Debt is good, sometimes

Debt is an important factor when sussing out a company to invest in. Knowing why the company has taken out debt, how much debt they’ve taken out, and the likelihood of them being able to pay off that debt are all crucial in the due diligence process. It’s the first place Warren Buffett looks when evaluating an investment. If the debt ratios are wonky he closes the pamphlet and it’s onto the next.

In case you missed part 1, I talked about the free online tools investors can use to analyze the anatomy of a publicly-traded company. In part 2 we will talk about debt ratios.

Taking on debt is a normal part of scaling a business, especially for startups. I wrote earlier this week about convertible debentures, a popular form of debt financing for newer companies. How much debt a company takes on is important.

A company that has taken on a lot of debt in relation to its overall equity isn’t in a stable position. If something unexpected happens with the company, or the market it’s likely they could take a costly financial hit as they won’t be able to pay back their loans, which could llead to expensive recurring interest payments, or ultimately bankruptcy.

Investors can also check the credit rating on loans the company has taken out. Everything from triple-A-rated to subprime with high default rates.

If a company has triple-A-rated loans it’s likely they will be paid off as both Moody and S&P’s triple-A rating loans have a default rate of less than 1%.

That means 99% of the time those loans get paid off.

A triple-A lender is like the ultimate social proof, it comes with a strong track record of getting paid back. This is the type of thing that makes Buffett’s disciples happy.

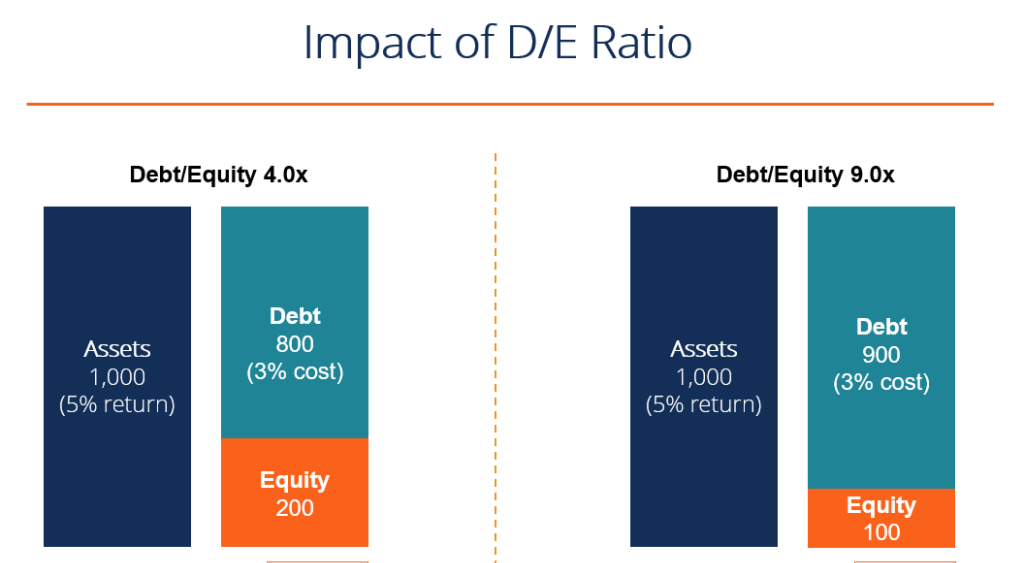

Two of the best ratios for calculating the financial health of a company are the debt/equity ratio and the current ratio.

See also: Why do so many startups use convertible debentures in capital raises?

Buffett’s rules

Debt/Equity = Total Shareholders’ Equity/Total Liabilities

The debt-to-equity (D/E) ratio compares a company’s total liabilities to its shareholder equity and shows how leveraged it is. Buffett for example won’t invest in companies with a debt/equity ratio higher than 0.5. Another way to think of it is, with a D/E ratio of 0.5, a company has 50 cents of debt for every dollar of equity.

On the other hand, a high D/E ratio is often associated with high risk, meaning the company has been aggressive in financing its growth with debt.

Investors will often use the D/E ratio to focus on long-term debt as the risks associated with long-term liabilities are different than short-term debt and payables. Short-term debt tends to be cheaper than long-term debt, and it is less sensitive to shifting interest rates.

For a shorter-term outlook, we will look at current ratio.

Current Ratio = Current liabilities/Current assets

The current ratio shows investors the likelihood of a company being able to repay its short-term debt within the next 12 months

It does this by comparing all of a company’s current assets to its current liabilities. These can be thought of as assets that will be turned into cash in a year or less, and liabilities that will be paid in a year or less. If the cash going in and out was exactly even the current ratio would be 1.

A company with a current ratio of less than 1 does not, usually have the necessary funds on hand to meet its short-term obligations if they were all due at once. A current ratio greater than one indicates the company has the financial resources to remain solvent in the short term. Buffett as an example won’t touch a company with a current ratio of less than 1.5.

For some context, I’ll pick some names at random from the psychedelics sector – MindMed (MNMD.Q) has a current ratio of 14.8, Cybin (CYBN.N) 9.93, Havn Life (HAVN.C) 47.25, Seelos (SEEL.Q) 11.88, Mindcure (MCUR.C) 18.45, Atai (ATAI.Q) 6.88, Compass Pathways (CMPS.Q) 42.82, Revive 31.96 (RVV.C). All of these companies look to be in positions to pay back their debt over the next 12 months.

A baseline

Buffett’s metrics for investigating stocks is an important baseline to understand, but not necessarily operate from. On one hand, eliminating companies with mounds of debt that are unlikely to be paid back makes the stock selection process a bit easier.

On the other hand, some of the ratios value investors like Buffett use such as current ratio, debt/sales or EPS (earnings per share) don’t show much of a story to an early pre-revenue psychedelics company.

In part 1 I wrote about leveraging free online tools like SEDAR, SEDI, and Edgar to dig deeper into who is behind a company, what their financials look like and insider trading records to name a few.

Adding these two ratios to your bag will give you another laying of understanding as to what’s happening underneath the hood of a company. This type of analysis will get you past the price targets and hyped newsletters.

See also: Part 1: How to research stocks if you’re not an analyst but still want to go deep

I’m sure Buffett would argue that a pre-revenue psychedelics company isn’t worth touching because there are too many unknowns this early in the game. Taking this conservative approach does limit your downside risk, but it also limits your width as an investor. I like to take them as soft rules, or guidelines before I dive deep into a stock. It only takes a couple of seconds to see debt/equity or current ratios on Yahoo Finance, MarketWatch, Morningstar, WebTMX etc.

I remember in my earlier days of doing due diligence I would spend hours researching a company, reading its pitch deck, and getting excited about its future growth strategy – only to find out they were drowning in debt.