I remember the first time BlueOcean NutraSciences (BOC.V) came to my boardroom. They were amped over something that, they were certain, was going to turn the nutritional oil world on its ear.

Shrimp oil.

Yep. Oil from shrimp.

Not for running your car or heating your lantern or greasing your engine; this oil would be for your guts, and would come from the crushing of shrimp shells, a source that comes almost literally free, being as its the trash left over when fishery processors shell their catch.

Fish oil is mondo healthy for you and has plenty of omega lovelies, which your body loves. But it comes with a burp that tastes like the underside of a dock.

Krill oil doesn’t hit you with the big fishy burps, but it takes a lot of krill to make the oil and that’s not exactly sustainable. The oceans have a hard enough time staying alive as is, without plundering them for what is, basically, tonnes of fish food.

But shrimp oil? It’s easier to swallow, it’s easy for the body to absorb, it supports brain and heart health, it’s sustainable (since the shells are going to be tossed out if they’re not used in this way), it’s flush with Omega-3’s, and has 10x more antioxidant power than our krill brothers.

Okay, great, so shrimp oil is amazing. So why isn’t BlueOcean at $10 per share?

Here’s the catch: You’ve gotta squeeze a lot more shrimp shells to get a good dose of oil than you do krill. And though the end product is way better for you, if there’s no cost saving, and it’s more work, the business-to-business model the company was forged on just isn’t doable.

But consumers? They’ll pay extra for a superior product. In fact, if you move away from bulk sales and into retail nutritional product sales, there’s enough margin in there to make a good living.

So BlueOcean pivoted, and the market walked away, because developing a product – or several SKUs of products – for retail shelves is a longer process. A process that requires patience. And contacts. And testing. And brand-building.

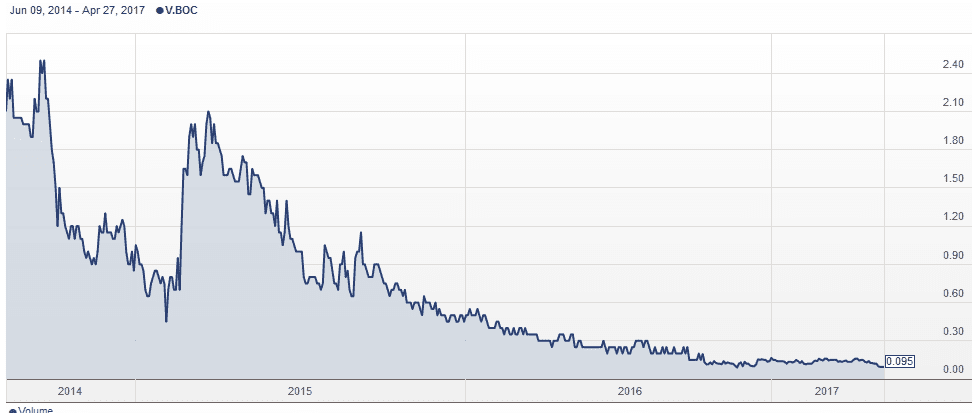

You don’t want to be invested in a company going through that two-year process. It’s a soul-destroying, faith-testing ordeal that sees stock price inevitably shrink to single digits. Or less.

And so it was with BlueOcean.

Today, the share price sits at $0.085, and that’s after a 10:1 rollback late last year. In essence, if you buy BlueOcean today, you get it for less than a cent in last year’s metrics.

But would you want to?

Let’s dig deeper. Here’s what MegaRed, the top selling krill oil product, looks like:

Meh.

Here’s what BlueOcean threw out there in competition:

Meh. It’s like if someone made a nutritional supplement bottle label using Microsoft Word art from 1998.

So they went back to the drawing board, specifically recruiting people who’ve done this before.

In as the CEO came Dr., Marvin Heuer, a medical doctor who owns a company that handles clinical trials for FDA applicants.

From his official bio:

[Dr Heuer is] an internationally accomplished medical research physician and executive with more than 30 years’ experience in international and domestic clinical research, pharmaceutical and nutraceutical development. Along with the practice of medicine for over 40 years, Dr. Heuer has served as Chief Science Officer for Iovate Health Sciences International.

Heard of Iovate?

You should have. They own Hydroxycut, which is in the top five highest selling weight loss brands in North America.

Where does it fit in that top five?

Oh, only number one. It’s the single best selling weight loss supplement, period.

So BlueOcean comes along and Dr Heuer is tempted enough by the science to leave Iovate, which was just bought by a Chinese firm for $730 million, and take on (pun fully intended) the minnow of the sector.

Then he pulls in directors from Iovate to join his board, including Vincent Scalisi, who was Iovate’s Chief Marketing Officer.

Then he goes to the guy who did Hydroxycut’s branding and says, “Do me a solid.”

Solid done.

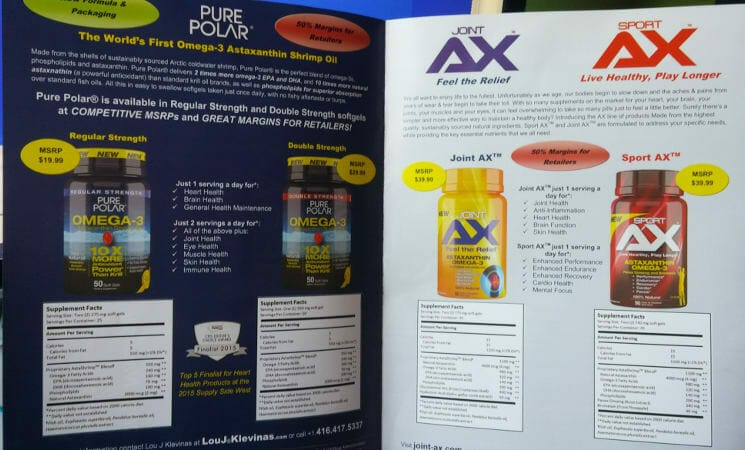

This is what BlueOcean is going around to potential resellers with right now. Pricewise, their product competes with consumer krill products, but nutritionwise, they’re coming in hot.

The top Astaxanthin product (the stuff that we’re really talking about, where all the health is) out there in terms of sales right now, MegaRed, has 0.2mg of the good stuff per capsule.

“We’ve got 2mg,” says Dil Vashi, VP of Business Operations. “We blow MegaRed out of the water.”

What’s next? A big push to stores and nutrition chains that have made millions from Iovate products, and who know Heuer well. Eyes are also on the company from out east, where three of the biggest shrimp companies in the Maritimes would love to be supplying BlueOcean with their refuse.

“We get the shells for about 20c per lb,” says Vashi. “Basically, they give us the shell for free, and we cover the cost of shipping and handling.”

“The margins are good,” he continues. Though we send the product to Thailand currently to be processed, which cuts into that margin, a $2m to $3m plant could be built locally in about three months that would shred costs, make the product even more sustainable and environmentally friendly, and as we scale up production, the margin really gets healthy.”

At a small batch, half of the product costs currently come in the way of the labels and bottles. That number falls off a cliff as orders build.

So why isn’t someone bigger already doing the shrimp oil thing? That’s the punchline.

“Nobody is allowed to,” says Vashi. “We licensed the patent to do this, and we’re protected for the next 8 years.”

That’s one hell of a head start.

Of course, it’s going to cost money to make money, and BlueOcean isn’t exactly flush with cash. There’s maybe $600k of value in their existing inventory, their costs have been shaved to the point where they’re negligible, and their market cap, frankly, is laughably small.

BlueOcean is not the healthy all-singing, all-dancing stud of the market you might be looking for. But it’s interesting, if only because, on paper, this is a bad ass concept with bad ass people who have left bad ass jobs to be with this, let’s be honest, thus-far-failure of a firm.

These are not plodders. They’re not in it for the love. They’re genuine all-stars of the pharma game doing something they’ve done to great success before, several times.

Will BlueOcean eventually be Hydroxycut? Will it be MegaRed?

That’s all guesswork. But if those goals were ever going to be attainable, you’d need to have heavy hitters like the ones BlueOcean attracted to make it happen.

For mine, don’t buy BOC.V stock today. Sure, it’s cheap, but it’ll still be cheap after the first piece of good news emerges from them, because nobody cares just yet. Watchlist it. Pay attention. Get your Google alerts set and wait for that news that a Whole Foods or GNC has ordered a batch, or that another Iovate exec has switched sides, or that another harbour has been turned red by the dumping of a thousand tons of shrimp shells back into the water causing an outcry over why we can’t find something useful to do with all that shrimp waste…

They didn’t roll this thing back for looks. It went 10:1 because something’s afoot.

Book it.

Oh, one last thing: Around the time the company rolled its stock back, it put out news that it was looking to develop a product called Sea-BD. Think about it…

— Chris Parry

FULL DISCLOSURE: Equity.Guru has no commercial arrangement with BlueOcean Nutrasciences.

If you are going to focus on Astaxanthin as the featured ingredient of a dietary supplement, you should really be comparing Pure Polar to the microalgae products. MegaRed’s focus is on Omega 3s more so than Astaxanthin.