Fund Manager Risk

/fənd ˈmanijər,ˈmanəjər, risk/

: is the added(or subtracted value in most cases) alpha of having a professional money manager allocate your assets for you.

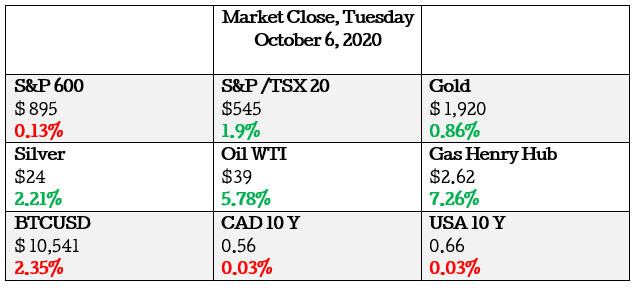

- S&P 600 (USA Small Caps) down by 0.13% and S&P 500(USA Large Caps) by 1.40% for the day

- S&P/TSX 20(CAD Small Cap) up by 1.9% and the S&P/TSX 60 (CAD Large Cap) down by 1.06% intraday

- Bitcoin up by 2.21%

- Oil is up 5.78% and Gas up 7.26%

Market Movers

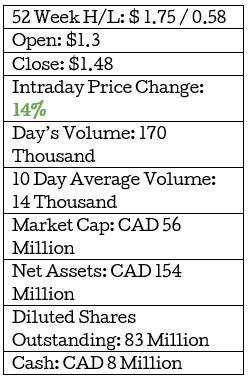

Today we the judges have picked: Founders Advantage Capital Corp (FCF.V) as an “attractive common stock”

- Business Summary: Founders Advantage Capital (FCF.V) is an investment company and they state that their purpose is to grow shareholder value by acquiring majority interests in and creating long-term partnerships with premium founder-owned companies with both defensive and high growth characteristics.

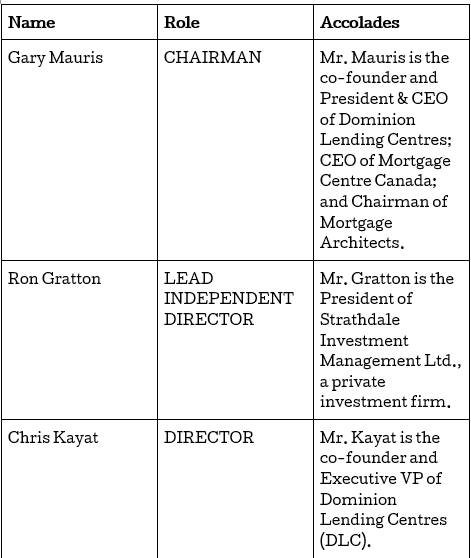

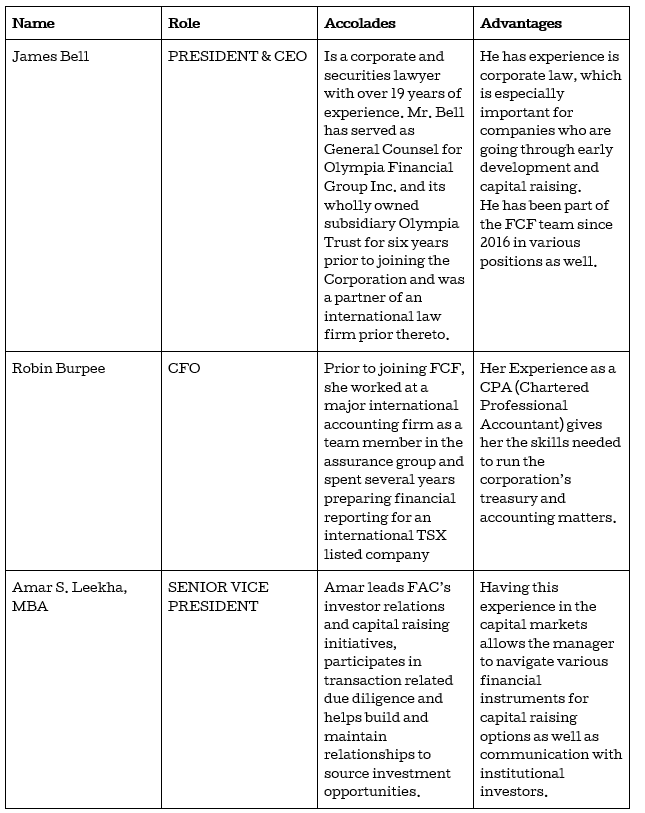

Team of managers

For FCF to survive they need to have a board and management team that has a diverse set of skills and business acumen. FCF owns a majority interest in firms that operate in many different industries specifically leisure facilities, mortgage financing, and communications equipment.

These industries bring about their own challenges and risks that need to be assessed individually but mutually beneficial to the long-run success of FCF.

Board of Directors

Management Team

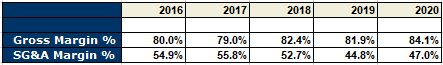

With this abundance of experience, management has been able to generate business and keep costs relatively low. The first thing we can look at is the gross margins over time, which are the gross profits compared to the total revenue. This reflects how much money is left over after paying for direct costs to produce the services. A great and easy example from FCFs portfolio would be their recreational business that sells fitness services, like gym memberships and professional trainers. The direct cost to run this operation would be the wages paid to the training staff.

A great cut-off for the gross margin would be between the 20-30% range.

In its entirety, the consolidated results of Founders Advantage Capital have been well above this cut-off point.

As can be seen from the table above as of 2016 they managed to consistently generate $1 of revenue and keep 80 cents as profits, excluding a minor decrease in 2017.

Selling, general, and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expense also know as SGA includes all the costs not directly tied to making a product or performing a service. That is, SGA includes the costs to sell and deliver products and services and the costs to manage the company.

Knowing this it would be beneficial for any company to keep their operating costs as low as possible for them to achieve profitability. The best range that can be suggested here that would indicate a business with a high ability to control their costs would be between 10 – 30%.

Founders Advantage Capitals SGA margin is a bit higher than our suggested range and should be watched over time. Although it is high they have managed to reduce their operating costs from being 54% of revenue to 47%. I know 7% might not seem like a dramatic drop but this is a reduction of $3 million dollars from their total selling, general, and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses which is not easy to do.

So far they have not been able to break even or turn a profit, the managers have made it clear that one of their strategic goals is to improve their cost structure at the consolidated level and for their three operating businesses. We can only hope that this strategic plan does not affect the quality of the services provided by the subsidiaries.

Sum of Parts (Portfolio Companies)

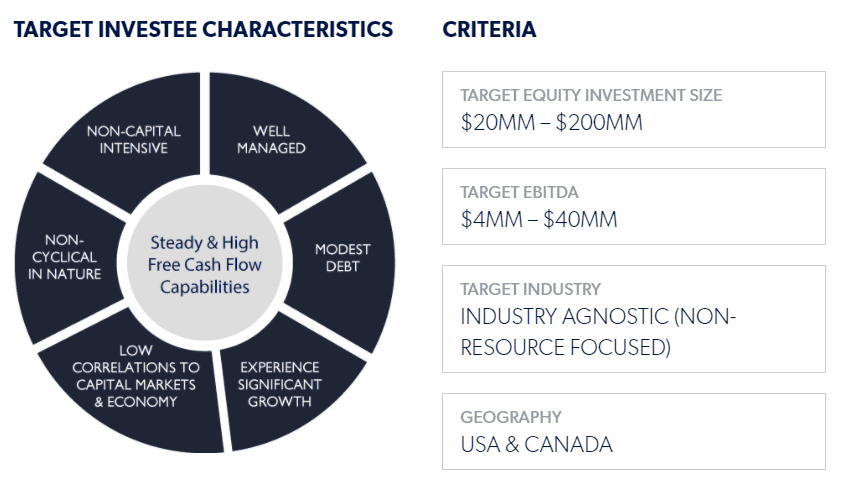

Before we get to the main body of the article, we need to take a slight detour and look briefly at the companies in the portfolio that fit the specified targets set by FCF that are in the chart above. This helps us understand what factors are driving the top line or revenues of Founders Advantage Capital.

The first of the three is CLUB16 which operates fitness centers, under Club 16 Trevor Linden Fitness Clubs and She’s FIT! Health Clubs brands. The company is based in Vancouver, Canada. Although the main office is in Vancouver the business has operations in the United States as well giving it a wider total addressable market. FCF has held this business in its portfolio for 3 years now and owns 60% of the units outstanding making it a majority owner.

Dominion Lending Centres Inc. operates as a mortgage brokerage company in Canada. It offers residential mortgages, including home purchase, refinance, mortgage renewal, home equity, and mortgage life insurance; commercial mortgages; and equipment leasing, auto leasing, and leasing vendor programs for businesses. The company also franchises its business and generates licensing revenues. Dominion Lending Centres Inc. was founded in 2006 and is based in Port Coquitlam, Canada.FCF has held this business in its portfolio for 4 years now their oldest investment and owns 60% of the units outstanding making it a majority owner.

Impact Radio Accessories Inc. designs and manufactures communication products for public safety, military, security, construction and industrial, rental fleets, retail, and hospitality applications. Its products include universal radio chargers, surveillance kits and earpieces, speaker microphones, speaker mic accessories, throat mics/bone induction mics, headsets, audio enhancements and parts, radio adapters, and noise-canceling accessories. The company was founded in 1999 and is based in Kelowna, Canada. It has a distribution center in Wilmington, North Carolina. FCF has held this business in its portfolio for 3 years now and owns 52% of the units outstanding making it a majority owner.

These three flagship operations have met the criteria set out by the FCF managers and have been selected for the portfolio to meet their long-term goals of creating shareholder value at the same time building profitable partnerships with their subsidiaries.

Is it better to let someone else manage your money or do it yourself? (LINK)

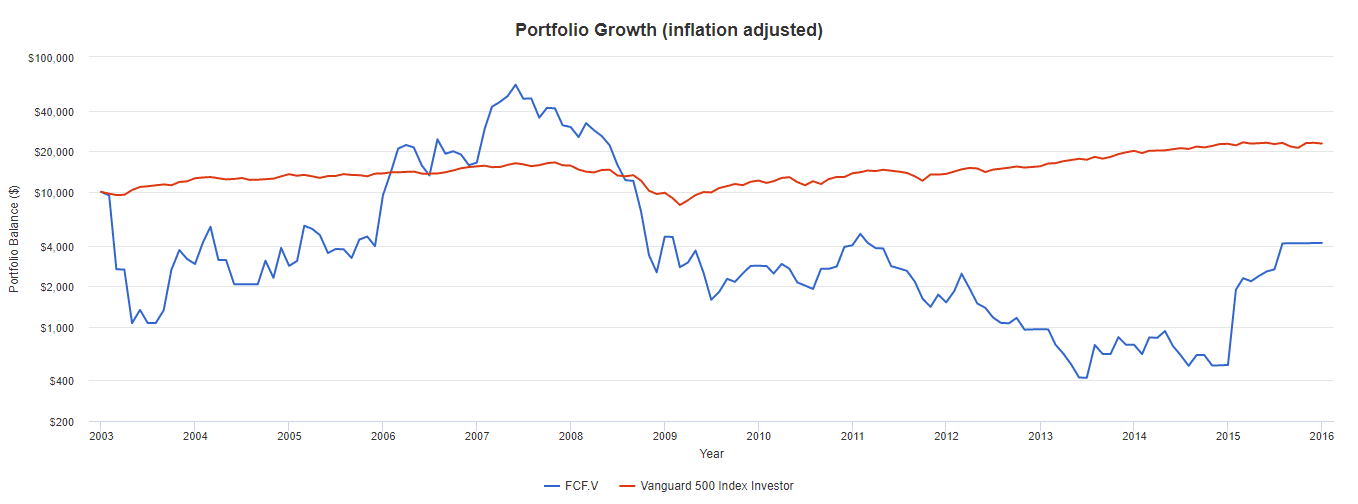

Was it better for the gifted stock picker to invest in FCF or just park their capital in a diversified portfolio of companies? This is the question we will try to answer. The simple answer is Yes, the more complicated answer needs a side by side comparison of the two stocks over time.

Luckily in investing there is hindsight when looking at the performance of two assets over time, but as always, this past performance does not mean future results will be the same.

We backtested the performance of the Vanguard ETF index (VOO) against the stock of Founders Advantage Capital Corp (FCF.V). This is the best way to test if the added skill by the FCF management team has been worthwhile to shareholders. The next best alternative would have been a passive investment in a cross-sectional diversified mutual or index fund.

Analysis

- We invested $10,000 in both assets from 2000 until 2016

- We did not add any extra money or take out any cash. There was no rebalancing and only the initial amount was monitored. This gives us a clean number free of manipulation.

- We also adjusted for inflation, this is because the effect of money printing reduces the value of the dollars you own over time.

Results

- The $10,000 in the two assets would have turned into $5,473 for the FCF shares and $29,840 for the ETF.

- This translates to a return of (4.53%) and 8.77% for the assets over 16 years, respectively.

Meaning over this specific time period the investor in a passive ETF would have beaten the FCF management team with their three operational business.

Of course, this does not mean this trend will persist as of today the S&P/TSX 20 for small caps is down 8.5% and FCF is up 8% for the year, and 14% for the day whilst TSX20 is up only 1.9%.

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism.

HAPPY HUNTING!