When I walk into a boardroom these days, and I’ve walked into more than the janitors do, there’s a new scent in the air. Gone is the stench of desperation. No longer is there the whiff of opportunity. Now we’re bathing in the musky aroma of “Shut up, I don’t have time to hear your pitch, just take my money!”

I’m not saying I’m immune to the junior markets version of Sex Panther.

I just bought into a pre-listing cryptocurrency private placement where, instead of having a discussion about whether the company might become a marketing client of ours for a fee, we went straight to how much money Equity.Guru was going to invest in their deal and didn’t even broach the topic of providing services.

That’s right – letting us in on some of these deals has become similar to being paid to market those deals.

This happens. It was long the way of stock picker extraordinarie Fabrice Taylor; Let him in early on a deal he likes, he’ll buy a bunch of early stock, and no other money needs to change hands as the company runs upwards – if he’s picked wisely. Followers liked the confidence that he’d invested in a given company and trusted that judgment, which led said companies to move up, and that’s how he’d make his dough.

We haven’t done business that way previously, but we’re sitting on a bunch of recent wins and see more coming, so we have the same rush of blood to our head that y’all do. We’re as dumb as you are, right now. And y’all are dumb.

Rich and dumb.

You’re chasing whatever is on a run at 9:30am every Monday to Friday, and while that’s working for you right now because everyone else is playing the same game, THIS CAN NOT CONTINUE FOREVER. Eventually you’re going to see some rollback and, when that happens, the weak will be feasted on by the pack.

HIVE Blockchain is down, a victim of a trendsetting crazy run and ongoing Globe and Mail coverage that is all but calling the thing a pump and dump. When a journalist wants to point at the junior markets and say “These here people be crazy!”, HIVE is the easy target because of how hard it has run.

From Stockwatch today:

The Financial Post reports in its Wednesday edition that after bottoming nearly two years ago in January, 2016, the junior market has staged a big recovery, but it is not the usual suspects driving gains at the TSX Venture Exchange. The Post’s Jonathan Ratner, writing in Buy & Sell, says that the bull run which followed the financial crisis saw the index surge thanks to strength in commodities.

This time around, the unfolding bull market is much more broad-based. “We’re talking about cannabis, blockchain, artificial intelligence and the Internet of things,” said Steven Palmer at AlphaNorth. In the blockchain group, Mr. Palmer had a short position in Hive Blockchain.

While Hive is the first publicly traded cryptocurrency miner in Canada, Mr. Palmer noted that there is nothing proprietary about this business either. “It checks a lot of the boxes you want to be negative,” he said.

“The founders have three-cent stock, millions of dollars have been spent on promotion, and the EBITDA [earnings before interest, taxes, depreciation and amortization] forecast for next year is minimal. When a stock goes up by multiples in just a few months, the risk-reward is usually not to further upside, but more to the downside.”

So, a few things on this. First, he’s not wrong on the risk-reward side. If you polled 2000 public markets participants and asked them what they’d do when their three-cent (or thirty-cent) paper went free-trading on a stock that is up x100 (or 10x), they’re going to say, almost to a man, “I’m selling.”

Almost.

If you’re playing averages, you’d bet on the sell side. But the HIVE folks I know, who I’ve known for a long time, are of the true believer variety. They’re cashed up and understand a news cycle. If you want to sell your $2.83 HIVE stock to them for $2.30 on Monday morning, they’ll take it from you happily.

I know, because I’m one of those guys, and I’ll take that paper from you in a heartbeat.

I can say that because half the people I talk to on a daily basis are also up on the stock. Every newsletter writer, every promoter, every broker, every merchant banker, Jed in the backroom at your dad’s brokerage house, friends and family of same – they all got in at $0.03, or $0.30, or when it opened at $0.90, and they’re all up. Vancouver’s financial industry is ridiculously, merrily, completely up.

And they’ll all churn out in time, or at least take some money off the table.

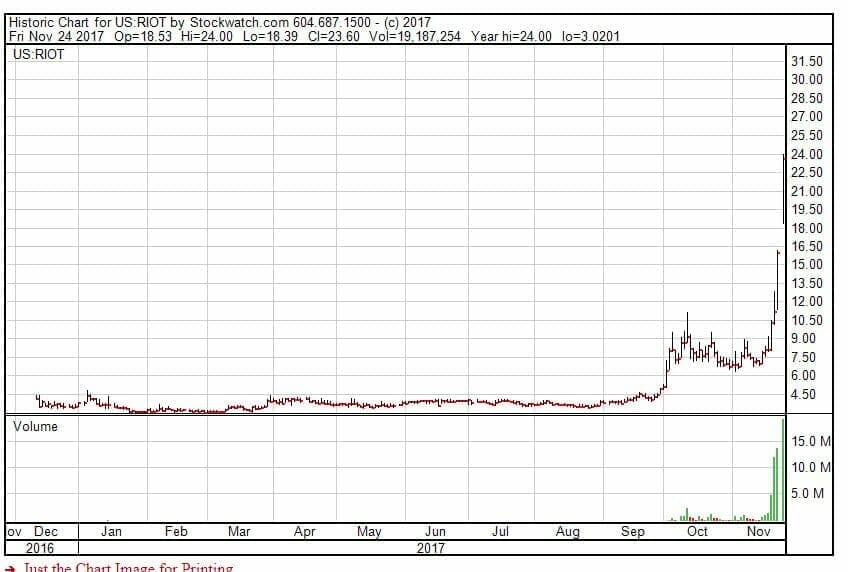

There will be selling on the back of that. There already has been. Not from me, because I have a three year outlook on this thing and when it runs, it’ll run like a stampede of wildebeest, but it’s clear from the insanity going on with Riot Blockchain (RIOT.NASDAQ), which has gone from $8 to $24 in a second and a half, that there’s a ton of money looking for a big target to settle in with.

With HIVE on the drop, a lot of that money has gone to weed, and a lot has gone to RIOT.

But if I was going to short anything, would I short HIVE, which has already halved and come back to a place where, even as an investor, its valuation makes more sense?

Or would I short this?

That jump is on straight up nothing. the last news was about an advisory board posting, which is a snore. It’s a money park. And as long as people see it rising, it’ll find more people climbing on.

Today’s market activity on RIOT is like an ivy climbing a maple tree. It keeps running and running and before you know it, all you can see is ivy – and the tree ends up strangled.

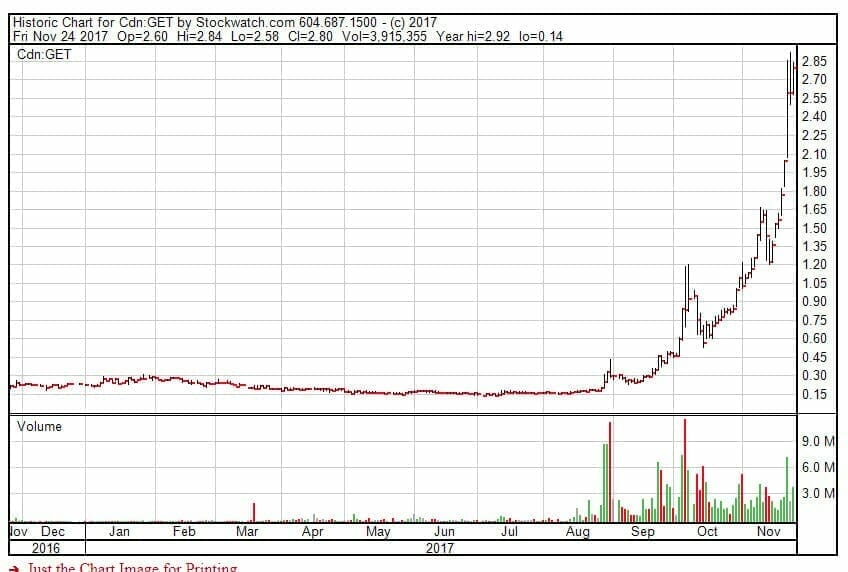

RIOT’s value two months ago was $50 million. It’s $200 million today. That’s overvalued. But so is HIVE. So is Aphria (APH.T), which hit ten bucks today in the weed space, and Aurora (ACB.T) which has doubled in ten days, and Global Hemp Group (GHG.V) which has seen insane buying on no news in the last week and is up 4x what it was a month back. Glance Technologies (GET.C) has a chart that, frankly, I don’t know what to make of. Do I jump in and ride another double by Tuesday, or is that a tall tree with a chainsaw moving through it?

QMC Quantum Minerals (QMC.V), which is a client of ours, was something we talked about when it was at $0.07, and was touching $1.70 today before profit taking.

At the request of the Investment Industry Regulatory Organization of Canada (IIROC), QMC Quantum Minerals Corp. confirms that its management is unaware of any material change in the operations of the company that would account for the recent increase in market activity.

Okay.

Global Hemp Group Inc. is unaware of any material change in the company’s operations that would account for the recent increase in market activity.

Sure.

At the request of the Investment Industry Regulatory Organization of Canada, Matica Enterprises Inc.’s management is pleased to provide an update on company activities.

Yep.

Block One Capital Inc. is issuing this press release in response to a request by the Investment Industry Regulatory Organization of Canada (IIROC) to comment on recent trading activity of its stock.

The company announces that it is not aware of any material, undisclosed corporate developments and has no material change to report at this time. The company will keep the market informed as required.

Enough now.

Erin Ventures Inc., in response to a request by the Industry Regulatory Organization of Canada, has released this comment on recent trading activity of its shares.

As a general policy, Erin does not publicly comment on market speculation and rumours. The company is not aware of any material change that would account for recent increase in the trading volume and price of the company’s common shares on the TSX Venture Exchange.

STOP.

At the request of the Investment Industry Regulatory Organization of Canada, Alchemist Mining Inc. wishes to confirm that the company’s management is unaware of any material change in the company’s operations that would account for the recent increase in market activity.

Christ.

At the request of IIROC, The Tinley Beverage Company Inc. confirms that the company’s management is unaware of any material change in the company’s operations that would account for the recent increase in market activity.

Namaste, Cannabix, Radient, Abcann, Hempco, WeedMD – everything is on a tear and that can’t last without some merit.

Kaneh Bosm Biotechnolgy Inc.’s management is unaware of any material change in the company’s operations that would account for the recent increase in market activity. The company would also like to report that it has been searching for marijuana-related projects to acquire as per the company’s CSE medical marijuana status. The company will be looking at new opportunities that will potentially increase shareholder value and will report any material events and developments as they come due.

Wait, KANEH FUCKING BHOSM IS UP?!? Come on, now. That thing is a wet sack of prairie oysters sitting under a barn for six months, and it’s tripled?.

NetCents (NC.C) moved from $0.90 three days ago to $2.90 today. Is the Globe writing about how cool it’d be to short that stock? Calyx (CYX.V) is up from $0.05 in September to $0.185 today, and the CEO feels aggrieved that the market isn’t paying enough attention to him. MOGO Financial (MOGO.T) is up a double because it farted in blockchain’s direction, adding some $60 million to its market cap. Reliq Health Technologies (RHT.V) is up a six-bagger over four months (though we’re actually okay with that).

Coming soon: The Green Organic Dutchman (TGOD), complete with nearly 4000 pre-listing investors, including a LOAD of first timer private placement investors. You think that’s going to take some time shooting upwards? Not a chance, under the current market conditions.

Meanwhile, the guy The Financial Post quoted saying he was dark on HIVE’s chances of being a thing worth investing in, says he’s hearing nice things about Leonovus (LTV.V), which we don’t disagree with (and, full disclosure, they’re a client).

From Stockwatch again:

Steven Palmer at AlphaNorth Asset in Toronto is keen on LeoNovus, a provider of blockchain-enabled storage software. The firm has been backing LeoNovus for several years. The company’s technology allows data to be stored on a dispersed network, so rather than a bank, for example, storing its data in one place that requires expensive security and cooling, LeoNovus can essentially chop up the data and store it in many different places, such as thousands of computers or even hotel cable TV boxes. “They’ve been getting major companies, including a Canadian bank, health care company, and marketing firm, to sign pilots for the technology,” Mr. Palmer said. “I expect them to announce further pilots with other companies before the end of the year.”

When the Green Rush happened, and everyone became a weed kingpin overnight, even years before they might get a license to grow, we saw much of this same activity. ‘Nothing’ companies that had been ‘nothing’ for years went on crazy runs because they hinted at being in weed (indeed, hinting was all those companies were allowed to do, lest they get halted on a change of business process). Satori Resources (BUD.V), Abattis (ATT.C), Affinor Growers (AFI.C); there was a time when some of these tripled daily, and when I’d get hate mail for daring to say they were bullshit, or that they weren’t.

We’re there now. We’re in the hype spike. Which is to say, money will be made and lost on no news, and little reason. You may choose to stick your money in just about anything (honestly, Kaneh Bhosm, really?) and, as long as the market continues to inflate, you will be able to tell your Facebook friends what a genius you are.

But this shall pass. The market will come back to a place where the expectation is that a 10% jump in a day is a ‘nice little earner’, and a double will take a month or two (or a year or two) and you’re going to need to be okay with that because these times are not a reflection of your genius, anymore than selling grandma’s condo for a profit and sticking her in a home is a reflection of your genius.

Leave grandma be. She likes her stories and she doesn’t eat much.

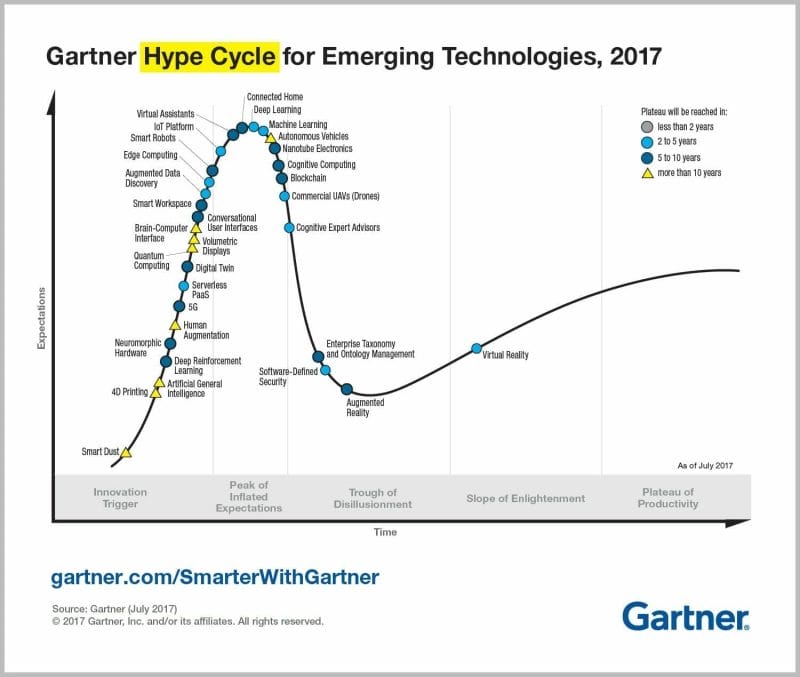

This is the Gartner Hype Cycle graph for 2017. We not only believe this graphic to be a true reflection of the tech world, but we’ve based everything we’ve done in 2017 on it. The reason we were writing about blockchain before any of our competitors is because of this chart. The reason we opened an office in a BC Tech virtual reality hub workspace is because of this chart. The reason we’ve invested in some VR companies in the last few months is because of this chart.

Understand this: The market will dump blockchain at some point and move left along that graph, only for the good blockchain companies to shake that off and move along the right to where real business is done. The profits taken will go to the next thing (which may be weed, but may also be AI if what I’m hearing is true).

So how does one play all this?

Cautiously. It’s never a bad idea to take our your original stake so that you have zero chance of losses. I’ve thought about selling some HIVE and may still just, depending on how the executive team responds to the short selling and news coverage. If they’re building the company they say they are, they’ll have the weekend to show the world their plan.

If they don’t, if they’re quiet next week and the stock keeps bleeding, then people will be justified in assuming it’s a paper play.

What I do know is this: If the HIVE crew decide to start squeezing short sellers, I’d rather be on the HIVE side.

— Chris Parry

FULL DISCLOSURE: Tinley, Calyx, QMC Quantum Minerals, and Leonovus are Equity.Guru marketing clients. We have a position in HIVE and several other cannabis and blockchain companies not mentioned in this piece.

NB: Pursuant to a resolution passed by the directors dated Nov. 27, 2017, Calyx Bio-Ventures Inc. changed its name to Calyx Ventures Inc. effective as at Feb. 5, 2018. The ticker symbol CYX is unchanged.

Excellent round-up Chris, really appreciate your coverage of HIVE and your insights on the internal politics. Had no idea that the stock was being tarnished on FT, since I don’t read legacy press.

Thanks Chris. Any plans to bring on any VR/AR companies as clients?

Mos def.