So you’ve got a little side money you want to sling about in a hot tech sector, and you know all about cryptocurrencies and blockchain tech, and you’ve seen companies like HIVE Blockchain (HIVE.V) just crank over the last few weeks, so you’re ready to plunge in.

But where do you start? With all the companies charging into the blockchain space right now, and with the Toronto Venture Exchange’s rep for fly-by-nighters backflipping into whatever’s hot, what’s a good deal?

I’m going to attempt to shine some light on the major (and minor) players for you because, frankly, it’s crazy town right now. I’ve stopped answering the phone from all the calls I’m getting from brokers and promoters and financiers who really want me to know about this great deal they’re into that’s HIVE V2.0.

Let’s start with HIVE 1.0.

HIVE Blockchain (HIVE.V): The first mover/miner.

The company says: HIVE’s launch transaction involves the acquisition of an initial state-of-the-art blockchain infrastructure facility in Iceland from Genesis Mining Ltd., the world’s largest cloud bitcoin mining company. The facility produces mined cryptocurrency around the clock. Assembly of the facility, which utilizes cutting edge computing components and infrastructure design, was just completed in May 2017. HIVE also has an option to acquire at least four additional data centres from Genesis in Iceland and/or Sweden.

The market says:

HIVE came to the party early, backed by Team Giustra, and engaging in a deal that was in no uncertain terms a large one. Genesis makes money – that’s not in dispute. And their facilities, if you’re looking to invest in the cryptocurrency mining side of the sector, are substantial.

Genesis did the deal with HIVE not because it needed money – it doesn’t. It did the deal because it wanted access to the markets for future financing purposes, because stacking cash in your Bitcoin wallet means, one day, trying to get all that cash out of your bitcoin wallet, and if you’ve ever tried to cash in a thousand bucks worth of cryptocurrency at a random cryptoexchange, and had to wait a few weeks for them to get their act together, you can probably get a sense of what it must be like to get your hands on $15 million or so.

Genesis makes money. HIVE can bank that money, and do the accounting, and arrange large financings going forward, and be a bully at the crypto table as well as the liaison between New York’s finance houses and Reyjkavik’s Dr Evil volcano currency mining lairs.

Genesis has invested some of its cash into HIVE since the initial deal, adding $7 million to be precise, choosing to retain its stake as the company engaged in a $30 million financing. As part of that deal, HIVE acquired a second data centre.

The downside: Everyone in the stock promotion business bought into this deal if they could get their hands on some, including yours truly. That means there will, at some point, be a cashing-in event, where that early money gets drawn down. Lithium-X (LIX.V) experienced this, with much of the same crowd and much of the same profitability, and came out the other end okay. In fact, it’s stayed pretty much at or near its high for a long time now.

The onus will be on HIVE to keep growing quickly and warrant folks holding on to their stock, even if it’s up x10.

The other knock on HIVE from some quarters is, with the volatility of cryptocurrency, a public company will face difficulties in their accounting holding currencies that can fluctuate by 20% in a day. Mining the currency is only part of the equation – realizing the returns, and knowing when to sell (or buy, or switch your miners to) the various crypto opportunities is going to take some brains trust.

Bitcoin has been extremely volatile for the length of its history, and just yesterday moved more than it has in a month. By being entrenched in Ethereum, Genesis has done very nicely for itself as that currency has rocketed to number two, but it’s also had some rough patches as a series of forks (accidental and hard) have tossed it about.

A gold miner can sit on its stockpile and be fairly sure that commodity swings will only hurt it (or help it) so much, so it becomes easy to negotiate contracts and sell your product. But a crypto-miner could see what it owns swing wildly in 24 hours, while getting it transferred to cash can take some time.

On the upside: Any new currency that shows its head and goes on a charge will be grist for Genesis/HIVE’s mill. They’re turning cheap Icelandic energy into money in the closest thing to an arbitrage situation you could plan for.

Imagine if you could print Canadian dollars and only had to cover the cost of the printing – that’s what HIVE is up to right here. Now imagine if the Canadian dollar could lose 20% of it’s value in a day? Probably still worth the effort.

Changes in regulation could have a marked impact on the level of profitability, but won’t affect the fact that profits are being made, as long as there’s any love for cryptocurrencies from speculators, and that looks likely to be the case for a long time.

DMG Blockchain (AXN.H – to change soon): The picks and shovels play

DMG Blockchain (AXN.H – to change soon): The picks and shovels play

It’s called MAAS: Mining As A Service. DMG is establishing containers loaded with mining rigs in parts of the world with inexpensive power, and renting parts of those containers to folks who live in places where energy prices make mining prohibitive.

As an example, Japan has regulated Bitcoin as a currency and represents half of all global trading activity in the space. But energy costs in Japan are around $0.16 per kwh – at best. Post-tsunami and with nuclear reactor shutdowns, that’s shifted up to $0.35 per kWh at times, making coin mining a less profitable enterprise in the land of the rising sun. In Germany, which is also liking the crypto world, electricity hits $0.35 per kWh on the regular. In the Solomon Islands, it’s a buck, though if you live in the Solomon Islands and know what Bitcoin is, who’s watching the goat?

Canadian energy costs are low comparatively, with canuck energy prices going as low as $0.06 in Ontario, and $0.04 in Quebec, with government subsidies. There are other countries that are cheaper, but they’re not always places you’d want to set up shop (China has banned Bitcoin, and Brunei is #198 on my ‘places to do business’ list).

So DMG, while it has a little mining set-up for itself that’s delivering cashflow, has pushed into the ‘mining for the energy poor’ market, and that’s a considerable market. I’d love to have a little mining rack set up in the garage but, I don’t want to be sourcing GPU cards by the truckload and getting worried notes from BC Hydro asking why I’ve amassed ten grand in power bills this month.

I’d much rather sling a chunk of my change at DMG to deal with all that, and just slot my amassed crypto-coin into an account every month.

As of the last investor presentation I saw, DMG owned 300 servers and were queuing up 20,000 more over the coming year, in 40 self-contained mobile server units. If the global energy scene changes and they find a more agreeable place to drop them, those containers can be moved at a moment’s notice to take advantage of pricing shifts.

Where this deal differs from HIVE is, the aforementioned first mover is going to be very hooked into the volatility of what they mine and own. The upside will no doubt be higher, but so too will be the downside, if currencies wane. On the DMG side, their monthly income will be predictable and based on tenants signed, rather than whether Ethereum just took a fork or Dogecoin suddenly becomes the currency du jour.

A lot of blockchain deals are going to be team-dependent, because much like the rush from literal mining to weed in 2014, just having a notion to join in won’t be enough to sustain a public company in this space.

In the case of DMG, you’ve got some heavy hitters from BitFury, one of the world’s largest blockchain/crypto mining groups, and who raised $90 million recently. Sheldon Bennett is a director, and he led BitFury’s mining operations for the last three years after a few decades in the financial sector. Chairman Chris Filiatrault opened Japan to Bitcoin, launching the first Bitcoin ATM there in 2014. Board advisor Steven Eliscu was Head of Finance at BitFury.

There are other aspects of this company and HIVE that could bring in revenues and even a stronger focus going forward, like an exchange platform and blockchain technology products, but you’re not investing in the deal for those right now, it’s the team and the primary focus, and those are pretty nice.

Mining is for chumps – at least that’s the thinking behind a lot of folks in the blockchain space, who see definite opportunities in the currency arena but think the future of blockchain applications is going to be monumental and world-changing.

We’ve all heard the claims that every bank is going to change how they’ve done business for decades and line up new blockchain-based software – and they will. But those nascent companies that think they’re going to tie down Bank of America to a software deal with six hairy guys listening to industrial hardcore rock in a garage in Kazakhstan are dreaming.

The entrepreneur coders will show what’s possible, then the Forbes 100 crowd will set their armies of bespoke suited code monkeys to the task of creating their own proprietary systems.

The opportunity then becomes in supplying blockchain capabilities to the other 400 in the Forbes 500, or even the guys who haven’t been mentioned in Forbes ever.

The company says: “eXeBlock employs a team of blockchain programmers currently developing two innovative blockchain DAPPs. eXeBlock will release proof of concept and white papers outlining the operating parameters of the first DAPP by the end of the calendar year, and the second in the first half of next year. Specifics relating to the DAPP’s purpose, market potential and operating protocols will remain confidential until the white paper release date. Further, eXeBlock has plans to launch a minimum of two blockchain based DAPP each year.”

What are those DAPPs? Well, more info has been put out in their investor deck.

eXe50/50 is a white label solution for 50/50 draws, which will provide blockchain security and functionality to groups raising money through such methods. I know, being on the board of a local soccer organization, that we avoid 50/50 draws because you have to chase down every ticket, every dollar, from volunteers all over town, then you have to deal with regulatory requirements, and at the end of the day it’s all a bit too much of a drag.

But we want a way to fix that, and that’s what eXe is working on.

After that, and perhaps more importantly, the company is putting together something called Freedom Ledger, which will allow folks who don’t have cryptocurrency accounts to participate in those markets. The point of that is to allow folks who aren’t active participants in the crypto systems to engage with blockchain apps that utilize them, effectively mainstreaming such applications and earning a per transaction fee for eXe.

I can tell you these apps relate to industries nobody is talking about right now in relation to blockchain functionality, but that remain very large industries in their own right and that, once developed, eXeblock will be supplying without competition. And that’s the point here.

If you’re familiar with the weed space, I’d line this play up with Dixie Elixirs: They’re not looking to fuel the sector off the bat, they’re looking to own verticals off to the side that the first movers don’t care about initially but that become very important going forward.

It’s early days in this play: eXe is coming to the CSE and will do so with $3.5 million raised (scratch that – I’ve just been informed the money guys ended up shoving them over $6 million in that raise, almost double what they were looking for), according to company releases. If you’re after more info than that, you’re going to need to wait for a bit, but I can tell you the team is closer to the grindstone than most any other we’ve discussed. While HIVE has a team that is high level ownership based, and DMG has a team that has come out of the blockchain pioneer realm, eXeBlock is in the trenches.

And a smart allocation of investment in the blockchain space, for mine, covers all three levels of that space.

Leonovus (LTV.V): The hard to explain one

Leonovus (LTV.V): The hard to explain one

As we start to shift away from the obvious blockchain and crypto opportunities, we start to drive into those that require more explanation, and which begin to push more into the opportunities for blockchain in the deep corporate world.

The company says: “Blockchain-enhanced enterprise data storage flexibility with improved governance, ROI, ultra-security, with compliance reporting and monitoring.”

I know, right? I was confused too.

What it comes down to is one simple phrase: Military grade data storage.

Now I’ve got your interest.

The exponential growth of unstructured data coupled with rising data security threats is creating huge challenges for IT organizations. Leonovus and Storage Made Easy have met this challenge creating not only a secure but also a cost-effective scalable approach to storage.

Leonovus’ algorithms can identify existing idle or under-utilized storage assets, on-premise or in the cloud, like Microsoft OneDrive or Google Drive, and redistribute for use by the rest of the organization. End-user collaboration and governance support from Storage Made Easy with File Fabric provides cost-effective self-service file synchronization and sharing for organizations and service providers that scales to hundreds of thousands of users.

Paraphrasing: You’ve got a massive company with massive storage needs, but traditional storage and bandwidth for that storage goes in ebbs and flows. There are often big empty spots while the company is paying more and more for servers at places like Amazon to cover immediate surge needs. Leonovus is using the blockchain to spread things out, keep things handy, scale up and down as needed, prevent leakage, using multi-tier encryption, helping adhere to compliance needs, and lower costs by driving down storage needs by as much as 50%.

As an example, if a company is paying $2.80 per GB per month for storage, and lets say 32% of their data is high performance, ‘need access to it now’ storage as opposed to the rest being things that may be needed sometimes but not often (backups, project-related, archives), Leonovus says its system can save 64.6% on storage costs over on-premises, hybrid cloud, and public cloud options, which is a MASSIVE cost to big companies inside and out of the technology space.

How deep can they go? They can even use Google Drive accounts, smart light bulbs, or small sensors on-site to store data, using the chain.

Imagine Bob from Accounting has his 2014 financial projections stored in the light bulb in the men’s room while Phyllis’ from the Office Party Committee has the ‘Happy Birthday card’ .PSD file she uses twice a year stored on the temperature control switch in the break room. That’s madness, but that’s doable using the Leonovus system – today.

We’re getting deeper into the weeds now as to what this whole blockchain thing can do, and that’s where it starts to get really interesting.

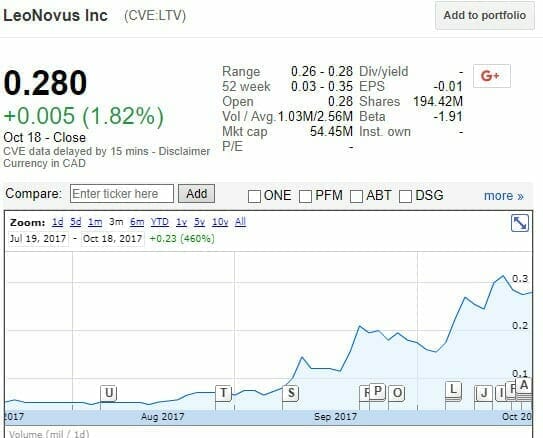

The market agrees:

Real business brings real returns, and investors are understanding this.

Blockchain Intelligence Group (ACM.C – to change soon): Supplier to the Feds

I’ve not heard a more conflicted response than the buzz after Blockchain Intelligence Group (currently Acana Corporation but halted as it transitions) ran a webinar presentation explaining what it does to an audience of potential investors. Folks wanted in, there’s no question about that, but folks also wondered if the business plan in the long term was viable.

I’ll explain.

In a nutshell, BIG wants to employ a system that will make crypto-transactions more secure, by giving a ‘rank’ to each participant in the system. Set up an anonymous account to sell your motorcycle to someone using bitcoin? Get a low trust rank. Submit your drivers license to prove you are who you say you are, and not a Belorussian teen hacker? Get a higher trust rank. Do a few transactions that go well? Your rank moves higher still.

The guts of it all is, the mainstream won’t accept crypto as a genuine currency option until you can be certain that the guy you’re buying a laptop from using bitcoin will A) actually deliver the laptop, and B) not be some sort of crusty gangster type who is selling child porn from the same account you just did business with.

Let’s be clear: Paypal doesn’t provide such security over your transactions currently, so the moment someone does, that’s going to be a big deal. A big, profitable deal.

Here’s the other side of that: If you’re using cryptocurrency currently, it’s pretty much because you don’t want anyone tracking your purchase.

And therein lies the gap between certainty and where we are. The phase III of BIG’s plan is to be able to sell access to the chain to law enforcement, so that they can actually identify and track unreliable players. And it should be said, according to the company, law enforcement is VERY down with that plan.

Like, they’re IN. Discussions are ongoing and high level and involve dollars. Government dollars. They want this.

The question remains, do users? Will I sign up for BIG’s BitRank knowing I could have my purchases flowing into the DEA’s server? Will I even be asked to sign up, or will the system tie into existing online machinery that I use, or will use going forward, and approve as part of a long terms of service agreement I won’t read as I attempt to sign up for something more innocuous?

“Free bitcoin transactions, you say? Why, that sounds positively ginchy! Of course I’ll sign up. Hey, what’s that knock on my door at 2AM? Mavis, delete the goat porn and hide the crack!”

The market hasn’t taken a swing at this one yet, but they did have to jack up a $2.5 million raise to $3.5 million to fit in the demand, and if they can figure out how to get user uptake, the US government – and others – will pay them a lot of money for access to the data. Stay tuned.

Global Blockchain Technologies (BLOC.V): The vertical integrator

The company says: “Global Blockchain is an investment company that provides investors access to a mixture of assets in the blockchain space, strategically chosen to balance stability and growth. Blue chip holdings such as Ethereum and Bitcoin are complemented by best-of-breed ‘smaller cap’ crypto holdings, many of which are not yet available to other investors.”

Any time there’s a big shift into a hot sector, you’re going to get the pioneers, the monetizers, the niche plays, and the vertical integrators, and BLOC.V has that last part of the equation down. It’s investing in ‘blue chip’ crypto (Bitcoin/Ethereum), small cap crypto (everything else), it’s engaging in pre-ICO and ICO financing, and it’s engaging in blockchain DAPP development.

All nice. But when you look at their investor deck, everything is short on detail.

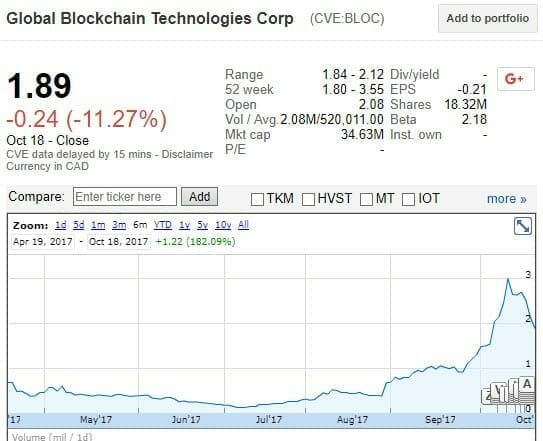

That includes news. You’ve got news of an Australian listing, a name change, a half million dollar raise, and some peeps appointed, then their sponsorship of a money summit. But where’s all those verticals being integrated? Where’s the business being done? For all the talk of buying cryptocurrency and incubating ICOs and blahdy blah, I can’t see any of it actually having happened yet, which makes a $30 million valuation entirely vapourware.

Not helping is ‘news’ like this, which reads like ESL – drop a period once in a while, bro:

“It should be clearly noted, that we strongly believe in the token funding model, this includes tokens that represent access to networks and services as well as those that represent completely new classes of financial instruments, which simply would not be possible without Blockchain technology. Both Utility and Securities tokens will give access to an exchange network with global reach with unprecedented liquidity, make no mistake that the token economies first decentralized disruption is as a funding network, but there is definitely a need for crowdsales that are based on well vetted proposals and teams with substantial claims. This will be the biggest value provided by Global Blockchain, will vet the best concepts from a technical and business perspective, whether investments are needed.”

If you want more information, that’s promised … soon.

“We are currently starting incubation of four ventures in the telecoms, energy, cannabis and entertainment industries that touch on all the above areas of innovation and we will be announcing them in the coming weeks.”

For a company with no announceable assets to be listed on the TSX-V, FSE, and the OTC already, and for it to have a $34 million valuation, and for that valuation to have been $54 million a week ago, and $10 million six weeks ago, and for the C-suite to be filled with guys who start their bios with the words “serial entrepreneur” and boast about how they’ve had six companies, makes me feel like this is much less a company than a play. And the big money has already begun to leave it.

BTL Group (BTL.V): The Pioneer

The company says: “BTL Group Ltd. (BTL) […] is a Canada-based technology company. The Company’s business focuses on developing blockchain technologies to disrupt and transform existing industries. The technology is developed in-house and through BTL’s incubator and accelerator programs, based in Vancouver, British Columbia. The Company’s technology platform is a remittance business called Xapcash which, combined with the Company’s cross border settlement technology (Interbit), is focused on leveraging blockchain technology to create cash-in cash-out settlement solutions from Canada and the United Kingdom to target countries. The Company offers SecurePlay, which is a platform that uses blockchain technology to allow for accountability and transparency in Fantasy Sports.”

Here’s what I like to see in a company engaging in a hot sector: That they’ve been there foor a while. BTL Group was the literal first mover, in that it was the first public blockchain company.

I also want to see an employee page that includes titles like UX Designer, and Integration Engineer, and Blockchain Developer, rather than Serial Entrepreneur.

And I want to see Youtube videos with folks talking about technology ideas in ways that so very nearly make sense to a layman but leave us wanting to learn more.

And I want to see lines like this on their website:

“We are actively building relationships with organizations who are strategically growing their blockchain technology practices and who have JavaScript developers with Node.js and Redux experience.”

God damn it, that’s the sound of real business being done. Not a marketing pitch or a public markets sell, but legit wheel turning and patents being filed.

The downside of BTL? It’s already got a $90 million market cap. If you’re one who likes to dig in the $5-10m range for companies that will bring multiples inside the month, this might not be your daisy.

Calyx Bio-Ventures (CYX.V): The unknown quantity

Calyx Bio-Ventures (CYX.V): The unknown quantity

Getting a handle on what Calyx is up to is not as easy as it is in other deals, for several reasons.

First, the company has had a few iterations, and while its current state isn’t a full pivot from where it came from, it’s definitely still forming what it wants to be in the world.

Second, the CEO isn’t one to talk up his moves in public, which has left interested parties to piece things together as best they can.

While Global Blockchain will tell you how great it’s going to be at being cutting edge everything, a Calyx news release will more likely be an education about what a crypto fork is, and how they’re developing tech that will prevent it, rather than who’s buying that tech and for what.

Calyx earns a gold star by being the smallest market cap player in the space, which means if they do get their game together, an investment will pay off in bonkers fashion, but we’re still waiting to see what the tech they’ve legitimately been building out and spending money on and expanding their team for (and they have) will do.

We know there’s a messaging platform that extends to B2B commerce and industry-wide communications and that they’re applying blockchain to that and that previously there’s been focus on the weed world, and they’ve also had seed-to-sale software in that space, and commercial real estate management systems and… man, if all of that ties back into the one platform, there might actually be something there.

But there’s risk inherent in investing in promise. Weigh that against the potential return of a company that’s gone from $0.05 to $0.10 in a week, and has just a $6 million market cap, and just announced a $1 million raise at $0.07, and maybe ‘hold and hope’ works for you as a strategy.

There are others in the blockchain world who are not on this list, and there will be more almost daily as blockchain companies on the list hit multiples of value on the fumes of actual business. If a company isn’t here, it’s because they need to do a better job telling their story.

To me, specifically. Let ’em know.

— Chris Parry

FULL DISCLOSURE: eXeBlock, Leonovus, and DMG Blockchain are Equity.Guru marketing clients. The author owns stock in HIVE Blockchain. Calyx has been in talks to become a client. Do your own due diligence, especially in a hot sector rife with new companies.

NB: Pursuant to a resolution passed by the directors dated Nov. 27, 2017, Calyx Bio-Ventures Inc. changed its name to Calyx Ventures Inc. effective as at Feb. 5, 2018. The ticker symbol CYX is unchanged.