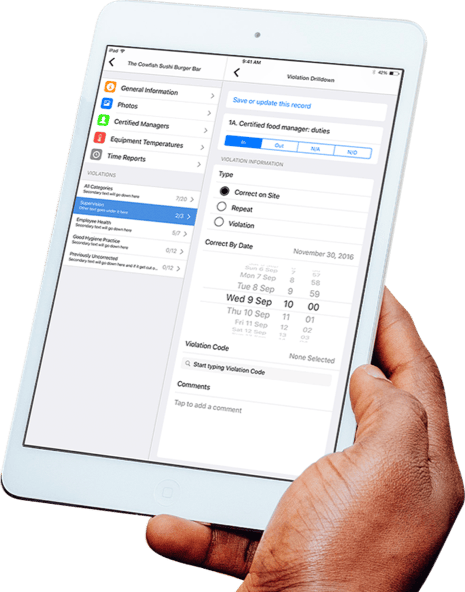

Healthspace (HS.C) hit the CSE with a twin focus: To supply health inspectors with online tech tools that could replace their old clipboard and photocopy and pencil-based systems of compiling inspection data for restaurants, tattoo parlours, swimming pools and agriculture operations, and to sell the ensuing treasure trove to big corporations that could use it.

The idea was that the Yelps and Googles and Ecosmarts and McDonalds of the world would pay to be able to access the data as soon as it was logged, to know that a restaurant had a hygiene problem as it happened, to be able to sell them soap or fire a manager or get a pest controller in or show that they passed muster to millions of interested potential consumers.

That was a fun idea. But the public markets never really bought in, which made it tough to scale.

So Healthspace had to do it the old fashioned way – by making sales and earning revenue and using that revenue to grow slowly.

Their tech is completed and polished and good, and competitors in the space have recently been bought out by bigger players for very big dollars, so they’d be forgiven if they simply sat back on what’s been built and waited for their buyout, but Healthspace has another piece of the puzzle that has kept them busy, because it will potentially change everything.

Blockchain.

Companies that are in the blockchain space, right now, are absolutely exploding on the markets. That’s nice in the short term, because everybody has a plan and everybody’s stock is going up as a result, but long term it’s going to be the companies that have a real use for blockchain, and can really deliver a product around it, and can actually do deals in their relevant industries, which will be the huge market caps of the future.

Understand this: Healthspace is not going to ‘hire an internal rockstar blockchain technology team’, and anyone who says they will is full of crap. The number of companies looking for blockchain technology talent is vastly larger than the number of coders who have any. Any blockchain expert worth their salt is already busy.

But there’s a real opportunity for Healthspace here, because hospitals and medical records and data storage and compliance and security is where the blockchain technology is desperately needed, can make the largest positive impact, and is the most difficult to penetrate from an outsider’s viewpoint.

Medical records are a mess. Companies looking to update and upgrade health systems charge millions to do so, but the movement of your medical data from your doctor to your specialist to your hospital to you, that’s a business that, much like the health inspector business that Healthspace has been bringing into the 21st century, relies on clipboards and colour coded folders and understanding medical scribble and never EVER getting anything wrong lest a patients dies as a result of a 5 looking like a 6.

It’s a massive cost, massively inefficient, and massively important.

But in order to enter the health services industry with a blockchain product, a company would need to do the following:

- Have years of experience doing business and signing contracts with health departments. Not a few municipalities or clinics here and there, but big city health organizations that run hospitals and regulate doctors and ensure compliance of pharmacies and food suppliers and countless other industries. This isn’t easy to get, because those groups don’t take unsolicited meetings. You have to earn the right for a sit down, usually based on white papers you’ve done and prior contracts signed.

- You need existing technology and tools designed to not just help with compliance of multiple industries with regulatory bodies, but enforce said compliance, and those take years to do because, again, your target market is government bodies and large corporations, which don’t open their systems to any old Joe.

- You have to actually be able to deliver a product that will be acceptable as secure, functional, efficient, and using best practices. It has to be built at the elite level.

Healthspace could put out a few news releases dropping cryptocurrency and blockchain terminology and probably get a little pop on their share price without committing themselves to anything, and a lot of companies have done that.

Or, it could use its existing health department network and customer base, which is substantial, to open the door, while paying one of the most elite blockchain outfits in North America to deliver the actual work.

HealthSpace intends to use the initial version developed with SIMBA Chain to provide a proof of concept in order to demonstrate how audits and other regulatory checklists can be stored efficiently and cohesively in the blockchain. By doing so, HealthSpace can further integrate its existing iPad and Android apps to go beyond just government inspections and into private audits. Combining audit control software with the power of the blockchain will create a comprehensive toolset for furthering transparency between multiple parties who need concurrent access to the same chain of data, but have different rules for how or when that data is entered.

What’s that mean?

In layman’s terms, Healthspace’s software can be upgraded to use blockchain tech to become not just better, but open to an abundant number of new potential end clients in additional industries.

And who is SIMBA Chain?

SIMBA Chain Inc. (www.simbachain.org) is a Blockchain as a Service (BaaS) company. SIMBA Chain Inc. is a wholly owned entity of ITAMCO and was formed from a grant awarded by the Defense Advanced Research Projects Agency (DARPA) to Indiana Technology and Manufacturing Companies (ITAMCO – www.itamco.com) in order to develop a secure, unhackable messaging and transaction platform for the U.S. military.

Sorry, what was that? Did they say SIMBA Chain does blockchain technology for the US Military?

SIMBA Chain partnered with the Center for Research Computing at University of Notre Dame to develop their SIMBA API which is a robust and efficient technology originally implemented for Defense Department communications. Its uses included communication between ground troops and their headquarters or between intelligence officers and the Pentagon.

Holy smokes. They’re legit.

Most recently, SIMBA Chain was awarded a contract by a Fortune 500 American multinational chemical company to integrate its SIMBA API with the company’s SAP ERP system for the use of Blockchain in tracking and logistics.

To be sure, the potential millions that will come from adding blockchain technology to this existing business, and their network of clients, and the ability to vastly add to their potential client base, will not happen by next week. There’ll be some time needed to develop things and do the white papers that will be needed to sell it to large players – but they’re doing it. They’re doing it in no uncertain terms.

If I have a garage full of hardcore industrial metal enthusiast coders in Uzbekistan and I decide they should revolutionize the health industry, the health industry will tell me to take a running jump because security and privacy and failsafes and consultants being bondable are the most important thing in that business.

Congrats on your cool coders and their Gastown tech loft, but in order to penetrate the billions of dollars floating around in the legacy healthcare industry, you need military grade code and tech and, lo and behold, Healthspace is going out and adding exactly that.

There’s real business there right now, in the existing health inspector software revenue that’s coming in every month. And there’s a solid case to be made that, based on activity among their comparables these past couple of years, that larger players could come in at any time and make an offer for Healthspace that would be profitable to accept. And then you have the long upside future story, of what can happen when the military-grade blockchain outfit delivers upgrades to Healthspace’s existing business.

In terms of now, I believe Healthspace is undervalued.

In terms of the short term future, I believe it is way undervalued.

In terms of the long term future, I don’t even know how to adequately assess the potential market, because it is broad and large and, at this point, anyone’s guess.

And it appears others agree. A month ago, the stock was trading at $0.05, where it had sat for a year-plus. Today, at the time of writing, it’s at $0.16 and moving hard. That’s a big deal.

If you like blockchain technology as an investment, and you like how it might fit into the health business, and you like the idea of hundreds of Health Departments as existing customers which could be upgraded to blockchain technology down the road, and you like the idea of government contracts that pay their bills on the first of every month, I can’t see how you could not have Healthspace on your watchlist.

— Chris Parry

FULL DISCLOSURE: The author has been compensated for this piece by a third party but Healthspace has no commercial arrangement with Equity.Guru.