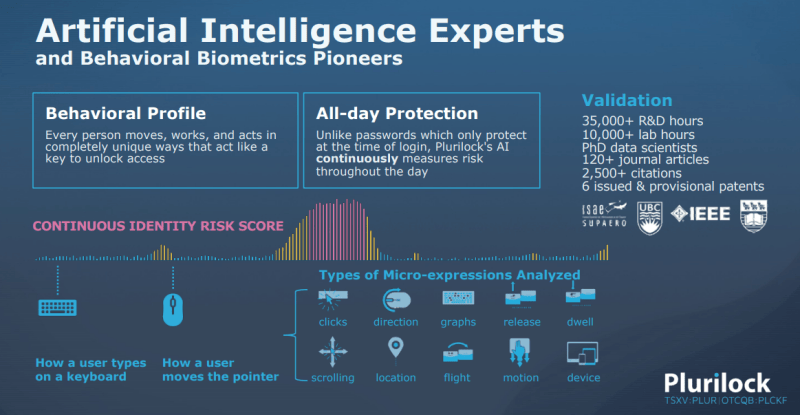

Plurilock Security (PLUR.V) is a Canadian identity-centric cybersecurity solutions play. The cybersecurity company provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

Machine Learning that reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity. No more having to remember your first pet’s name for a password!

Today, Plurilock announced a purchase order for the company’s flagship cybersecurity platform from a US Credit Union. The Credit Union is selecting Plurilock for its cybersecurity solution as part of its zero trust strategy. The customer will license the continuous identity confirmation functionality of the Plurilock platform.

The first cross-sale following the transaction with Atrion Communications was completed within 5 months whereas the previous initial cross-sale orders were secured approximately 13 and 8 months after the acquisition of Aurora Systems Consulting, Inc. and Integra Networks Corporation.

This track record highlights the Company’s ability to expedite the cross-selling process following new acquisitions. The Company aims to continue completing more sales of its high-margin software products and will leverage cross-selling opportunities through existing distribution channels.

“We are pleased to see the expansion of our sales pipeline for our flagship cybersecurity platform with a U.S. credit union,” said Ian L. Paterson, CEO of Plurilock. “Financial services firms require a strong cyber defense to protect their employees and database, which we aim to help strengthen with our zero trust technology offerings. Moving forward, we intend to secure additional cross-sale orders for our Technology Division’s high-margin software product.”

Plurilock Security is currently up 3.70% at time of writing on the news.

From a technical perspective, we have a potential bottoming in the works. The stock recently made all time record lows hitting $0.12. Since then, the stock has just ranged. The major support zone at $0.14 was taken out which led to the printing of all time record lows. In a way, the stock not sliding down further on the breakdown is a good sign that buyers are in the area.

What was once support, now becomes resistance. Plurilock did close above $0.14 on January 16th 2023. A very nice pop, but the momentum was stalled due to a private placement.

Now once again, Plurilock will need to regain the $0.14 level for further upside momentum. Interestingly enough, a move higher could trigger a reversal pattern. I have drawn a line at $0.165. If Plurilock can close above this level, we would trigger a double bottom pattern.