For mine, the biggest marijuana industry success in the public markets of last year isn’t actually public yet.

It raised millions of dollars from Average Joe investors, its ticker symbol was on everyone’s lips, and when it had its big pre-listing financing, it sucked in so many small retail investor dollars that the rest of the industry struggled for months to keep their stocks liquid.

It has a grow license, and grow product it does. It recently received a sales license and reported a flood of contact from other growers looking to supplement their supply. It’s expanding as fast as, and to a size comparable with, the Big Three.

It grows organic product, one of a handful to make the claim, and the only one to do so without needing you to forget their previous product recalls.

The ticker is so well know in the marketplace that the front page of their investor flyer simply says, in huge block letters:

Sure, Canopy Growth Corporation took their company to more than a billion dollar market cap. And, yeah, Aphria bought a piece of a lot of vertically-integrated operations. And okay, Aurora was the first company to grow their facility to over a million square feet.

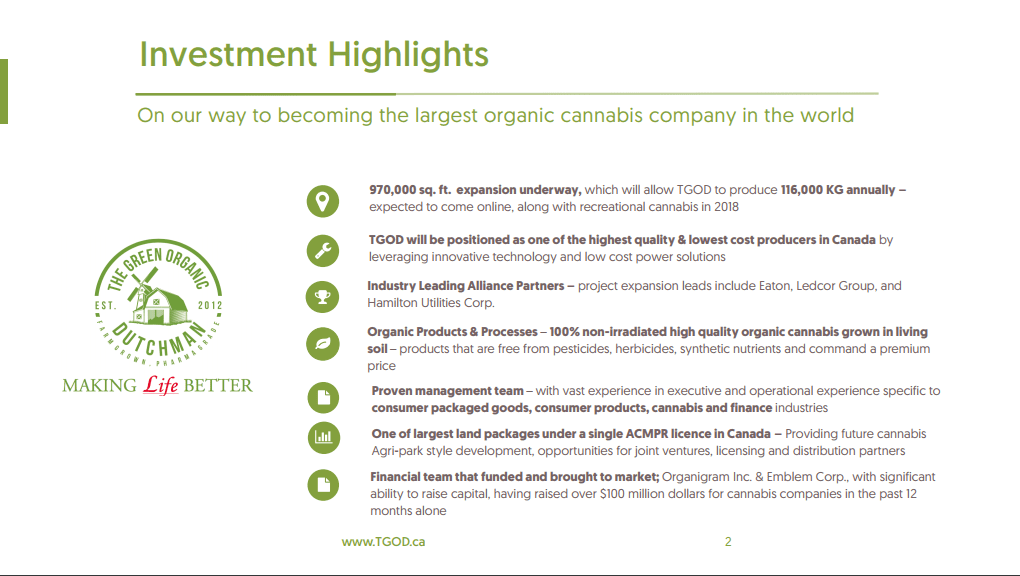

Meanwhile, TGOD looms over them all, with a capital markets team that has already helped launch major players in Organigram (OGI.V) and Emblem (EMC.V), building a combined value of the three companies in excess of $600 million.

Their agreements and purchases bring with them major multinational partnerships with companies that specialize in power management, engineering and construction, and greenhouse design.

Their expansion program, now well underway, mirrors that of Aurora’s giant facility in terms of tech, size, layout, and even the architectural and financial team behind it.

Their investor base – before they’ve even listed – is 2400 people strong, a size that is usually the stuff of banks and airlines.

TGOD hasn’t even sat down just yet, but they’re already bossing the table.

Speaking of tables, I just sat down with their team in the temporary TGOD war room at PI Financial in Vancouver, and it was shocking how many people are in and out of the place every few minutes. Things are moving quickly at TGOD. Sandwiches don’t last long. Juice bottles come here to die. The structural integrity of whiteboards are constantly tested. Anyone looking for a moment to check their Twitter feed or call the good wife better tell their story walking because the boss has more for you to do.

TGOD honcho Rob Anderson is firmly in control and has eyes on everything going in and out, as you’d expect from a multi-decade markets guy who sees this as his legacy. IR ninja Danny Brody does not let his fingers leave the keyboard for longer than it takes to shovel sustenance into his mouth, or jam a cellphone into his ear.

The guys running the book? They’re not in the room because they’re churning through sub documents relating to their next financing in Toronto. Execs report in from the east coast, from the US, from Europe, from the grow, from the construction site, via email, phone and text, in a fashion that makes it hard for me to get questions in, but don’t for a second imagine this scene is one of chaos. It’s part of a plan, and a plan that, frankly, I can only tell you part of because I signed an NDA and, to quote Anderson, “We’re not going to give the competition any ideas.”

To that end, what I’m going to talk to you about today will not be the whole entire TGOD plan. In fact, it may only amount to Phase I of five. But it’ll be enough for you, because their Phase I is a barnstormer and launches them out of a cannon right into the middle of the biggest players in the space.

What follows Phase I, in the next several years ahead, will be cherries on top. For now, this is TGOD.

- LOCATION, LOCATION, LOCATION

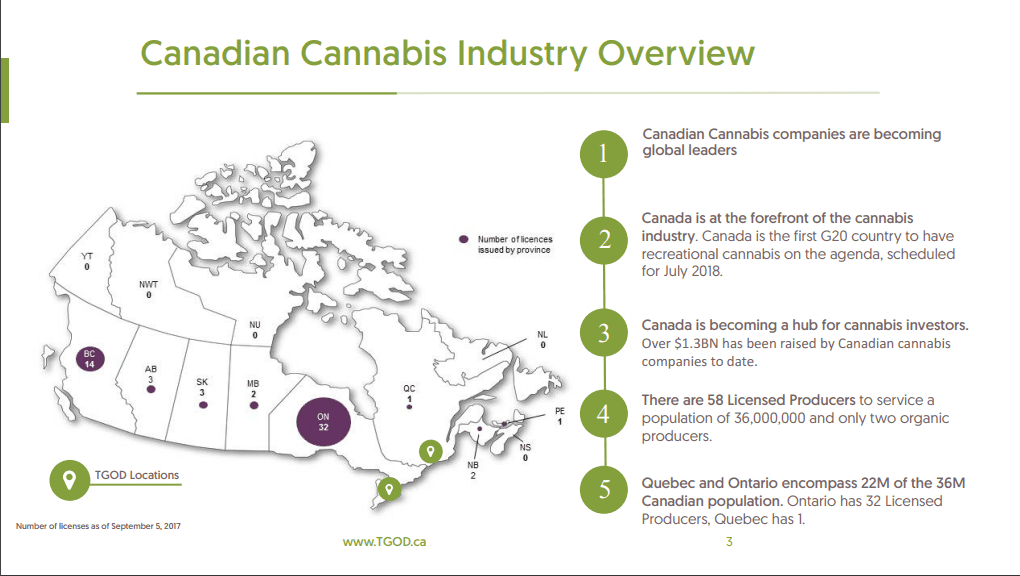

If you look at a map of Canadian licensed producers, and how many are located in each province, you’ll see a legion of LPs in Ontario, a handful in BC, and a big gaping maw hanging over Quebec. With the exception of Hydropothecary, which has managed to botch several harvests so far in the wake of a product recall, Quebec is severely underrepresented in terms of local growers and product.

Which is bizarre when you consider Quebec has the cheapest power costs in Canada, and energy costs are the number one production outlay for marijuana growers everywhere.

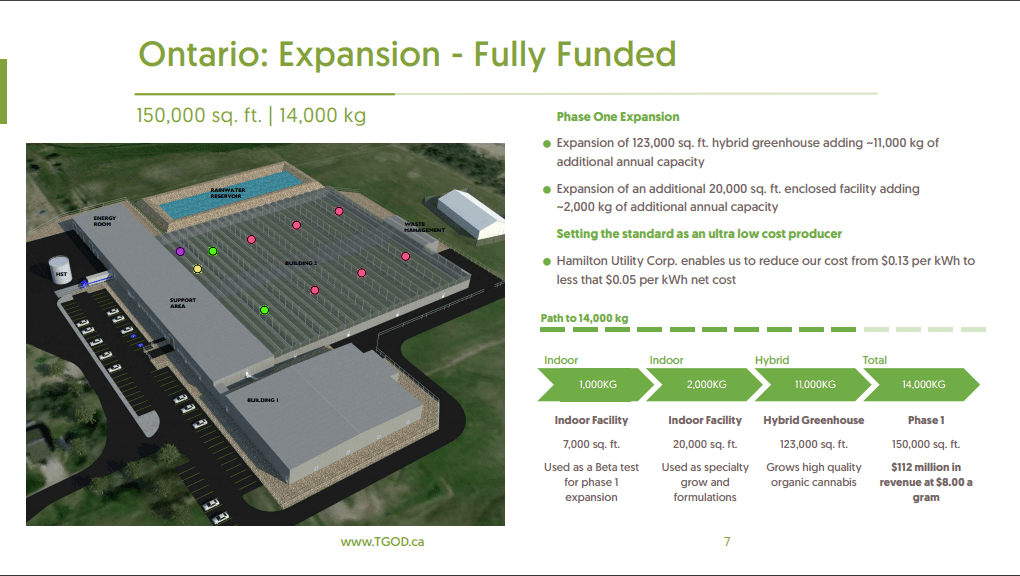

TGOD has a facility in Ontario already, which they are expanding quickly to 123k sq ft, with money they raised earlier this year, and which will most assuredly prove prescient considering the size of the ONT market, not to mention that, from next year, they’ll only need to sell to one client (the LCBO) to provide product to that entire province.

If nothing else was going on, if that was all they had, that 123k sq ft with a grow license in Ontario, you’d be looking at a $200 million market cap. We know this because Emerald Health, with a grow half that size, sits on a $120 million cap currently.

But there’s more to TGOD, and that ‘more’ is massive, and plays right into both that Quebec shortage and a very fair opening value when they hit the public markets in the next several months.

What they’re funding currently is an expansion to their new Quebec-based property, which will blow out to 220k sq ft in phase I, another 250k sq. ft at IPO, and they’ll tack another 350k sq ft in H1 2018, bringing it to Aurora size.

To be clear, Supreme Pharma’s entire facility is 360k sq ft, and their market cap is $230 million currently. TGOD is building, or planning to build, three Supremes, or a rough value in today’s market terms of about $600 million.

In terms of comparables, Aurora’s market cap is just shy of a billion dollars.

But there’s more.

- THEY’VE GOT THE POWER

Supreme based their facility at the backdoor of an energy plant, because power costs are the largest part of marijuana growing costs. It’s why Aurora, in energy-friendly Alberta, can get away with putting a weed greenhouse in mostly frozen Edmonton. And it’s why so many others, with their retrofitted chocolate factories and idyllic Vancouver Island locales and industrial parks in provinces that are ice-bound for half the year, have such trouble keeping their costs down.

If the marijuana business had a reset button, you can guarantee most LP CEOs would mash the crap out of that button and build their facilities afresh as close to a nuclear plant or hydro dam as they could get away with. They’d festoon them with wind-turbines and solar panels and place them in deserts, rather than tundras because those monthly power bills hit you right in the corporate cajones.

But TGOD wouldn’t have to bother with that reset button, because they’ve built energy in to their deals in ways most advanced.

By partnering up with Eaton, the world’s second largest power management company, they’ve convinced Hamilton Utility Corporation to agree to an alliance partnership that will establish a micro-grid on site, and a 6MW combined heat and power co-generation facility.

What does this mean?

It means they’re getting their power down from $0.13 per kWh, to $0.05 (or less).

It also means the carbon emitted from that micro-grid and power generation facility will be scrubbed and sent into the greenhouse to literally feed the plants, helping HUC keep their emissions and costs low, and keeping TGOD’s own costs low into the bargain.

In addition, by allotting themselves 6MW of power use, they’re in a position where future power needs are well sorted, while others are competing with each other for the slim energy pickings left over, and being hit by seasonal variations in availability and price.

This is genius. It’s the best possible win/win, when both partners profit and competitors LOSE money in the deal.

But while that Ontario power deal is a big win, it still leaves that massive grow in Quebec to power up. What’s the plan there?

No plan needed.

With government incentives already in existence, Quebec power costs can be as little as $0.04 per kWh, which beats even that amazing Ontario deal, let alone any grower in California or Washington State or Nova Scotia.

In addition, the province of Quebec has lavished infrastructure on the area of TGOD’s grow, bringing highways, sewage, unlimited raw water, gas lines, and as much as 50 MW of power, should it be needed, from a sub-station less than 1km away.

- THE NEW METRIC: COST TO GROW

For the last several years, the majority of marijuana investors have had two metrics in sight when they made their capital outlay decisions: square footage, and patient numbers.

With the announcement of upcoming changes to how cannabis will be distributed in Ontario, and most of the other provinces across Canada in all likelihood, cannabis growers and investors are going to have only one real metric to keep an eye on: Grow cost per gram.

That’s really going to be all there is. Patient numbers just became irrelevant because, as of next year, there’ll only be one customer to sell to in each province, and that’ll be the government.

All that money spent by the big guys on patient acquisition over the last few years?

THAT’S GONE.

And the LCBO, which will run the program for Ontario, has made it clear that organization will be looking to keep prices low in order to discourage the black market. Any grower that can’t get their grow costs down to a dollar per gram (or less) will be hard pressed to survive.

Aphria says they can hit that mark, though they don’t currently. Organigram will struggle because organics and recalls and lawsuits affect the bottom line. Canopy is buying up capacity as quickly as it can in the hope it can streamline operations and remain competitive on quantity. Maricann just announced it had losses when a storm that cost some $100m in insured damage blew sand in through the window and they had to torch everything, so they’re working from scratch. Supreme has geared itself to be a low cost producer from day one and has a similarly decent deal on their power needs but really wants to focus on supplying others who can’t make their nut rather than the general public, and Aurora went as big as it could early so they could counter any margin problems with quantity, which is a good thing because their extensive patient base may not account for much in the months ahead.

In contrast, TGOD plans to have that same large quantity grow as Aurora WITH one of the lowest cost grow operations in the country, with a large part of that grow operation slated for organic product.

And remember: This is just part one of their plan.

- THE DYSTOPIAN APOCALPYPTIC FUTURE OF WEED GROWING

TGOD is not the slightest bit worried about selling flower to people through the mail. They’ll do it, and extract oils, because why leave money on the table, but it’s not their raison d’être.

They’re scopelocked on the corporate market; the B2B opportunities that nobody really talks about right now because, though we know CBD will be in just about every grocery SKU one day, the idea is far too ethereal for most, and the reality is that no industrial weed supply contract can be done with a pharma company or a drink giant until someone can figure out how to make their end product consistent.

I’m not talking ‘within the scope of reason’ consistent, I’m talking legitimately, down to the hundredth of a percentage point, across tonnes of end product, consistent. TGOD has a guy in the room today who is actively looking to advance that side of the business, and that’s where we start getting into the Secret Squirrel end of the equation.

Let’s put it this way: I’ve no intention of smoking cannabis medicine on the regular, ever. Just not going to happen. So I’m not a customer of Canopy or Aphria or Supreme, and will be unlikely to be any time soon.

And I’m not walking into a dispensary because, well, I don’t want my name on a customer list that will end up seized by the feds, and though I can certainly get my head around the idea of edibles or cannapills or even oils., I don’t trust any of the products on shelves in an illegal dispensary, created from grows run by who knows who, formulated on a Coleman barbecue in someone’s garage, and with variations in dosage that can’t be predicted.

So, while more people may be in at the edibles point than the smoker point, most of us are still out. Non-customers. Never darkening the door of an LCBO or otherwise.

So how does the weed business ever get my dollars? How does it transition from the 15% of the population that will smoke to the 100% of the population that will drink milk supplemented with CBD?

By not being the weed business anymore.

We all need, and should take, vitamin D supplements if we live in Canada. That’s a medical given. And when we buy those, we buy them in pill or gel cap form, from companies that have heavily researched and had their products approved by the feds and invested a ton of time and money building their brands and getting them into drug stores.

But what does a Vitamin D cap contain?

A substance called colecalciferol, which is produced by the ultraviolet irradiation of a dehydrocholesterol extracted from the lanolin found in sheep’s wool.

I’m going to guess that, despite vitamin D being a huge industry, you’re not investing in the sheep business to take advantage of it.

And I’m going to guess that, despite needing that vitamin D, you’re not making your own colecalciferol at home, or extracting your own dehycholesterol. At least I hope you’re not, because it’s also used in rat poison. And I’m going to guess you don’t buy your vitmain D from a guy on Craigslist, or in a store that sells home made pills.

But you might invest in the nutritional supplements business, which is where the money is made in vitamin D.

Ditto in weed, in the years to come.

The potential market for people who want to get shittered on a Saturday is big, but incredibly small compared to the market for people who’d like to get a little CBD in their sandwiches, or in their milk, or in a soda or juice or pasta sauce or coffee or in a multivitamin.

That’s where this market will make its billions, not at the LCBO, not in a dispensary, and not at Canopy’s online store selling Purple Pineapple Kush one gram at a time.

TGOD is built from the ground up to take advantage of that distant phase of the marijuana game, when we don’t even give a shit about smokers anymore and deals are done between Coca-Cola and Loblaws and Pfizer and growers, for a product that is less about giving you a nice body high and more about ensuring the first shipping container of product is exactly the same, genetically and otherwise, as every other shipping container of product.

Those deals will multiply the current market caps by a double digit factor. They’ll be international in scope and will create giants in the business that we’ve not even heard of yet.

Which begs the question: Why does TGOD want to be a weed farmer at all?

Simple answer: They want to secure the best source material for those deals, and growing their own allows them to be consistent.

TGOD isn’t an agri play. It’s not a weed play. It’s a biotech play.

From where they’ve put their growing facilities, down to the first deals done to fuel them, TGOD has established itself as an industrial cannabis products play that will be tough to beat on cost, tough to beat on their ability to bring in the biggest of partners (their construction partners are Ledcor – you may have heard of them since they’ve built half the infrastructure in Canada), tough to beat on shareholder base, and with a capital structure that is heavy on insider ownership as well as retail support.

And we haven’t even gone into the boardroom lineup yet, but three of the people in that room merit a spotlight beyond the attention usually given to the CEO.

The CFO: Amy Stephenson, former CFO for Aurora during their massive growth phase.

The President: Csaba Reider, with over three decades spent as an executive in the Consumer Packaged Goods business, including soda giant Cotts, century-old juice giant Sunpac Foods, and the guy who started UFC-branded energy drink, Xyience.

The VP of Growing Operations: Dave Perron, formerly of organic grower Whistler and consultant to many others.

Throw in the aforementioned Rob Anderson, a legend in the Canadian public markets, with over $100,000,000 raised in just the last 12 months, and you’ve got a serious operation.

The management team holds 17.6% of the float, with a longer than usual six-month hold from the first day of trading, so nobody is burning early paper, and with a new $20 million financing now taking place at $1.65 per share, the company will have an all-in value of $280 million, by my reckoning.

Aurora: 1000k sq ft of grow – $900m

Supreme: 360k sq ft of grow – $230m

Emerald: 50k sq ft of grow – $120m

TGOD: 1000k sq ft of grow – $280m (pre-market)

I can’t even.

NOW FOR THE KICKER:

You know how, normally, the wealthy inside guys get all the sweet deals and warrants and options, and make their money before you guys ever get to jump in?

You’re going to love this. This financing taking place right now is not your usual financing.

Last time TGOD raised money, they went out to the retail investors and offered something very unusual; a full warrant for every share you bought.

Usually you’ll get a half warrant for each share you buy, which is nice if the stock goes up after IPO, because a warrant is an agreement that you can buy more shares for a set price. Instant profit!

TGOD went full warrant because they wanted investors to sit on their stock for six months from IPO, rather than the usual four months.

To quote Anderson on the reason why, “I want to bring you a return on your money, and four months isn’t enough time to get everything happening properly. We’re building a company, so we all agreed to the same deal. Give me the time I need to grow it and I’ll give you every reason to hold it.”

Retail investors responded exceptionally well to that call; TGOD comes to IPO with 2400 shareholders in tow. But for the next financing round, which is likely to bring even more small stakeholders, they’re going to shake things up again.

If you buy into this current financing, you’ll get a half warrant, but it’ll be free trading on day one of the IPO.

This final pre-IPO non-brokered private placement is priced at $1.65 per unit. The shares will have a six month hold period from the day of the IPO and the warrants will be listed for trade, and have a $3 exercise price – for three years.

Technical420 covered this well, so I’ll let them take it from here:

In theory, this means that if the stock trades at $4.50, the warrant should trade at $1.50 ($4.50 – $3 = $1.50). And that is if you do not add any time value to the price. In this kind of scenario, an investor could pay $1.65 per unit and get back the equivalent of $0.75 per share [on the warrant] giving us a purchase price of $0.90 per unit.

Anderson is really clear as to why he’s running his financing in this way.

“What I am doing is creating a large breadth of shareholders, as each individual involved in the financing is going to be four things to the company; a shareholder, a potential medical patient, a potential recreational customer, and a TGOD brand ambassador.”

Anderson says, by allowing the retail shareholders the opportunity to participate in the pre-public ‘seed rounds’, they become part of TGOD’s business plan and will bring value to the company beyond just their investment dollars.

“These individual investors are the cornerstone of our company as it is those people that will finance the business plan, both in the early stages and later on, as consumers.” he says. “We have to treat our shareholders exceptionally well, as this is their company, and their value to the enterprise is immeasurable.”

Nobody else is doing this. Nobody is establishing a backroom team dedicated to processing small placements by hand instead of just going to a handful of big fish and institutional investors. Nobody has gone to the effort to bringing you, the average Equity.Guru reader, a chance to play in a bigger game.

We will be taking part, like we did last time. Tradeable warrants on opening day are a really nice incentive, but what it all comes down to in the end is, this is the kind of weed play I would build if I could build a weed play.

— Chris Parry

To see the TGOD investor deck, click here.

FULL DISCLOSURE: TGOD is an Equity.Guru marketing client, and the author invested in the last financing. The above is not a solicitation to buy or sell any stock and is for informational purposes only. Do your own due diligence and talk to a qualified investment advisor before making any investment decision.

Hi Chris, TGOD is behind schedule with accepting all the private placements from us small timers giving more time to get in. Just thought I’d check that you are still gung ho on them before I jump in. Please let me know if you have a moment.

Really appreciate all your posts, interesting times ahead

So how do you buy TGOD if it isn’t trading now, do i call the company and what is the smallest amount you can invest to start out with.”THANKS”.

What has happened to this wonderful company?????