With all the hype in the crypto and cannabis sectors, it’s natural they will attract the short position players. The smell of hype is like blood in the water for these sharks, and the scent is strong.

Cannabis and crypto stocks are overrepresented on the big board of short positions. This is scary if you took a short position early and watched the gasbag continue to inflate overall. Some of you have long positions and are waiting for the right time to sell a little to the panicky short folks.

This is a piece for those of you like me who aren’t in either spot yet and thinking about diving in.

How to get into a company’s shorts

(Skip this if you already know the basics, or share

with your grandparents / co-workers / random stranger).

Basic stock market 101 – all investment is betting on how a company will do. Often this has little or no relation to what’s actually happening at the firm. News can start or push stocks movement, but there are so many different trading platforms and algorithms with different models and weightings, things have become pretty skewed.

There are those who live on the edge, gaming the up and down of a stock by betting with stocks they don’t actually own. These folks are short sellers. They are kept in check by the long-holders, the greatest of which are always ready to put the sensitive parts of a short seller in a vise if and when they bet wrong.

To have a short position, I would hypothetically rent the use of your 10 shares at today’s price for say, 1 year – and I’ll pay you 5 per cent interest too. I sell your stock because I’m betting the company’s share price will tank within the year. I can buy it back at a lower price, give you back your shares and keep the difference.

You just have to guess which company’s stock will tank. Easy right?

What about the other side. Well, if I think the company is great and has long-term value. I will give you those 10 shares for a year (with a 5 per cent vigorish). If the stock goes up, I get them back in a year, at a higher value plus the interest. Where I make my real money is when the short guys bet wrong.

When the stock keeps going up for longer than the option to use my shares, welp, I need those shares back, and you’d better have them to give back to me.

So the guy who went in on a short position has to scramble to buy the stock at whatever price it’s at to meet his commitment. When a short position starts to skyrocket, that’s when my other 90 shares will really bring home the profit.

There are a lot of ways you can finance or leverage your position, but the basics remain the same. If you think you can time when a stock will drop – you can profit from others’ misfortune. If you’re wrong, the short squeeze will clobber you.

The Short Squeeze

The moment as investors we want to watch for, is the short squeeze. When a company starts on a tear, there’s a dip or flatline and then spikes, especially when there’s no discernible reason – it may signal the start of the squeeze.

The squeeze starts when the players with a short position scramble to cover their commitments. A stock will see massive volume increases and price spike, tapering off as the chaff is cleared out. Meanwhile if you’ve been holding the stock for a while, you are cackling madly and counting your profits.

Case study: Canopy growth – possible squeeze

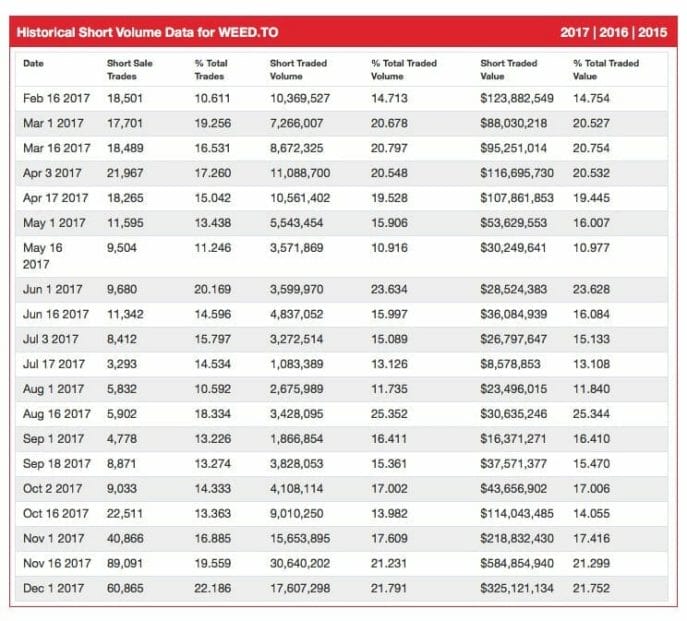

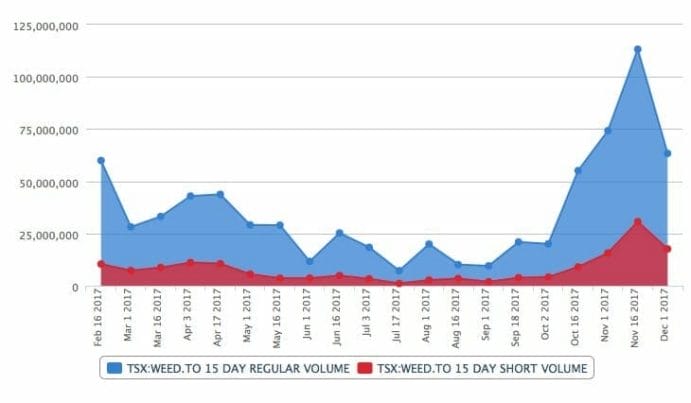

So let’s take what happened with the short position on Canopy (WEED.T) this month. It looks enough like a classic illustration of a covered short to give you an idea of what I’m talking about.

(Source shortdata.ca)

On October 16th, Canopy made a news announcement and the stock took off. Short traded volume started going up. When the stock continued to rise (November 1) the squeeze got worse, the cycle continues, short position folks were forced to buy at whatever price they could get to cover their positions.

By November 16th, if you had some Canopy to sell, bully for you! You just made a ton of cash. The latest numbers show the squeeze slackening, as most of the folks holding a short position covered their losses the stock is stabilizing again.

This is what to look for in this game. If you time it right on either side, short or long, you can make a nice profit. In this case, the long-hold investor comes out on top, and some people who timed their short position wrong likely took a haircut.

Who’s Next? I Dunno, but I have some educated guesses.

It’s clear there are several opportnunities in crypto and cannabis to play a short game. One of my particular favorites, Golden Leaf Holding (GLH.C) looks to be just starting a squeeze right now.

Since November 16, the volume of short trades jumped 600% to 12 per cent of overall volume. The short trade sales volume jumped from $250k to $12.2M. That’s a 97% increase in short trade volume. If you have some squirelled away, I’d suggest watching the stock very carefully.

If it is in a squeeze you likely have some time to see if you can grab some profits. If not, start watching your portfolio.

In the coming days and weeks, i’ll start illustrating some stocks in our speciality areas (e.g. energy metals, cannabis, etc.) and why they are ripe for, in the middle of or ending a short sale event.

In the meantime if you hold any stocks in this area, you can park ‘em in your TFSA etc, or strap on your sword and shield and step into the arena. Dress code is shorts.

FULL DISCLOSURE: GLH.C is a client, but I do not own stock. I do own a collection of very expensive prop replicas. Probably not the better option.