“Element Nutritional Sciences was born from a desire to develop and deliver products based on pure nutritional science. Our company is built on the passion to utilize modern science to innovate and deliver high-value nutrition products that enhance the well-being of all our consumers and allow them to maximize their health and longevity.”

Element develops nutritional products. It also in the retailing of its products through stores (Walmart, Walgreens) and online platforms like Amazon.com. Rejuvenate, its flagship product, is a muscle health product designed to help slow and/or prevent muscle loss due to aging. They claim that the formulation is based on 17 years of clinical research with 25 peer-reviewed clinical studies supporting the formula and its efficacy.

Based on the potential of the formula in delivering a clinically proven nutritional intervention for muscle loss, Rejuvenate is now Element’s flagship brand. Element began commercialization of this brand in April of 2019.

Opening sales were through e-commerce on Element’s websites in the US and Canada and on Amazon.ca and Amazon.com. Retail sales commenced in the second half of the year at 6,000 CVS retail stores and 2,838 Walmart stores in the United States. Total sales for Rejuvenate for 2019 were $1,402,663.

In March of 2018, Element acquired the JAKTRX product line of protein powders and other nutritional supplements targeting the sports nutrition market.

Their business is simple to understand and has some added key partnerships with retailers and manufactures that have allowed them to grow sales by 500% (% Change YoY) from 2018 to 2019. Sales went from $280,000 with gross margins of 17%, to $1.6 million in 2019 with gross margins of 46%. Of course, they have only started commercializing some of their products, so their operating income or operating earnings are still in the negative. This is normal for a company that’s slowly establishing itself especially as a vendor to retailers.

Simplified Business Model:

Production of the Goods

- Products are being developed using the patented methods of administering a preparation of essential amino acids

- The Company is currently working with KGK Science in the development of research protocols with the Rejuvenate formulation.

- Element currently utilizes three independent contract manufacturers to produce all products sold in North America

- become a vendor of record by completing all the internal paperwork with the retailer necessary to set up a product in the retailers’ system so that the retailer can issue purchase orders for the product.

- A vital part of Element’s business strategy is to protect its products and technologies with patents, proprietary technologies, and trademarks.

Establish Sales and Marketing Channel

- branding and marketing to appeal to the entire sports nutrition consumer and take advantage of the projected growth in the North American sports nutrition market for their JAKTRX product line

- Establish a distribution and sales agreement with contractors or independent firms

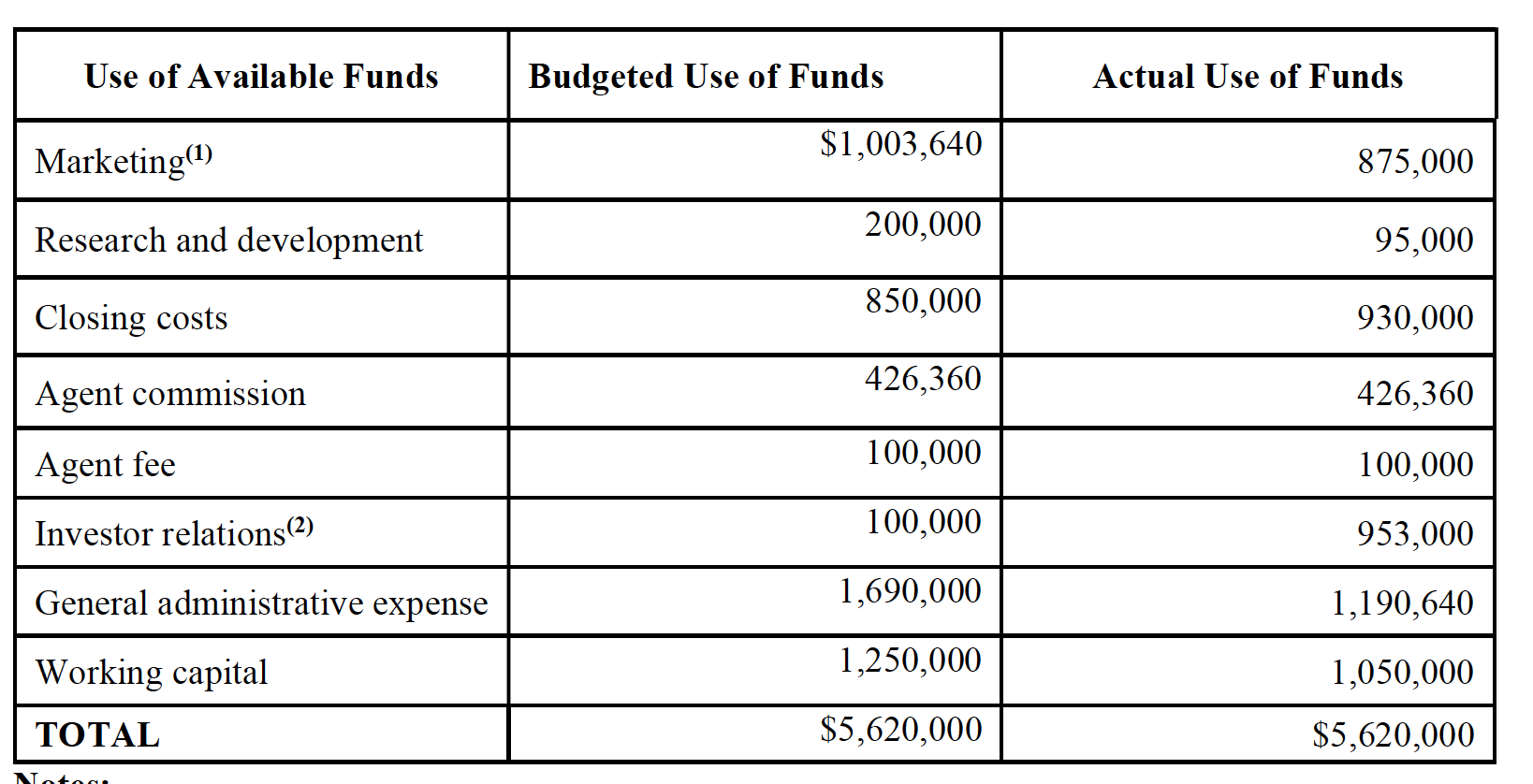

The Company raised $5,620,000 from the private placement and the funds were received in May 2021. The company broke down the use of the funds in the table below.

Like we noted above the company is still at the beginning of commercializing its products. Meaning for the next few years they will be raising a lot of money through private placements through either equity or some form of a debt obligation. Usually, this money will be used to fund the day-to-day operations of the business, and lucky for us we have a breakdown of their budgeting period for the Six Months Ended June 30, 2021.

- From the money they raised they budgeted that majority of it would go to their marketing, general admin, and working capital expenses.

- They also had a large budget for their closing costs and agent commissions as well.

- They spent 875,000 on marketing, 930,000 on closing costs, 1.1 million and general administrative expenses, and 1,000,000 on working capital.

- they also spent $900,000 on investor relations which were above their budgeted $100,000 because of initiating programs that were anticipated to begin in Q3 and Q4.

Their most important expense now is their marketing as the firm established its brand identity with consumers and retailers. Marketing costs are an effective and essential expense towards engaging its customers and branding. The firms marketing campaign costs include activities associated with:

- digital content

- social media and paid media,

- direct to consumers.

As of their last reporting day they have $5.81 million dollars left in cash on hand. They also have $970,000 in accounts receivables, $2.24 million (most of which are Finished goods) in inventory, and $420,000 in prepaid expenses. They also have $3.2 million in accounts payable and virtually little debt.

This puts them in a positive short-term liquidity position allowing them to deploy more capital into either

- marketing and advertising initiatives

- salesforce expansions

- investments in R&D/product development and

- and other purchases of property plant and equipment

This is what will help them leverage their current brands and expand their reach into the shelves of other large retailers.