Playgon Games Inc.

- $63.961M Market Capitalization

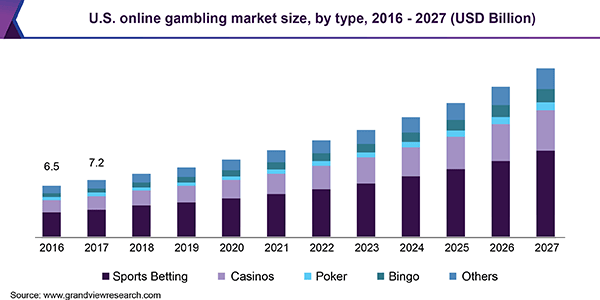

The COVID-19 pandemic has been a transformative experience, impacting almost every facet of life. From social distancing to wearing a mask, we have had to reconsider even the most trivial of tasks. As a certified hermit, the coronavirus didn’t pose too much of a threat to my secluded lifestyle. On the other hand, extroverts were forced to confront daunting obstacles such as social deprivation, loneliness, and depression. Those who relied heavily upon social interaction to pass the time were now left to find alternative outlets, often turning to video games, streaming services, and social media. In particular, the global online gambling industry grew substantially following the onset of the pandemic, reaching a valuation of USD$64.13 billion in 2020. Keep in mind, this market is expected to reach USD$112.09 billion in 2025, expanding at a compound annual growth rate (CAGR) of 12%.

With this in mind, Playgon Games (DEAL.V) is a software as a service (SaaS) technology company focused on developing and licensing digital content for the growing iGaming market. Looking to capitalize on the lucrative online gambling market, Playgon provides a multi-tenant gateway offering online operators innovative iGaming solutions, including the Company’s Live Dealer Casino, e-Table games, and Daily Fantasy Sports. For context, iGaming refers to any sort of online game that is associated with betting, gambling, or casinos – a niche that Playgon is very well acquainted with. With this in mind, the iGaming industry has developed rapidly in the last couple of decades. In 2000, the iGaming industry gained more than 8 million customers, generating net revenue of approximately $2 billion. By 2010, online casinos were successfully compatible with mobile phones, adding a whole new level of accessibility to the online gambling scene. Shortly after, revenue from online casinos grew to roughly $10 billion.

Playgon’s Hand

Speaking of mobile gambling, in most countries mobile users account for about 80% of all users in the online gambling industry. According to a study published on Rub90, a casino vendor, the proportion of gamblers who preferred using smartphones to participate in gambling grew by 117% between 2012 and 2018. As someone who would play an absurd amount of Solitaire while waiting for class, I can’t say I find this statistic surprising. On the contrary, I suspect that a majority of gamblers enjoy the convenience of being able to gamble while in the bathroom, on the train, or while trying to avoid the judgemental gaze of their wives. Men, I am looking at all 69% of you. With this in mind, Playgon hasn’t just dipped its toes in the mobile gambling industry, it’s swimming in it. For example, the Company’s Live Dealer Casino, featuring live dealers, brings handheld features and functionality to the mobile generation of gaming enthusiasts. Centered around providing a “perfected” one-handed play experience, Playgon’s mobile-first approach presents a captivating opportunity for gamblers looking to snack while they play. More impressively, Playgon’s Live Dealer Casino utilizes Progressive Web Apps (PWA) and live streaming to create an authentic Las Vegas casino experience, without the impromptu wedding. Currently, Live Dealer Casino offers Blackjack, Roulette, and Baccarat.

Similarly, the Company offers 12 e-Table games, 4 of which are currently available, including Blackjack, Tiger Bonus Baccarat, Baccarat, and Roulette. Additionally, Playgon’s Daily Fantasy Sports enables site members to compete against others in an accelerated variant of traditional fantasy sports. Opposed to those that are played across an entire season, Playgon’s Daily Fantasy Sports are conducted over short-term periods, such as a week or even a single day of competition. With this in mind, Playgon has an impressive portfolio of iGaming solutions under its belt. Moreover, Live Dealer is a mature product in the global markets and current estimates suggest it generates somewhere between USD$7 billion and USD$8 billion in gross gaming revenue annually. With its own mobile-first Live Dealer Casino, Playgon is well-positioned to capitalize on this market. Furthermore, despite various operational challenges created by the pandemic, the Company has achieved several milestones and is optimistic for the future. In an update, Darcy Krogh, Playgon’s CEO & Director stated:

“Moving forward to 2021 and some of the highlights we have experienced so far this year. By far the biggest milestone is the approval of our Class one MGA license in March which cleared the path to start launching our customers and of course the actual live production launch in May of this year. All things considered, we ended up being about 6 months late from what we originally planned but now that we are up operator feedback has been positive, player traction is growing, and momentum is building every month. We continue to see increasing operator commitments through the aggregator clients we have signed up and our direct and indirect sales and marketing efforts are working.”

Why is an MGA license important? As referenced by Mr. Krogh, Playgon received approval from the Malta Gaming Authority (MGA) for its Type 1 Gaming Service License. The MGA is a gambling regulatory authority that provides top-tier, globally recognized, gaming licenses through a stringent review process. Having received an MGA license, the Company will receive additional credibility as a trusted betting technology supplier in Europe and other regulated markets globally. More specifically, this will enable Playgon to begin generating revenue through previously announced agreements with other Malta-licensed entities.

Latest News + Financials

Most recently, on October 12, 2021, Playgon announced that each of the matters set forth in the Company’s management information circular dated September 10, 2021, were approved by the shareholders of the Company. The matters put forth during the meeting included the election of Darcy Krogh, Guido Ganschow, James Penturn, Mike Marrandino, William Scott, and Jason Meretsky as directors of the Company. Additionally, matters regarding the appointment of D&H Group LLP as auditors of the Company and the ratification and approval of Playgon’s 10% rolling stock option plan were also presented. In total, the percentage of shares voted by the shareholders was approximately 62.69% of all shares eligible to be voted at the meeting, and all matters put forth to the shareholders received a minimum of 99.31% of votes cast.

Playgon’s 10% rolling stock options plan was established in July 2004, whereby the maximum number of shares that may be reserved for issuance pursuant to such plan will not exceed 10% of the issued shares of the Company at the time of the stock option grant. In 2014, the option plan was amended and reinstated to bring it in line with the policies of the TSX Venture Exchange (TSXV). For context, a rolling plan is a plan whereby the maximum number of securities issuable is set at a fixed percentage of the listed issuer’s issued and outstanding securities from time to time, opposed to a specific date. This plan is intended to provide an incentive for and encourages ownership of Playgon’s shares by its key individuals so that they may increase their stake in the Company and benefit from increases in the value of the Company’s shares. Additionally, on October 7, 2021, Playgon announced that it had gone live with Solid Gaming, a Bally’s Corporation Company. It is worth noting that Bally’s Corporation is a global casino-entertainment company with 14 casinos across 10 states and numerous Online Sports Betting (OSB) licenses in 15 states throughout the United States (US).

According to Playgon’s Q2 2021 Financial Results, the Company had a cash position of CAD$2,428,400 on June 30, 2021, compared to CAD$781,456 on December 30, 2020. In the same period, Playgon’s total assets and total liabilities increased marginally to CAD$14,375,593 and CAD$4,498,433, respectively. However, for the six months ended June 30, 2021, Playgon reported revenue of CAD$2,218 and a net loss of CAD$7,077,082 compared to CAD$1,873,137 year-over-year (YOY). With this in mind, the Company attributes its net loss to increased depreciation expenses, advertising and promotion expenses, data access fees, consulting fees, interest expenses, professional fees, and share-based compensation. Keep in mind, on June 19, 2020, Playgon, formerly Global Daily Fantasy Sports Inc., expended significant resources to acquire Playgon Interactive. More specifically, the Company acquired 100% of Playgon Interactive through the issuance of 63,333,333 common shares of the Company at $0.15 per common share for a total value of $9,500,000. It is worth noting that the Company’s operations have been primarily funded from equity financings. With this in mind, Playgon had working capital of CAD$49,991 and an accumulated deficit of CAD$37,099,107.

Should You Bet on Playgon?

Although Playgon’s financials aren’t the greatest, the Company has a strong portfolio of iGaming solutions. That being said, the Company’s success will largely depend on whether or not it can secure online operators. On August 9, 2021, Playgon announced that an additional 7 operators had gone live with Playgon’s Vegas Lounge Live Dealer platform, bringing the Company’s total to 14 with an additional 15 operators in the pipeline. Furthermore, the Company has a variety of initiatives underway, such as increasing dealer and development staff, building a remote engineering team, expanding its table count from 15 to 25, and developing new game content for its Live Dealer platform. Of these initiatives, Playgon has already completed the expansion of its table count to 25. Ultimately, the Company has a promising track record when it comes to attracting operators. Additionally, Playgon’s iGaming solutions are now part of Bally’s Corporation’s network. However, Playgon’s success is dependent on unpredictable variables, including whether or not it can continue to obtain financing, and its ability to secure additional operators. Until the Company is able to attract more eyes from both investors and operators alike, it may be safer to watch Playgon from the sidelines. If you’re more of an auditory learner, check out Equity Guru’s roundtable for Playgon, featuring some of our experts! Furthermore, if you’d like a deeper look at Playgon’s financials and structure, check out Vishal’s Chart Attack and Taku’s analysis for Playgon!

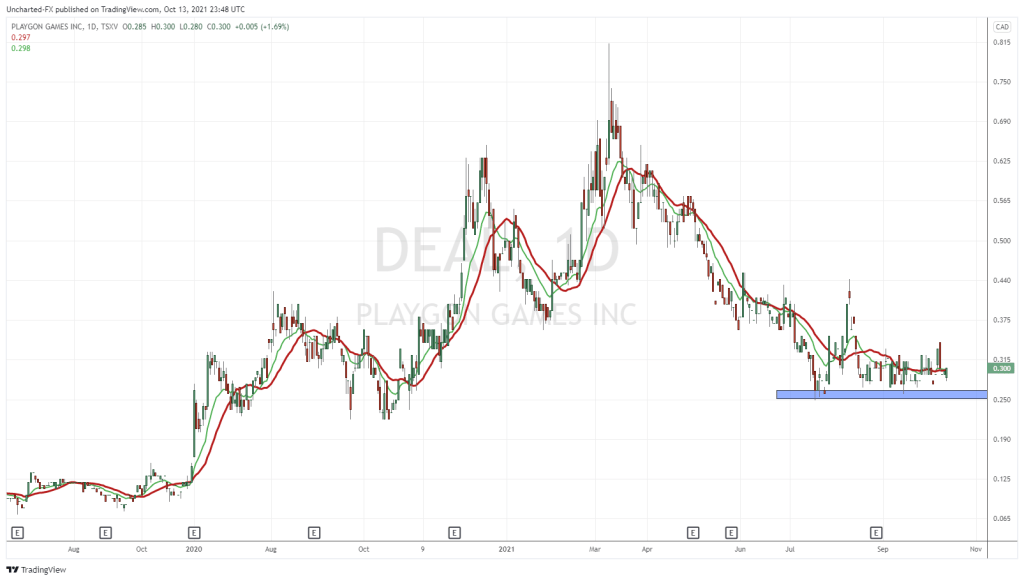

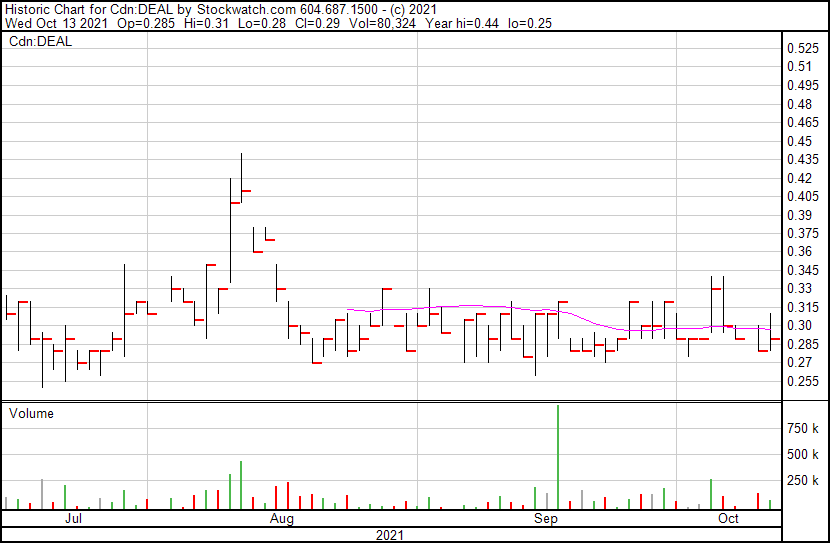

Playgon’s share price opened at $0.285 today, down from a previous close of $0.295. The Company’s shares are up 1.69% and were trading at $0.30 at close (October 13, 2021).