Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With eighteen projects covering over 460,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

We can now correct the above statement with today’s news. Skyharbour has added eight new properties to their list covering over 490,000 hectares in the Athabasca Basin.

Today, Skyharbour announced that it has acquired by staking eight new prospective uranium exploration properties. The new properties bring Skyharbour’s total land package that it has ownership interest in to 492,074 hectares (1,215,941 acres), across twenty-three properties, representing one of the largest project portfolios in the region.

The main focus remains its ongoing 10,000m drill program at the Russell Lake project, but these new properties will become a part of Skyharbour’s prospect generator business as the Company will seek strategic partners to advance these assets.

Jordan Trimble, President and CEO of Skyharbour Resources, states: “We have been actively staking new mineral claims and adding to our substantial uranium project portfolio in the Athabasca Basin. These newly acquired projects are strategically located and are geologically prospective with very little modern exploration having been carried out on them. They complement our more advanced-stage exploration assets including Russell Lake, Moore and South Falcon Point, and provide additional ground to option or joint-venture out to new partner companies as a part of our prospect generator business. Executing on this part of the business, Skyharbour has signed option agreements with seven different partners that total over $34 million in partner-funded exploration expenditures, over $22 million in stock being issued and just under $15 million in cash payments coming into the Company, assuming that all of these partner companies complete the full earn-ins at their respective projects.”

Here is a summary of the new properties, but more information can be found here.

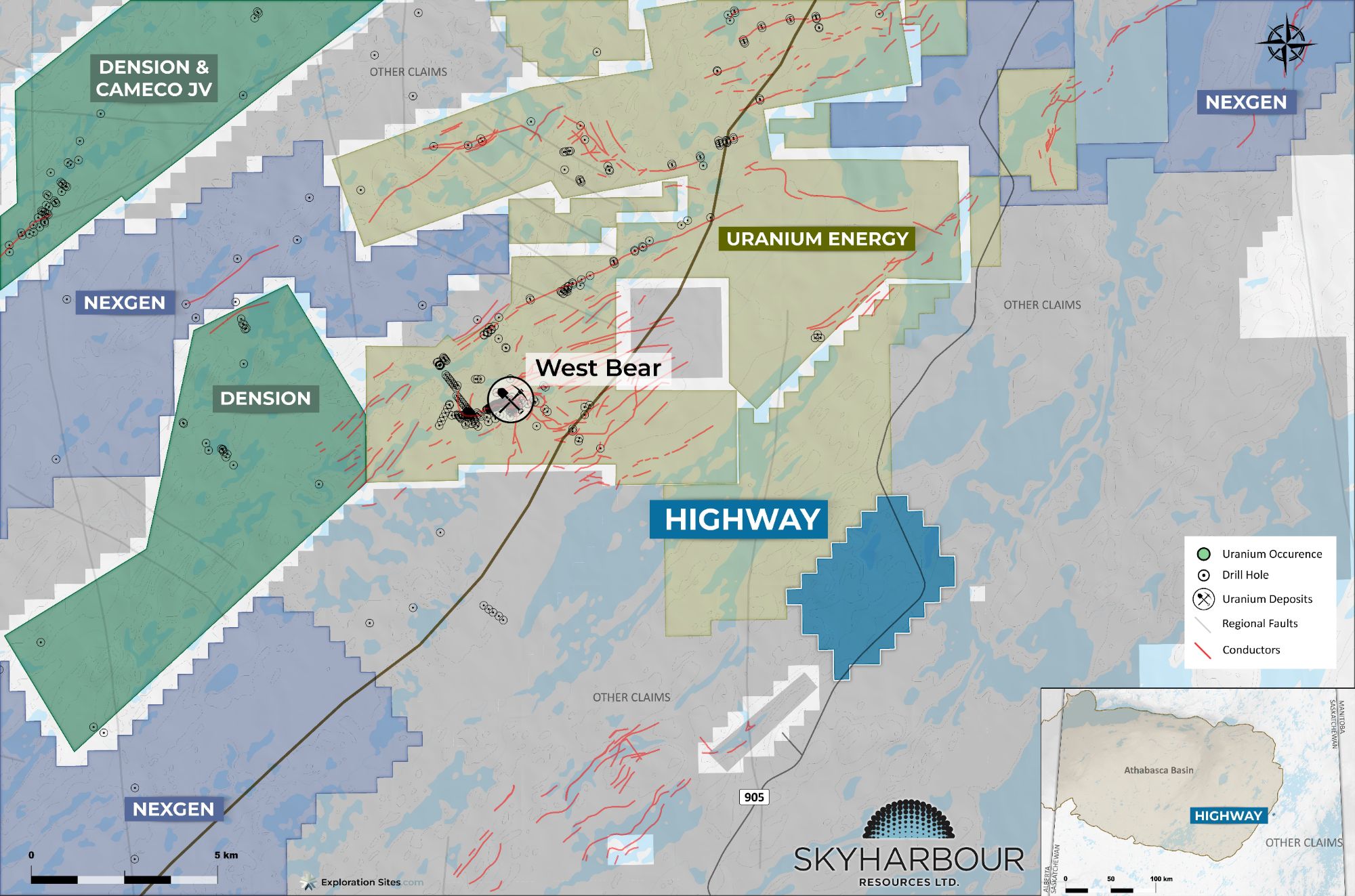

Highway Project

The Highway Project consists of one claim covering 1,184 ha approximately 41 km south of the Rabbit Lake Mine and 11 km SW of Uranium Energy Corp.’s West Bear U and Co-Ni Deposits. Highway 905 runs through the property and is in close proximity to regional infrastructure, providing excellent access for exploration. The project is relatively underexplored.

The earliest work on the property was completed between 1968-1978 and included airborne EM, magnetic, and radiometric surveys, along with bedrock mapping, prospecting, radon sampling, and ground EM surveying on portions of the property; as well as a single augered drill hole. The project has also been covered by portions of airborne EM and magnetics surveys in 2009, 2011, and 2017. There are historic EM conductors southwest of the property along strike at “T-Lake”, where surface sampling and historic diamond drilling encountered anomalous U, Th, and REEs graphitic faulting, and variably altered fracture zones.

Ground prospecting on the Highway property in 2011 encountered a pegmatite-pelitic gneiss boulder containing 3475 ppm TREE+Y+Sc, suggesting the Highway Project is prospective for rare earth elements in addition to basement-hosted unconformity-related and/or intrusive-type uranium mineralization.

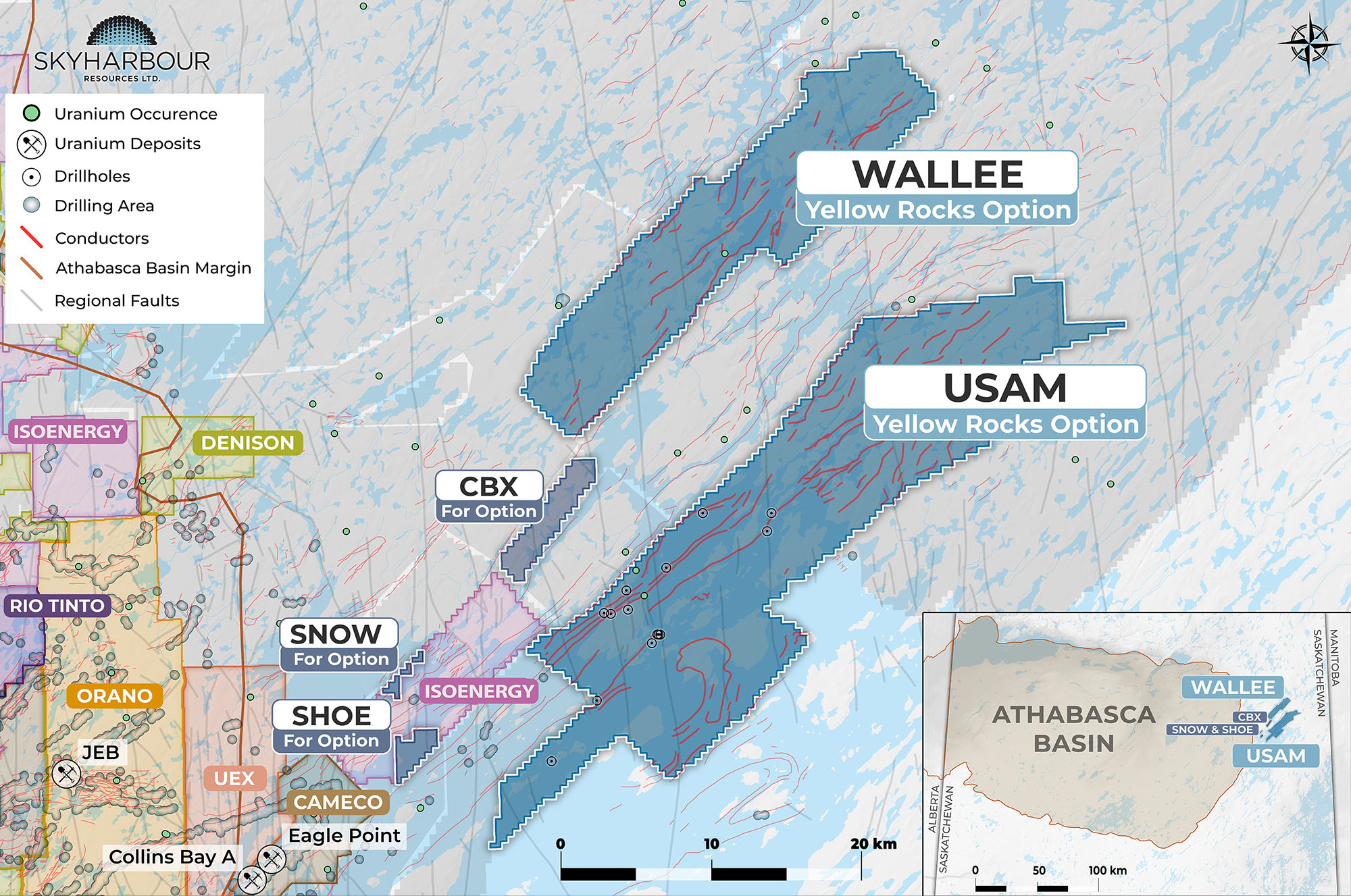

Snow, Shoe and CBX Projects

The Snow, Shoe, and CBX properties consist of three non-contiguous claims totalling 2,582 ha located approximately 10 to 25 km along strike to the northeast of the currently idled Eagle Point uranium mine (Cameco’s Rabbit Lake Operation).

Previous work on the properties is generally historical in nature, and consists of airborne EM, magnetics, and radiometrics surveys, marine seismic, prospecting, geological mapping, and geochemical sampling done mostly between 1968 and 1981, with some additional work in 1993. The only modern exploration on the properties themselves consists of a Heli-TDEM and magnetic survey flown in 2007, although drilling and other modern exploration have been done on adjacent properties.

No diamond drilling or modern ground geophysical surveying have taken place on the projects.

All three properties are prospective for unconformity-related, basement-hosted uranium mineralization as well as pegmatite- and granite-hosted uranium and REEs. The CBX property is also prospective for molybdenite, as sedimentary-hosted molybdenite and pyrite were identified in fractures in a quartzite outcrop on the property.

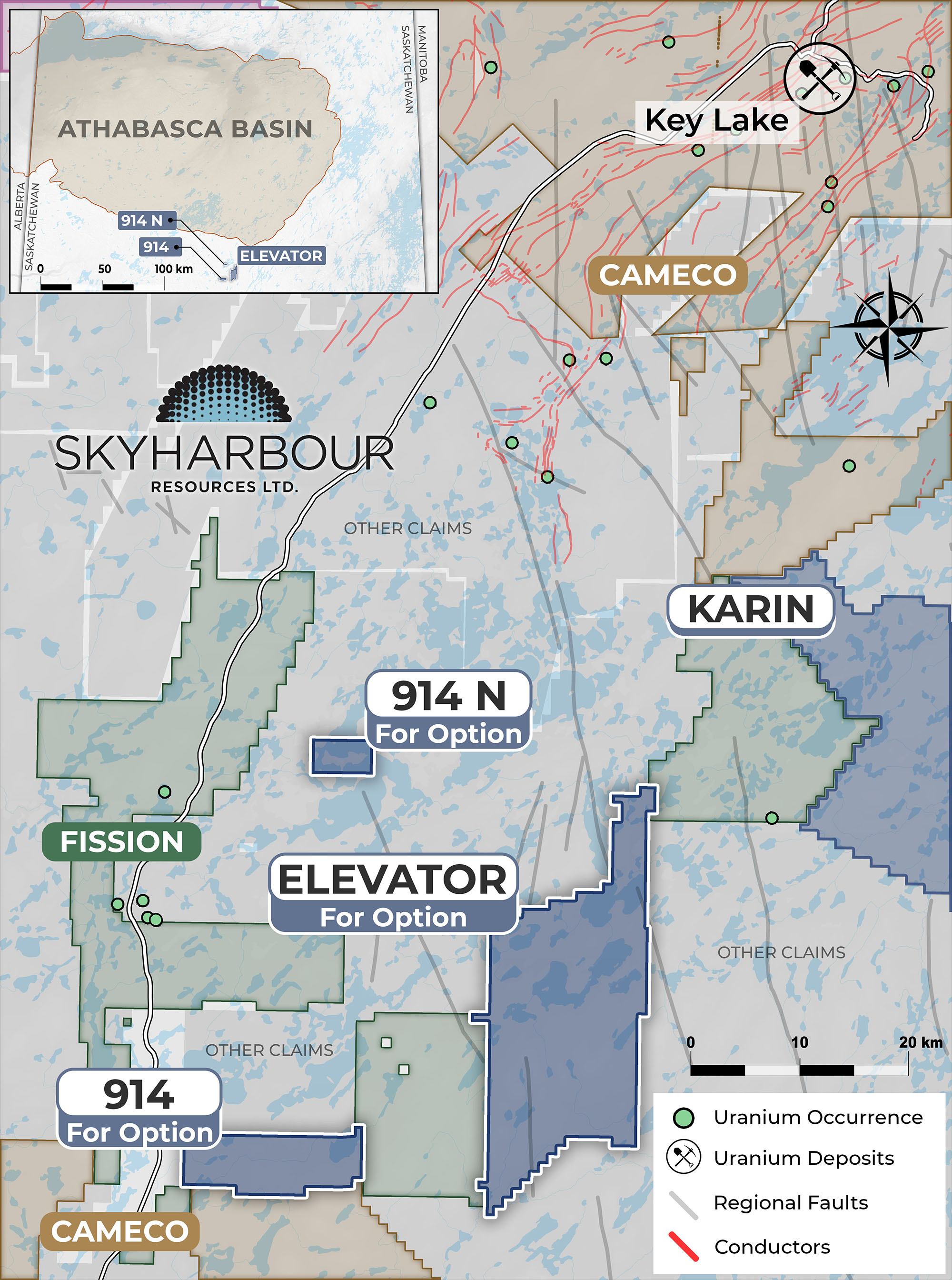

914, 914N and Elevator Projects

The 914, 914N, and Elevator projects consist of four non-contiguous claims totalling 11,873 ha and are located 31 to 52 km south of the Athabasca Basin margin and 35 to 55 km south of Cameco’s Key Lake Operation (209.8 million pounds U3O8 produced at an average grade of 2.32%).

Extensive work on the properties and in the surrounding area was conducted throughout the 1970’s and included magnetic, gravity, and EM surveys as well as geological mapping, prospecting, boulder, and sediment sampling programs. Modern work on the properties is more limited and includes partial coverage by an airborne VTEM survey, limited ground prospecting, and lake sediment sampling.

An EM conductor was identified on the 914N property and has yet to be drill tested; the remainder of the properties were not covered by the modern geophysical surveys.

More recent regional airborne magnetic surveys show additional complexity that was not reflected in the historical bedrock mapping. While there are no uranium occurrences noted on the properties themselves, multiple uranium and REE showings are present in the area including the Sandra Lake, Key Lake Road, Karpinka Lake, and Don Lake.

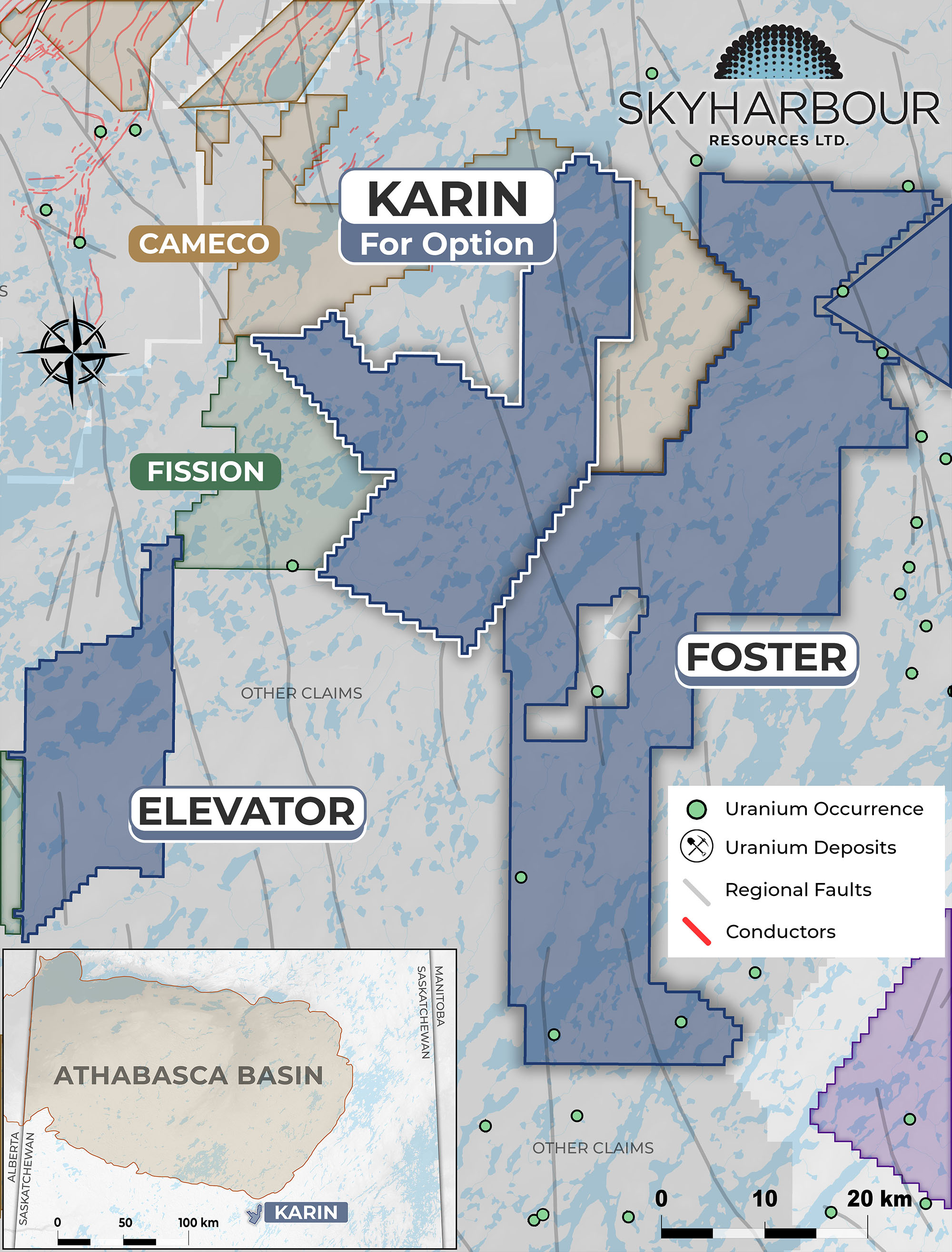

Karin Project

The Karin Project consists of five claims covering 18,383 ha approximately 20 km south-southeast of Cameco’s Key Lake operation.

Exploration work on the project is primarily historical in nature and consists of airborne EM, magnetic, and radiometric surveys, lake water and sediment sampling, radon surveys, prospecting and ground-truthing of airborne anomalies, geological mapping, and diamond drilling in the late 1960’s to early 1980’s.

A weakly radioactive pegmatite was intersected in historical hole 78-1 which returned 0.025% U3O8 over 0.45 m at a depth of 72.85 m. A limited amount of prospecting was completed in the area in 2008 and led to the discovery of an outcrop of pegmatite on the property which contained 181 ppm U, 205 ppm Nb, and 39 ppm Ta.

The project has otherwise been unexplored since the 1980’s and is prospective for both intrusive-type and unconformity-related uranium deposits and intrusive-related REEs.

Skyharbour stock is down -5.80% at time of writing sitting at a market cap just over $48.2 million.

A major technical break is occurring with a breakdown below the major support zone. This zone has been held since Summer 2022. A breakdown would be bearish and likely result to a move down to the $0.30 zone, our next level of support.

The chart is showing a breakdown, but there are still hours left to go in the trading session at time of writing. Enough time for buyers to bid up the price and take us over support. The breakdown will only be confirmed with a daily candle close below support.

The move can be explained by the technicals of uranium. In recent weeks, I have been explaining the bearish technicals on uranium. This drop in uranium has been hitting uranium stocks.

Uranium is in a consolidation phase with a range breakout potentially resulting in a reversal. But after a nice Friday, uranium prices are selling off at the top portion of the range bringing down most uranium stocks.

For more information on the uranium technicals, be sure to check out my most recent uranium sector roundup.