What a weekend! Since I wrote about BTC hitting $6,500, the BTC has continued to climb over 5 per cent. Smelling profit in the air, HIVE Blockchain (HIVE.V) is pushing forward with an early release of 29 million common shares.

At current market rates (as of 4 p.m. PDT Sunday) that’s $136 million worth of BTC related stock potentially hitting the market Wednesday A.M. (if all of those long holders cash in).

Before deciding how much (or if) to jump in, let’s see how the stock was doing on the news.

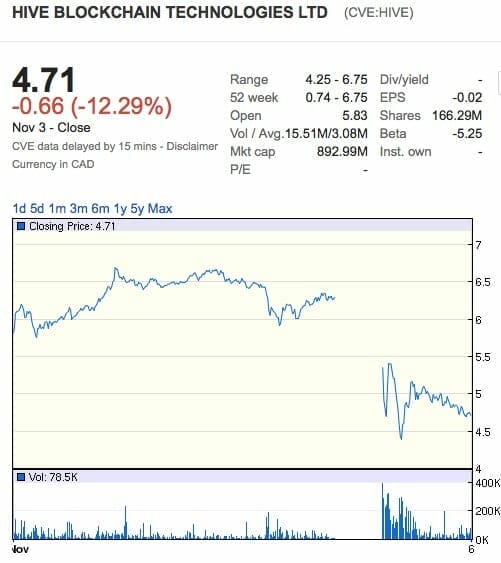

Welp, looks like the stock went from a 20% jump to a 12% fall in the last few hours of trading. The price may fall further on Monday and Tuesday, as the news continues to ripple outward.

There’s an opportunity here for a short, if you’re someone who likes playing roulette, but a bigger one might be to scoop up this company on the cheap and enjoy the stock rebound as the value does what it’s done before, and starts shifting upwards again.

Here’s why I think so.

First, everything Chris Parry says in his piece still holds. The stock has soared since it listed, and it has breached the $5 (and even $6) level already, and the market seems likely to push it high again at some point, especially if it keeps rolling out news and Bitcoin keeps rising in value.

Parry even called out the potential of overvaluation, and he owns the stock.

So why release stock early?

If you’re a cynic, you’d say it’s to let insiders cash out – the dump inherent in a pump and dump. That’d be too cynical for me. Realistically, this company was too hot, too soon, and yanking the handbrake on it makes a lot of sense – especially if you DON’T want to pump and dump, and actually want to build a real company with solid shareholders.

If the HIVE guys wanted to cash out high, they’d have let the thing keep running, but they know a large amount of that run has nothing to do with the company proper, and more to do with a ton of people just playing the trade.

That’s unhealthy, if you’re looking to build real value. You don’t want a $DRYS situation unfolding, so HIVE pumped the brakes and the daytraders have fled.

Again: Healthy.

So the HIVE sluices opened a little, cooling off a potentially overheated valuation, giving those who’d like to come in a cheaper price point to do it.

Again: Healthy.

But it’s also safe to say – it wasn’t entirely HIVE’s choice.

From one of my go-to guys when it comes to ‘what happened here’ situations:

The reason the shares are going to be released and the price rise as of late is, there was a massive short. Due to settlement issues, the exchange required the company to release shares to create an orderly market. One trade was short 400,000 at $2.25; the trade buy in caused a short squeeze rally, and the exchange stepped in to stop the madness. Was headed to $10 if they didn’t and shorts would have got clobbered. In my opinion, will settle around $3.10 a share above the $2.90 bought deal financing price.

So let’s assume the company knows what it’s doing – In fact I’m fairly certain it does. The next question is, should I jump in (if you haven’t already).

Well, look at Bitcoin since I trumpeted the $6500 plateau:

$7,367/BTC. The value of Bitcoin rose 6% in the last 72 hours. The upcoming fork I mentioned in last week’s story has lit a fire in this market and the rising value of BTC, coupled with a opportunity to buy into a company in this market like HIVE has many thinking of it as a pretty solid proposition.

Some facts on the Fork

For those of you still wondering about the upcoming fork – here’s a great rundown (credit to reddit user tenmillionsterling):

BTC Fork Basics:

The upcoming fork will split the original SegWit Blockchain into a 1X and 2X chain. This will have siginificant impacts on the BTC market.

Terms:

1X – Blockchain Classic

2X – New Blockchain

Fork at Block 494,784. Approximate date = 16th of November.

1X will continue to have a 1MB block and SegWit;

2X will have a 2MB block and SegWit;

The New York Agreement: The NYA involved parties representing about 83% of the then hashing power who all agreed to both hardforks – one for SegWit and another for an increased block size of 2MB (2X) within 6 months of the former. Further details in reference 1.

What will likely happen in the medium to long term:

It is safe to assume that miners will only mine the most profitable chain (possibly several chains in differing proportions).

If whales pump a single chain it will gain more value. If this happens, miners will be more inclined to mine that particular chain only. This will result in the other chain(s) potentially losing overall mining attractiveness.

Current Price Status (Futures) on BitFinex:

2X/BTC = 0.17

1X/BTC = 0.83

Current Mining Status:

2X = Around 85% of blocks are signaling for 2X.

It seems only a few mining pools including Slush Pool, F2Pool and Kano CKPool are not signalling 2X. All Antpool (Jihan Wu) owned pools are signalling for 2X and will likely continue to do so up to the fork. It is not clear if any other pools from the 2X signalling group will change their minds in the meantime.

Lower mining power chain:

Likely to be 1X. Fees likely to be extremely high as not many miners. Difficulty adjustment could take a few weeks, if not months. Until then it will be very difficult to transfer funds.

Double-spending:

Miners (from 2X) will have an ability and incentive to double-spend on the minority chain (lower mining power chain). If you have huge mining power, you can allocate some of it to just double-spend on the minority chain. Some people will possibly lose confidence in the minority chain as a result.

Replay-Protection:

Neither 1X nor 2X currently have replay protection.

What to keep and eye on before the fork to judge yourself where the fate of BTC is heading.

Mining signalling distribution

DAA: 1X or 2X software updates to implement Difficulty Adjustment Algorithms

Futures price before fork

Significant whale movement

References: