Canopy Growth Corporation (CGC.T), formerly Tweed/Bedrocan, is the dominant medical marijuana company in the Canadian public market space, and has been since there was such a space to dominate.

They’ve made mistakes – often expensive ones – and for a long time their market capitalization has been far outsized in comparison to their actual worth, simply because they had first mover advantage.

I’ve been critical of the company often, and it’s usually fully deserved the criticism, but I’ve always tempered that criticism with the words, “But they have so much money, they can buy their way out of trouble.”

And they have.

But today marks a moment where I shift gear a little on Canopy. For, as of today, I think they might actually be worth the price of the stock.

Canopy announced today that its Q1 fiscal 2017 numbers are out, and they’re.. well.. nuts.

First Quarter Fiscal 2017 Highlights

- Revenues of $7.0 million, representing a greater than 300% increase over the three months ended June 30, 2015 and a 39% increase over fourth quarter fiscal year 2016

- Over 16,500 registered patients at June 30, 2016 compared to over 3,600 at June 30, 2015

- Bedrocan began licensed sales of bedro-oils cannabis oil in June 2016

Those numbers aren’t just good, they’re officially crazy. The $7m revs are decent, though still significantly lower than you’d hope for a company with a $380m market cap, but the 39% jump in revs over last quarter is solid growth at exactly the right time.

And the 16,500 registered patients takes the company into a place where it can actually point to what I’d term a significant user base, something no marijuana company in Canada has yet been able to do. After years of weedcos doing business with users in the low thousands, now the rubber is hitting the road.

And the sale of cannabis oils having started means good things for the next quarter, because there’s real margin in oil products. Aphria and Mettrum are also pushing hard in that space, which will help in getting word out to doctors and patients that there’s an alternative to smoking your medicine.

In addition, the company closed a financing on August 24 for another $34.5 million, on top of the existing cash position of $19.5 million at the end of Q1. That’s $55 million with which to go shopping for any company that may add to the bottom line.

The company managed to move 984 kilograms of weed in the quarter, which finally gets the company to Scarface levels of supply.

And they’re moving into Australia and Brazil through partnerships with companies in those places, and Germany through an export permit.

CGC always said the problems it went through were nothing, and that the future looked bright, and investors that stuck with them have not hurt for the experience. To be sure, six months ago, when patient numbers were halved from what they are now, and revs were likewise, it was tough to justify what was then a $250m or so market cap.

That market cap is $380m now, with shares having briefly touched the symbolic $4.20, well above the $2.00-$2.50 range that had held the company for some time.

Others are making a challenge. Aphria (APH.V) for one has raised a fat piggy bank and made some interesting side bets. Aurora (ACB.C) blew up by 25% just this morning, on the back of news it’s raised the cash to expand to ten football fields in size. Supreme (SL.C) is up 20% as well, and it may be no coincidence that Aurora honcho Chuck Rifici recently visited the Supreme campus.

In general, despite a big flop on the day that Canada’s courts announced local yokel growers could continue with their back barn ‘personal use’ grow ops, the nation’s MMPR companies have thrived in the days since.

Supreme is up 73.6% since July 1. Canopy is up 38% in the same time. Aphria is up 55%.

Aurora? 116.6%. And their ‘active patient’ numbers ( as opposed to CGC’s ‘registered patient’ numbers) have climbed to 6500 in just seven months.

It would be silly to assume there’s going to be a repeat of these massive share price jumps in the 60 days to come. But for the first time in a long time, the weed business in Canada is thriving as a legitimate corporate concern, and not just on ‘promise’ of what might one day happen, but on actual dollars stacking on the floor.

The state of the union is strong. How strong?

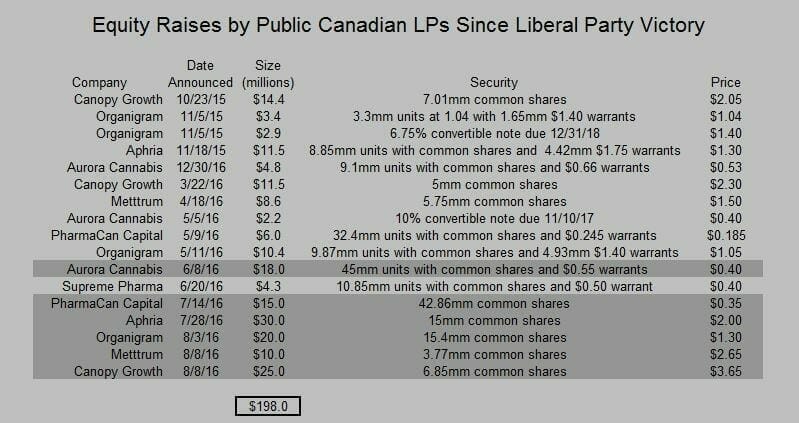

Borrowed from Alan Brochstein’s New Cannabis Ventures:

$198 million raised in less than a year – for growth.

— Chris Parry