A few days ago, I noted Canopy Growth Corp (CGC.T), formerly Tweed and Canada’s first big board cannabis company, had become the first Canadian billion-dollar weed company.

Today it’s the first $1.2 billion weed company. This, clearly, is madness.

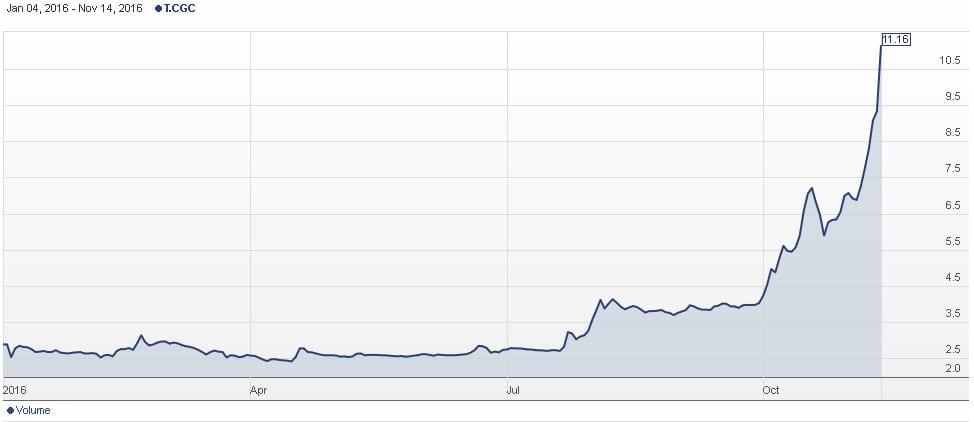

The stock closed Monday at $11.16. It opened today at $12.34. It closed today at $13.45. This, clearly, is madness.

And here’s why:

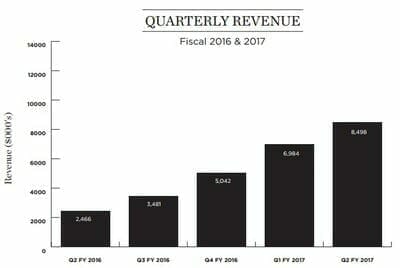

Tweed put out its quarterly numbers today, and showed nice progress. For a $50m company.

$8.5 million in revenues for Q2 2017 is fine, especially as it’s up 245% over the equivalent quarter last year. Net income was $5.4 million compared to $3.9 million in Q2 of 2015. All good.

But here’s the share price.

Holy Jesus, that’s madness.

That’s not to say Canopy isn’t killing it. Their quarterly highlights include a metric ton of weed sold, patient numbers are up to 24,000, they’ve expanded to Germany, opened a breeding facility, partnering with topical product formulators, and they raised $35 million in cash financing. They also acquired a licensed producer in Vert Medical of Quebec, which is a nice push into the French speaking market, they’ve upped their production license and, as we all know, some day soon Canada’s government is going to legalize recreational weed.

Some day.

To be sure, every weed company is having its moment of excessive exuberance. Companies that had $3 million market caps last month have $30 million caps today. Nobody is looking at profits, they’re all looking at potential. And that’s the formula for a good old fashioned dotcom-styled bubble.

CGC may continue to rise. As long as people believe other people will buy in behind them, CGC will have more inflation room, and there’s no indication that anyone is done with the weed bubble yet.

But when it comes back, boy howdy, is there a lot of room to run, based on those revenue figures. I mean, if the shorters storm the bastille, that’s some Bre-X-styled drop in the making.

Others are similarly flying. Aphria (ATH.V) jumped today by 20%, putting over a buck on it’s formerly $5.22 share price and rolling in with a $470 million cap. Mettrum (MT.V) is up 14.2%, sits at a $235 million valuation. Aurora is up 22.3% today, though it took longer than most to hit its acceleration point and remains a ‘reasonable’ $291 million in worth.

The value play appears to be Supreme Pharmaceuticals (SL.C), which raised $50 million in a bought deal, the largest ever, and $10 million more than previously planned. That stock went up 25%, but was largely flat through til today while others were going parabolic. At $154 million and with the biggest grow space around, it’s a veritable bargain.

Where’s that money coming from? The little guys.

Golden Leaf Holdings (GLH.C) got crushed on the day, and has shed about half its share price in a few weeks, without any fundamental business issues to explain it. Finore Mining/Kushtown USA took a 17% haircut, Tinley Beverage (TNY.C) slid 7%, and Arcturus Growthstar (AGS.C) slipped 4.7% despite putting out great news.

If the big boys hit their critical mass point in the days ahead and momentum turns downwards once more, expect those small plays to zoom again as the big money looks for somewhere to go.

It must be tough to be in the resource sector and watch the madness that is the weed world right now, because we know how this all ends. When everyone is overinflated, it only takes a small misstep to bring the whole thing down.

Which is why I’m taking my profits. Don’t be the last one off the train.

— Chris Parry

FULL DISCLOSURE: Tinley and Finore are Equity.Guru marketing clients, and the author has shares in Aphria, Golden Leaf, Supreme, Tinley, Finore and so so much more…

Planning on diverging of weed entirely or just staying clear of the big boys? I’ve been riding a lot of stocks like EAT, ACB and BE up and down continuously, but you’re right – the madness has to end somewhere.

Any thoughts on Emerald. EMH or would you recommend someone like SL or BE.

I think EMH has dragged the chain forever. SL would be my pick of those three. BE, too early.