XRP, or sometimes still referred to as Ripple by traders, is a cryptocurrency you either hate or love. And then there are those that don’t care and just trade it for gains. The token creates a divide because of it being labeled the “banker’s coin”. Also the fact that unlimited XRP can be created.

I remember investing into it in the early days of cryptocurrency. The hardcore crypto enthusiast’s weren’t fans because Bitcoin is decentralized while XRP/Ripple is centralized. The whole idea of Bitcoin and other cryptocurrencies is to be away from the hands of large corporations, large governments, and large institutions. XRP being the banker’s coin and centralized didn’t meet that criteria.

Fast forward to today, and we are now waiting for Biden’s executive orders on cryptocurrencies. Governments are set to regulate, and large institutions and corporations are getting involved in the crypto space. Many of the hardcore crypto enthusiast’s are running into DeFi because they believe this emerging space is what Bitcoin and the crypto space was supposed to be.

It seems that all those large players are getting involved with cryptocurrencies. A Central Bank Digital Currency (CBDC) where governments will be able to track all of your income and spending, is definitely coming. What this means for private cryptocurrencies is the 1 million dollar question. Some are thinking of tough regulations or downright bans because they want people to transact with their currency. Central Banks have kept the monopoly on creating money for many years. I don’t think they give that up easily. In a positive light, what I am trying to say is that one might as well make profits on XRP even if it is a centralized coin.

When one thinks of XRP, they think of the legal battle against the SEC that has been ongoing for years. The cryptocurrency sector’s complaints that Washington has gone too far in cracking down on its unregulated products are getting tested in a key lawsuit targeting Ripple Labs Inc. and its digital coin, XRP. Here’s some info:

The SEC says Ripple illegally raised almost $1.4 billion by selling XRP in violation of investor-protection rules, while its co-founder and chief executive, whom it also sued, reaped hundreds of millions of dollars in trading gains. The company says XRP is used for making international payments and isn’t an investment to be overseen by the SEC. Some XRP sales occurred before the SEC first said in 2017 that many cryptocurrencies should follow laws written to shield investors from fraud and misleading hype.

Despite the SEC’s 2017 guidance, thousands of digital coins have been sold in recent years without regulatory oversight. The SEC has brought enforcement actions against 56 token issuers, according to Cornerstone Research, but almost all settled with the SEC without going to court, where the regulator’s legal arguments could be tested by a judge or jury. An SEC win would boost its case to impose investor protections on most of the $2 trillion crypto market, while a loss would reinforce the industry’s call for Congress to write clearer and more suitable laws.

Regulators have said just a handful of digital assets, such as bitcoin, are commodities mostly exempt from federal regulation. In contrast, XRP’s usefulness as a currency “never materialized,” the SEC says. Ripple touted XRP’s commercial use but didn’t disclose that it paid a money transmitter to accept the coin. The money transmitter sold the digital coins, which gave the appearance that XRP was in greater demand, according to the SEC.

The battle regarding if crypto is a currency or a security (digital asset). This debate will continue to rage on and unfortunately, it may be the government who makes that decision.

Yesterday, Ripple and Modulr announced a partnership to enable seamless payments into the UK and Europe. Modulr is a leading payments platform, and Trust Payments, a global unified payments group, is the first customer to go live and benefit from this partnership.

Together, the two leading FinTechs will make it easier than ever for businesses, like Trust Payments, to run real-time payments internationally powered by Ripple’s financial technology, RippleNet. With Modulr’s technology, global businesses have an alternative to legacy correspondent banking and can now make payments into the UK and Europe faster, more reliable, and cost-effective.

No major pop on XRP on that news, although the crypto was up yesterday with the overall stock markets. Regular readers of my work know that Bitcoin and other cryptocurrencies still act as risk on assets. They move with stock markets with a strong positive correlation.

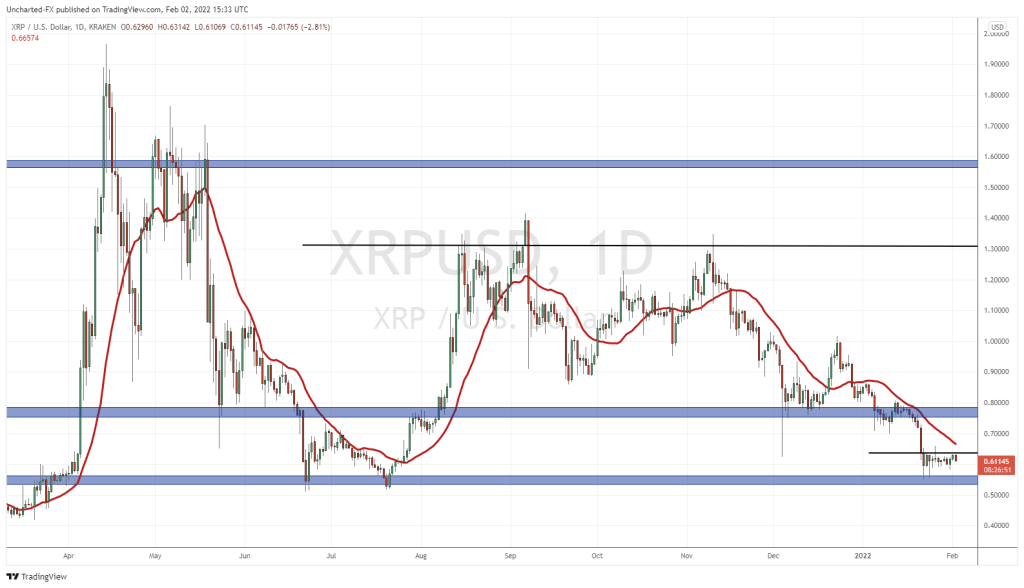

XRP has been basing just above the psychologically important support of $0.50 for nearly two weeks. I am a fan of trend reversal trades, and XRP could fit the bill. It is just missing the crucial element: the breakout trigger. We have been in a major downtrend, with multiple lower highs and lower lows. We then began to range at support. A major support, which is generally where you want to see the downtrend end, and a new reversal to take place.

Now, we wait for the breakout. I want to see a daily close above the range. Above $0.64. That triggers the break and confirmation of a possible new uptrend with multiple higher lows and higher highs. If we do not get this break, XRP can continue to range, or even break down below $0.50.