It’s not the ‘big boy play’ I’ve been talking about for the last month (still sitting on that one), but Emblem Marijuana (SAB.H) has been looming for many months now and is finally jumping into action.

Formerly Kindcann, Emblem is RTOing and currently in the tail end of a raise. They’re valuing it at $22.5 million, which is absurdly cheap compared to the established brands out there, and maybe only a little cheap compared to similarly sized plays.

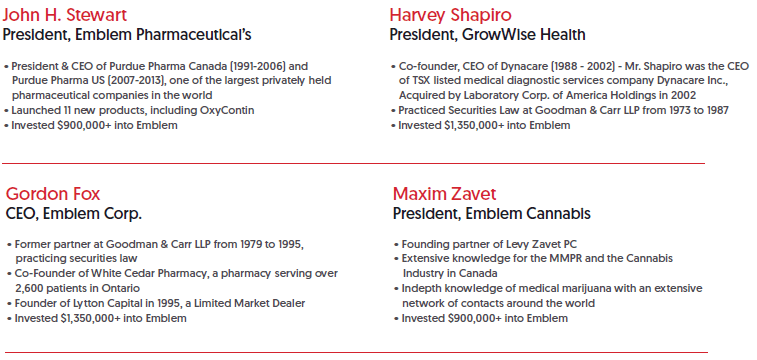

But where this one comes into its own is with the guys running the show.

Christ on a bike. Not only have you got a 15 year President and CEO of Purdue Pharma in there, you’ve got retail pharmacy knowledge, MMPR knowledge, biotech knowledge, you’ve also got $4.5 million invested personally between them.

Christ on a bike. Not only have you got a 15 year President and CEO of Purdue Pharma in there, you’ve got retail pharmacy knowledge, MMPR knowledge, biotech knowledge, you’ve also got $4.5 million invested personally between them.

I don’t have a deal with Emblem, but with the financing closing (shares are $0.75 with a six month hold), I figured you should know now, rather than later, because it’s a sweet deal.

To get in on that financing, contact Danny Brody at Emblem, 647-255-8106 ex 1810 or dannybrody@emblemcorp.com or Shane Parhar at Mackie Research, SParhar@mackieresearch.com and 778-373-8075.

— Chris Parry

You are killing us with suspense re big boy pants play……..no hints……..Cannabis Royalties Holding Company has to be a part of this somehow??????

Chris, how does financing work? Do they let individuals finance? Is there a minimum amount? Could you enlighten us newbies on how to proceed? Thanks

Sure Joe,

When a company needs to raise more money, one of their options is to sell more stock. When that happens, they offer said stock to investors through brokers at a set price, sometimes a better price than the open market but usually close to the average over the last few weeks.

With that stock, you often get what’s called ‘warrants’, which are agreements that you can, at a later date, buy more stock for a guaranteed set price – let’s say 30% above the market price now. Then, if the stock climbs above that price, you’re in the privileged position where you can get it cheaper than everyone else.

The broker will provide you with documents to sign that show you’re aware of the risks, and how much you wish to buy. You then send in your cheque and get stock certificates in the mail at a later date, which you can send to your online broker platform and trade happily.

The only catch? There’s usually a four-month trading hold on that stock, so you can’t sell them off right away. That ensures the share price doesn’t crater at the first sign of a slump.

Usually, in order to buy into a financing, the regulators want you to be someone of some net worth. If you have a million bucks in liquid cash, or you earned $200k for each of the last few years, you’re in. Otherwise, if you’re an existing shareholder or friend of someone on the board… there are ways.

Best option is to call one of the guys listed above and tell them Equity.Guru sent you, and they’ll walk you through the details.

C.

They ignored my emails and calls. They are not accepting individual investors, seems like a waste for posting if they are not accepting any offers