Over time, I’ve noticed that the capital markets seem to exhibit the most excessive forms of Authority bias. In other words, we have the tendency to attribute greater accuracy to the opinion of an authority figure and therefore be more influenced by that opinion – whether that opinion is ultimately correct or not.

In most cases, the authority figures are the large institutions on the buy or sell side of the industry. The sell-side is usually the investment bankers and corporate underwriters guiding the public listing or other financial instruments of a company. The buy-side is usually the large endowment firms and investment vehicles, who are doing the investing, or the ‘buying’.

The two sides contribute to this authority bias in different ways. But the greatest contributor, in my opinion, would be the investment banking industry. A very clear signal of this can be seen by some of the deals being done by the investment banks in Canada. Most recently these deals have been in the biotechnology industry.

Underwriters are faced with a two-tier problem, the first of which is the lack of available data with which to do peer analysis. This disadvantage shows itself when banks try to use traditional valuation models, where they have no clear-cut comparisons that allow them to come up with an implied valuation.

The second problem is the lack of stable cash flows being produced by the industry. This lack of cash flow comes from the fact that most of the firms conducting business have still yet to break even. These cash flows are usually used in different types of models to come up with an economic value, but of course, this can be extremely difficult when all firms are producing negative cash flow, thus implying an impossible negative stock price.

Before I dive into the main premise of the article, I think it’s best I provide you with my “unbiased conclusion”. After I give you this conclusion, I will go through a deductive argument to showcase how this authority bias can be unfavorable.

My conclusion is :

“Investment bankers are in the business of pricing securities for corporate managers, rather than valuing securities for investors.”

Knowing this, we can assume that most investment bankers’ economic incentive is to allocate the highest purchase price, thus decreasing the investment value for potential buyers. Because the costs are high, retail investors find it prohibitive as a high-return investment.

With that conclusion in mind, let’s continue with our process of evaluation in order to clearly see the inefficiencies that can occur because of authority bias in the investment industry. (And yes, by giving you the conclusion before the actual argument I have primed you into thinking in a certain way. But I feel this should be seen as an advantage and not a disadvantage to the argument .)

MCI OneHealth Technologies Inc. Files Preliminary Prospectus for its Initial Public Offering

MCI has filed a preliminary prospectus in connection with the proposed initial public offering of its Class A Subordinate Voting Shares to be listed on the Toronto Stock Exchange (TSX).

The terms of the offering have yet to be determined and the firm is still negotiating with its primary underwriter on the appropriate price. MCI expects to raise $30 million through the issuance of common shares at a price between $5.00 and $6.75 per share. This gives it an implied valuation above $200 million.

Without really going deeply into the underwriting process we can assume that this $30 million price valuation is the implied economic price that the bankers feel is appropriate for MCI.

But who is MCI?

MCI is one of the largest primary care clinic groups in Canada providing healthcare and healthcare-related services to patients and the employees of corporate customers through its network of 25 brick and mortar clinics.

These clinics are complemented by the telehealth division which distributes health-related services and information via the internet.

Below are some more interesting facts about this potential IPO :

- The Company performs approximately 850,000 healthcare and healthcare-related consultations annually.

- These services are provided to the employees of 250 corporate customers through a team of 280 contracted physicians, 340 employees, and other third-party healthcare contractors.

- As of year-end 2019, they made a total of $46 million in net sales utilizing $ 2million in equity. Most of this revenue was made by using $20 million in debt or leverage bringing their total capitalization up to about $ 22 million.

This $30,000,000 IPO for a business generating $46,000,000 in sales seems appropriate. But this valuation is the pre-IPO figure, and usually, after the IPO date, the share price can do three things

- Skyrocket to the moon

- do nothing

- hit rock bottom

The most likely outcome is number one because of the current market sentiment in a 2020 Bull market.

Knowing this we can assume some investors who got in on the private placement are expecting above 20% return on their investment. But as a potential investor in this IPO, we need to take a look at the alternative investment opportunities in the market before we decide to buy the stock.

A great way to see if a stock is trading at about economic value is to look at other companies in the same industry of a similar size that run the same business model (yeah, that’s tier 1 in that problem I said most investment analysts run into when it comes to biotech companies). And today is your lucky day: I have cut out the hard work, I’ve found one for you and it goes by the name Neupath.

NeuPath is Canada’s largest provider of chronic pain management services, operating under two leading brands in Ontario.

Brand One is the Centres for Pain Management: these branches work with patients to manage and treat chronic pain and is the largest provider thereof in Canada, with 9 locations across Ontario.

Its second brand is the InMedic Creative Medicine, which uses state of the art facilities and the latest in technology. Their team of dedicated medical professionals is able to deliver excellent treatment modalities, such as ultrasound-guided nerve blocks and advanced telemedicine services.

- NeuPath has 12 locations across Ontario with more than 100 health care providers that provide care to over 11,000 patients annually.

- NeuPath offers a comprehensive chronic pain assessment and multimodal treatment plan based on recommendations by a group of trained physicians

- NeuPath provides workplace health services and independent medical assessments to disability insurers through its subsidiary, CompreMed Canada Inc.

The firm currently has no wide economic moat. This is because of the nature of the industry it is in. A lot of the time, these economic moats help companies establish profitability while sustaining a competitive advantage. However, Neupath has instead set-in place two strategic measures that will allow them to stay competitive.

The first of the strategic measures are simply ‘organic growth’. Neupath’s focus is to generate revenue growth by improving capacity utilization at its existing medical clinics. Capacity improved to 56% in 2019 compared to 29% in 2017 but was negatively impacted by COVID-19 and the temporary closure of a medical clinic due to a flood in the nine-month period ended September 30, 2020, ultimately decreasing to 53%.

This organic growth will provide the firm with organic cash flows. These cash flows are known as operating cash flows which allow the business to pay off its expenses, repay its debt, and invest in capital projects that will increase the top line over time.

For context, usually, a healthy business is able to generate organic cash flows from its day-to-day operations without the need for raising money from the open market in the form of issuing common shares or debt financing.

The second way to establish a moat is through strategic acquisitions. The market for medical clinics is highly fragmented in Canada. NeuPath plans to acquire medical clinics in other provinces to expand its footprint and continue to leverage its existing infrastructure.

These business acquisitions can be very profitable when done appropriately with organic cash flows. The pure synergy between the organic growth and strategic acquisition business strategies will provide a starting point for the growth of a sustainable competitive advantage.

OK so long spiel aside, what do these two businesses in the biotech space have to do with authority bias?

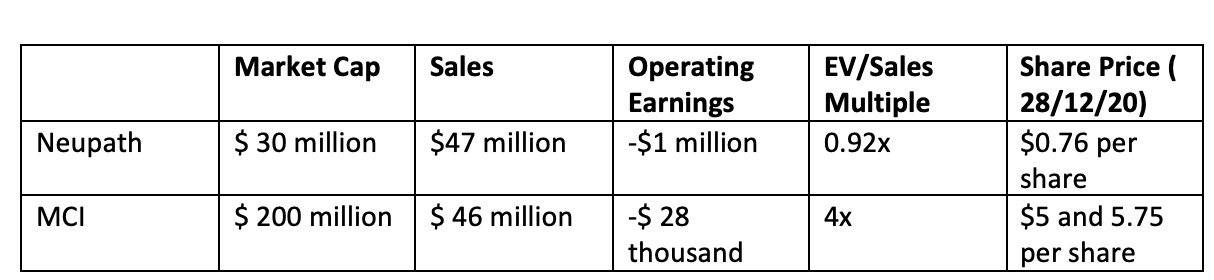

Hopefully from the explanations above it’s clear that the two companies are very similar when it comes to their business structures and can be helpful to each other when implying evaluation in the open market. The only difference is that one is about to IPO and one has been publicly traded for a while now. But if you take a look at the two market caps the companies are trading about the same price.

Canadian general average EV/Sales multiple is 18.24x and the USA average is 397x. It makes sense for MCI to be trading at 4 times its enterprise value to sales ratio because the business is still unknown and just about to IPO. But Neupath on the other hand has been in the market for a while now and the price is still relatively undervalued compared to the Canadian average of 18.24 times EV/Sales.

This doesn’t mean the underwriters are wrong but maybe the market’s appraisal of the businesses is incorrect – at the very least with Neupath. When you compare MCI to Neupath, there seems to be a misunderstanding of the right price.

In my opinion, MCI might be overvalued and Neupath might be undervalued. Not only has Neupath been publicly traded for longer, fundamentally the business seems sounder than MCI – but the investment bankers also insist that these two businesses trade at the same multiples. Some will argue that maybe MCI is also undervalued, but I ultimately believe this premise would be wrong as MCI has had less time in the market to be appraised appropriately by investors trying to figure out the value, and not the price of the securities.

As we know from stats 101, we can’t take a look at just two businesses and use this as a sample. So, to take the analysis a little deeper we use a few filters to come up with a list of businesses that are in the range of MCI and Neupath.

Filters

- Has to be traded in a public market in Canada

- Has a market cap of about $30 million and above

- Has a net sales in 2019 of above $30 million

Using these filters, I found two businesses that are within the range of comparison between MCI and Neupath.

- Well Health with revenue of $ 42 million & market cap of $ 1 billion

- Cloud with revenue of $ 10 million & market cap of 384 million

I know this might be the nerd in me, but it’s fascinating that these two companies just tell a totally different story of the market valuation. Both these businesses are trading above $30 million dollars but ultimately make less money compared to Neupath and MCI. For one of them, I even made an exception to be inclusive – it isn’t even profitable, and yet shows an incredible market cap. This is an impressive difference in the claim that the valuation is representative of the soundness of the business model when we compare these two companies with Neupath.

The rest of the industry had a market cap range between $30 million to 1.4 billion and revenues ranging from $100K to $48 million. The majority of the companies did not record any revenues in the last 2 years starting in 2019. Neupath had the highest revenue in the selection but the lowest market capitalization.

You never want to make bold statements in investing but this seems like a case where one stock is grossly undervalued by the market and the other might be at par or overvalued by investment bankers. On the open market, investors seem to be ignoring the growth potential that Neupath has shown over the last year and a half.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.