XPhyto Therapeutics (XPHY.C) announced today that it has signed a definitive agreement for the acquisition of 3a-Diagnostics GmhB, Frickenhausen, Germany, XPhyto’s exclusive diagnostic development partner.

“We have collaborated closely with the 3a-diagnostics team on several diagnostics products and have found them to be a highly innovative and focused partner. The successful development and recent launch of the 25-minute PCR test COVID-ID Lab is a great example of our fruitful collaboration. We strongly believe that this acquisition will result in powerful synergies and further feed Xphyto’s diagnostic pipeline, supporting our long-term commercial growth plans,” stated Hugh Rogers.

3a-Diagnostics GmhB is a research-based biotechnology company specializing in the development, production and marketing of point-of-care test systems. In April 2020, XPhyto and 3a signed a definitive development, techonology purchase and license agreement for the development and commercialization of real-time, low-lost and easy-to-use biosensor screening tests. Amended in July 2020, this agreement includes 3a-Diagnostic’s proprietary enhanced ribonucleic acid (RNA) screening system, related intellectual property (IP) and exclusive commercialization rights for its rapid COVID-19 tests.

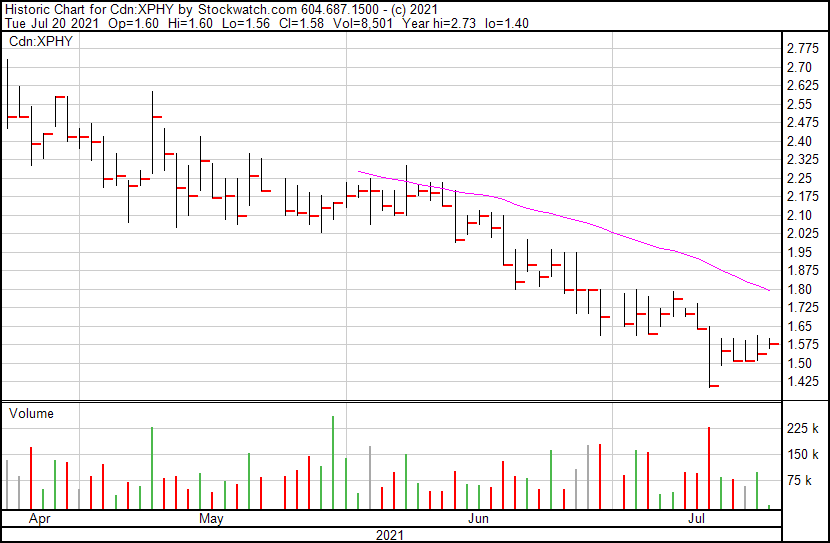

As referenced by Mr. Rogers, in March 2021, XPhyto and 3a-Diagnostics celebrated an important milestone after receiving European approval for its Covid-ID Lab tests within the European Union. Following the announcement, XPhyto shares climbed to a high of $3.10 on March 18, 2021, overshadowing a previous close of $2.73. With this in mind, Europe’s COVID-19 diagnostics market is expected to exhibit an impressive growth rate in relation to a rapidly increasing demand for technologically advanced COVID-19 diagnostic solutions.

“With our activities currently focused on Europe and the Middle East, 3a-diagnostics, with its facilities near Stuttgart, is a valuable addition to our Germany-based operations. 3a-diagnostics has an attractive pipeline, experienced team and is well respected for their work in the development and commercialization of innovative diagnostic products. They perfectly complement our existing capabilities and contribute to Xphyto’s successful corporate development,” commented Wolfgang Probst, director, Germany, of Xphyto.

Referring back to XPhyto’s latest announcement, the planned acquisition of 3a-Diagnostics is expected to result in numerous benefits for the Company including synergies in research, development and manufacturing. Additionally, this acquisition will enable XPhyto to improve margins for commercial products and expedite commercialization of products in 3a-Diagnostics’ near-market development pipeline. More importantly, through this acquisition, XPhyto will obtain 3a-Diagnostics’ patents, know-how, expertise and its various contracts with third parties.

Upon closing, XPhyto will acquire a foothold in the point-of-care biosensor market, which is growing at a CAGR of 8% and is expected to reach a market size of $42 billion by 2028. Moreover, the Company’s Q1 2021 financial results suggest that XPhyto’s is well positioned to capitalize on this market. By the end of Q1 2021, XPhyto was able to increase its total assets to CAD$9,230,030 while decreasing its total liabilities to CAD$3,923,983. Moreover, the Company’s cash and cash equivalents increased to CAD$3,561,553, up from CAD$1,876,628 year-over-year.

Pursuant to the definitive agreement, XPhyto will acquire all issued and outstanding shares of 3a-Diagnostics for a total of €3.9 million.

XPhyto’s share price opened at $1.25 and is currently trading at $1.24 as of 10:22AM ET.

Full Disclosure: XPhyto is a marketing client of Equity Guru.