Enzo Biochem (ENZ.NYSE), a leading bioscience and diagnostic company, announced today that it has received an expansion of its FDA Emergency Use Authorization (EUA) for the Company’s rapid extraction method on its proprietary test system for the detection of coronavirus SARS-CoV-2, including the genetic variants currently proliferating globally.

“One of the most important considerations in this EUA is the fact that Enzo’s tests successfully detect genetic variants of SARS-Cov-2 including the Delta and Lambda variants that are rapidly spreading throughout the world. This EUA brings the advantages of this platform to testing sites at a time when demand is expected to grow exponentially,” said Elazar Rabbani, Ph.D., Enzo CEO.

Under section 564 of the Federal Food, Drug, and Cosmetic Act (FD&C Act), when the Secretary of Heath and Human Services (HHS) declares that an emergency use authorization is appropriate, the FDA may authorize the use of unapproved medical products for application in emergency diagnosis, treatment and prevention of serious or life-threatening diseases. With this in mind, the Secretary of HHS isn’t just handing out EUAs like candy. At the very least, in order for an EUA request to be considered for approval, the FDA must first determine that the known potential benefits outweigh the known and potential risks associated with the product.

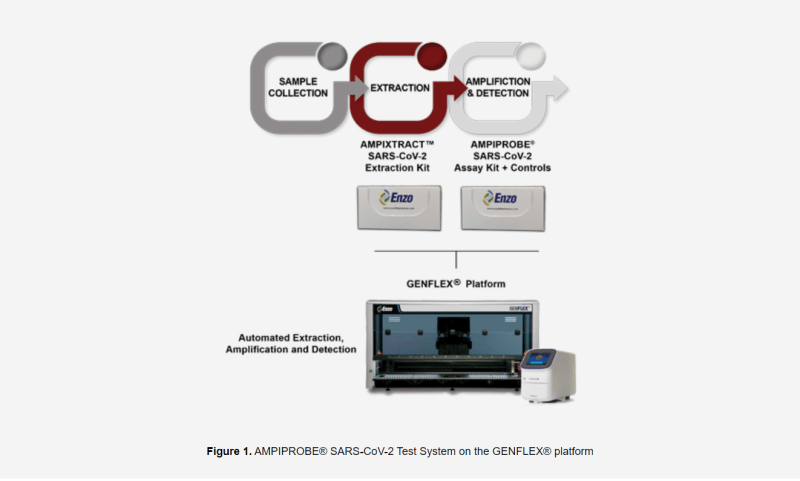

That being said, the FDA has accepted Enzo’s rapid extraction method on its proprietary test systems including the Company’s AMPIPROBE®. Having been approved by the FDA, laboratories are now able to immediately use Enzo’s extraction process to reduce diagnostic time by over one hour, or more than 25%, enabling more test runs on a single instrument. Furthermore, during an FDA-approved EUA test, AMPIPROBE® boasted a sensitivity rating of 96.2% and a specificity rating of 98% when analyzing nasopharyngeal swabs.

Our ability to supply advanced technologies to address needs in molecular testing is another reflection of the strength of our fully integrated business model. We are positioned to support rapid scale up and advance the new solutions in molecular testing that can address major challenges like COVID. We have confidence that as we gain approval for additional molecular diagnostic tests currently under development and evaluation that these efficiency measures can be adopted,” continued Elazar Rabbani.

However, as much as I would love to sing the high praise of Enzo, the Company has a bit of a troubling past. Enzo went public in June 1980 and has found itself in hot water a few time since then. For example, on September 24, 2014, the United States and New York State entered into a settlement agreement with the Company and one if its subsidiaries to resolve a case brought under the federal False Claims Act and the New York False Claims Act. To cut a long story short, an investigation revealed that, from at least January 1, 2004, Enzo had unlawfully input diagnosis codes into claims forms it submitted to the Center for Medicare & Medicaid Services (CMS). Why? To obtain unwarranted reimbursement from the CMS, an unlawful practice which led to a settlement of $3,510,245.94.

Don’t even get me started on the Harbert Discovery Fund dilemma. On November 18, 2020, Harbert Discovery Fund and Harbert Discovery Co-Investment Fund, Enzo’s largest shareholders at the time, wrote a colorful letter demanding the immediate resignation of Elazar Rabbani. Suffice to say, given than Mr. Rabbani remains the current CEO of Enzo, the letter did not succeed. I could go on forever about this letter, but I would not be able to do it justice. If you’re interested, I strongly suggest reading it for yourself.

Moving on, according to the Enzo’s FY 2020 financial results, the Company’s revenues decreased 6% to $76 million during the twelve months ended July 31, 2020. Although Enzo added $11.4 million of capital to its balance sheet via various grants, loans and advanced payments, the Company’s cash and cash equivalents were reduced to $48 million, down from approximately $60 million year-over-year. However, at the end of the day, good news is good news. In addition to receiving EUA, Enzo’s fully integrated business model will enable the Company to rapidly address capacity and supply limitations that had previously troubled the diagnostics market during the pandemic. With this in mind, the Company FDA-approved EUA could provide Enzo with an opportunity to capitalize on the expanding COVID-19 diagnostics market.

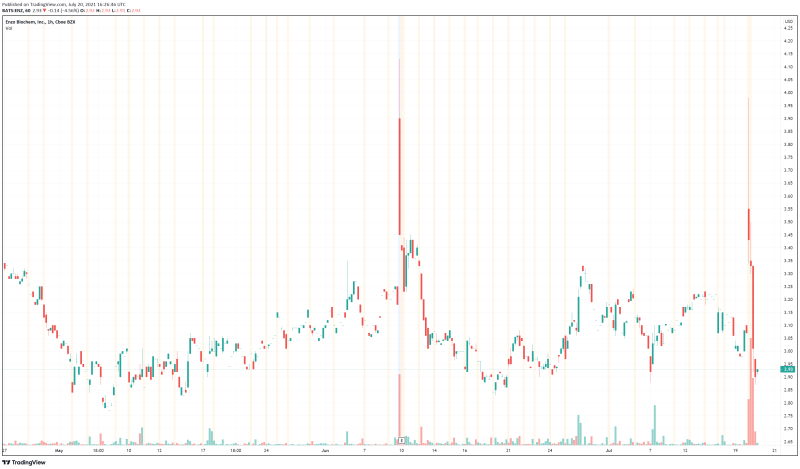

Enzo’s share price opened at $3.30, up from a previous close of $3.07. The Company’s shares are down -4.89% and are currently trading at $2.92 as of 12:27PM ET.