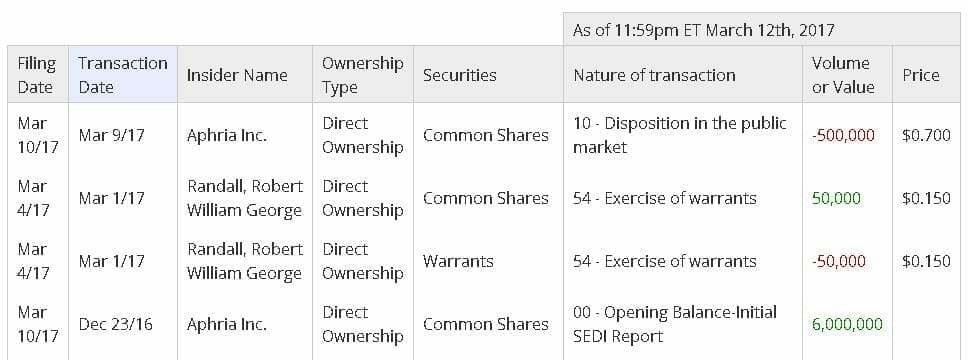

Much discussion was had over the weekend on various social media platforms as news dropped that Aphria had sold a chunk of their investment in weed referral clinic/data pile Canabo Medical (CMM.V) last week.

The news was odd, being as Aphria had bought in at almost double the current share price and are certainly not in need of $350,000 in pocket change right now. Added to that, Canabo stock had been running up nicely in recent weeks, touching $0.90 before the move dropped the price back to $0.70.

Was Aphria shorting the company? Was it lowering it’s percentage stake in Canabo for some strategic reason? Was this a ‘fat finger’ error?

ADDED INTRIGUE!

I’m told the stock Aphria sold was actually restricted, and the sale shouldn’t have been permitted, which would mean, if true, that Aphria will need to buy it back on the open market. This has led some to take a bet on the stock today, which had seen it climb 7.1% in early trading.

The stock above shouldn’t be traded until late April. So what gives?

Canabo isn’t commenting, but that’s understandable. My guess is we’ll see clarification soon. Have confirmed with the company that the shares in question are definitely restricted.

Also, there’s going to be plenty of news in the next few weeks, including several new clinics opening. The company will release their first public research report on April 7 at a large Toronto medical conference, relaying their primary findings on reduction in benzodiazepine use with weed treatment. I’m told that paper will also be published in medical journals on the same day, all of which is great news.

LAGUNA BLENDS HALTED ON ACQUISITION NEWS

Long time Equity.Guru topic of conversation Laguna Blends (LAG.C) also came out of the gates Monday morning with intrigue, as they released news of an impending transaction but were extremely light on details.

Laguna Blends Inc. is pleased to announce that it has signed a letter of Intent (LOI) to acquire 100% interest of a global Cannabis leader with unaudited annualized sales of $12,000,000 USD and adjusted EBITDA of $1,588,000 USD.

This acquisition is a major step forward in establishing Laguna as an international leader in the global cannabis industry. The Target company has an extensive portfolio of intellectual property and hemp driven CBD products including isolates, full spectrum oils, pain creams, oral sprays and other nutraceutical products. The Target company also has a medical division and is currently focusing on Latin America to develop cannabis-based pharmaceutical products.

Here’s what we know: The target company is in the weed space, has a presence in California and Colorado, has a deal in cannabis drinks and unaudited revenue of $12m.

Much chatter online about who it might be, with names like Kushtown and Naturally Splendid kicked around.

I know it’s not NSP, because they’re not really a weed company and the numbers don’t stack – and NSP’s financials are audited. Kushtown is a possibility, with Finore Mining (FIN.V) having been trade halted for a long while now as their Change of Business process drags on.

But the more likely target is Isodiol, a US company that produces several existing Laguna products, including CBD water, Vitadots gummy chews, and Henneplex shots.

Which would be fine for LAG fans, as it moves things along and secures product supply, but it’s not the exciting gamechanger alluded to in the now pulled back news release.

Either way, the stock is up 15%.

— Chris Parry

FULL DISCLOSURE: Canabo Medical is an Equity.Guru marketing client and the author has purchased stock in the company on the open market.

Nobody can read Aphira’s mind, but there’s a few things that I think are relevant here.

1. A stop-loss at a 40% decline is a disciplined strategy, and an easy one to defend when:

2. You’re a publicly traded company who has to answer quarterly for their positions.

Furthermore, the 6M share position that they had has only been reduced to 5.5M, possibly because

3. Unloading the whole position would have sunk Canabo like a rock.

When a shareholder starts to pepper out at a loss, it doesn’t necessarily mean they’re no longer true believers. It could be that they weren’t sure about their timing the first time around and want to lighten the load while they re-assess.

The share were restricted to trade on public market by an hold period, not to trade on TSX Private Market!

Wrong, CMM was down with sector, the block trade was made in afternoon @ 14:31 when price had settled to 0.7 and anyway it was an intentional cross trade via TSX-PM not interfering with market?