Bed Bath & Beyond Gone

- $414.61M Market Capitalization

Bed Bath & Beyond (BBBY.Q) announced today that it has shown its CEO Mark Tritton the door. Paired with a -21.75% stock drop, it has been a bloody Wednesday for Bed Bath & Beyond (BBB), everyone’s favorite home goods store. The last time I was at BBB, I was looking for a diffuser, whereas Mr. Tritton will now be searching for a job. I guess there’s always Homesense? Here’s what happened.

“After thorough consideration, the Board determined that it was time for a change in leadership. Our banner’s heritage is built on the premise that when customers are shopping for a home, Bed Bath & Beyond is the perfect destination for unique solutions and inspiration,” said Harriet Edelman, Independent Chair of the Bed Bath & Beyond Inc. Board of Directors.

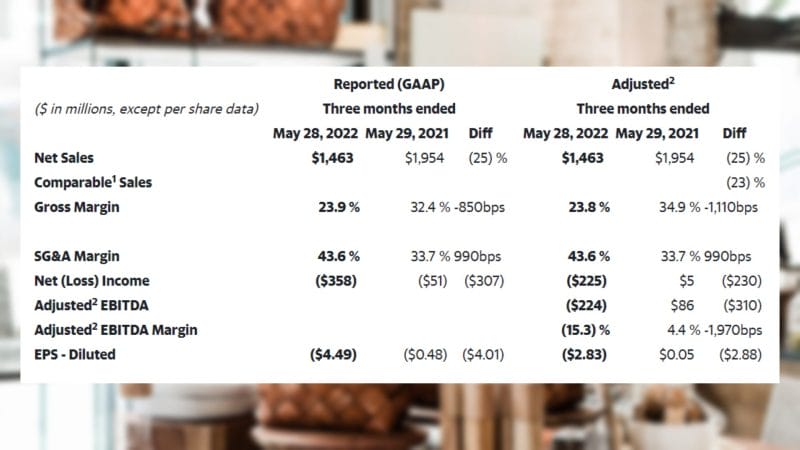

Today, BBB announced that it is making “significant changes” to the Company’s senior leadership. This is intended to reverse recent results, address supply chain and inventory, as well as strengthen its balance sheet. Let’s talk about that balance sheet for a second. In Q1 2022, BBB’s net sales declined 25% to $1.463 billion, with same-store sales also falling 27%.

For the three months ended May 28, 2022, BBB reported a net loss of $357,666,000 representing a substantial increase from $50,874,000. In total, the Company had cash and cash equivalents of $107,543,000 as of May 28, 2022, compared to $439,496,000 on February 26, 2022. If you would like to know more about the Company’s subpar performance, BBB hosted a conference call earlier today.

Now, let’s talk about Mr. Tritton, a man with over 30 years of experience in retail. Previously, he served as the Executive Vice President and Chief Merchandising Officer at Target Corporation (TGT.NYSE). Mr. Tritton resigned from Target following an announcement in October 2019 that he would be joining BBB as its President and CEO.

Since joining the Company in November 2019, Mr. Tritton’s journey has been anything but smooth. Shortly after taking the reigns of BBB, he pulled the plug on 1,500 brick-and-mortar stores and furloughed 40,000 employees. For BBB, this was a necessary sacrifice needed to allow for renovation and new in-house brands.

Changing the Sheets

Following Mr. Tritton’s appointment, BBB’s financials stabilized and the Company’s omnichannel capabilities were improved. However, BBB inevitably took a beating from the COVID-19 pandemic, creating a slippery slope for the Company. Disappointed with its latest results, BBB has opted to replace Mr. Trittion with Sue Gove.

“We are committed to addressing the urgent issues that have been impacting sales, profitability, and cash flow generation. We are confident Sue brings the right combination of industry experience and knowledge of Bed Bath & Beyond’s operations to lead the Company, focus our resources, and revise strategy, as appropriate,” continued Harriet Edelman.

Ms. Gove is an Independent Director on the Company’s Board of Directors and Chair of the Board’s Strategy Committee. She has now been named Interim Chief Executive Officer of BBB. In addition to executive changes, BBB reaffirmed that it is evaluating options for buybuy BABY, the leading specialty baby products retailer in North America.

To provide some background, on March 22, 2007, BBB acquired buybuy BABY through an all-cash acquisition. With this in mind, the Company’s Strategy Committee is working with management as well as strategic and financial advisors to assess buybuy BABY’s value potential. It should be noted that buybuy BABY is arguably one of BBB’s most attractive points.

Despite BBB’s consistent decline, buybuy BABY managed to achieve double-digit growth in 2021. According to Ryan Cohen, who bought nearly 10% of BBB’s total shares, buybuy BABY is estimated to reach $1.5 billion in sales by 2023, demonstrating potential growth of at least 50%. With this in mind, buybuy BABY has caught the attention of potential buyers.

BBB’s share price opened at $5.46 today, down from a previous close of $6.53. The Company’s shares were down -19.94% and were trading at $5.23 as of 11:19 AM EDT.